|

Backup Data Files |

|

Watchlists and project files are stored on your

computer. |

Trading Diary

May 29, 2004

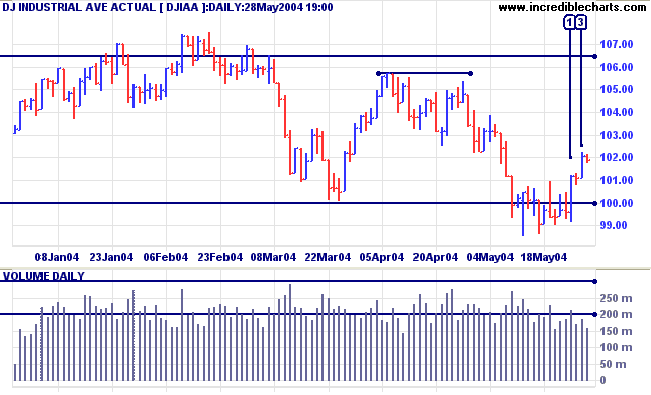

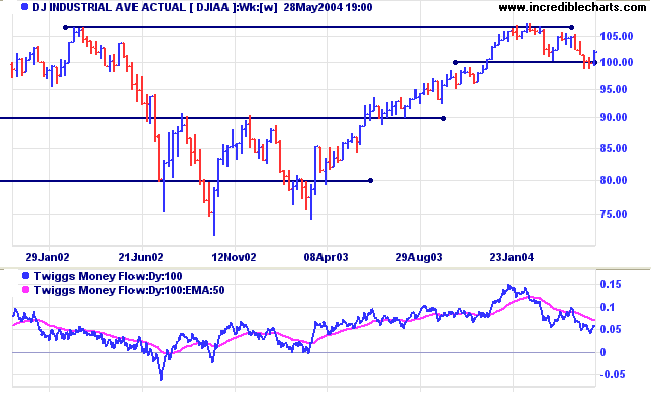

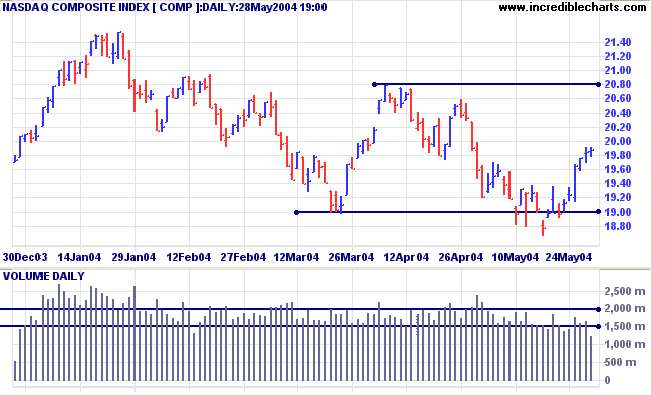

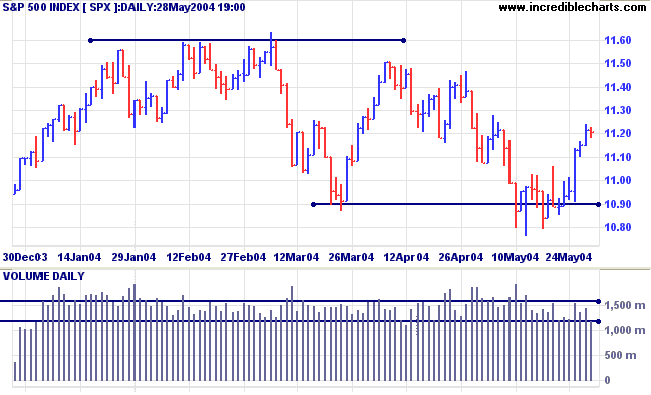

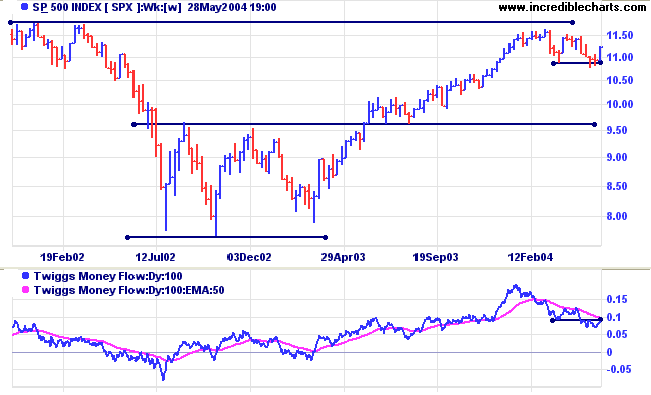

Twiggs Money Flow continues to signal distribution.

Twiggs Money Flow continues to signal distribution.

The Chartcraft Bullish Percent Index is on Bear Alert status, having recovered slightly to 60.98%.

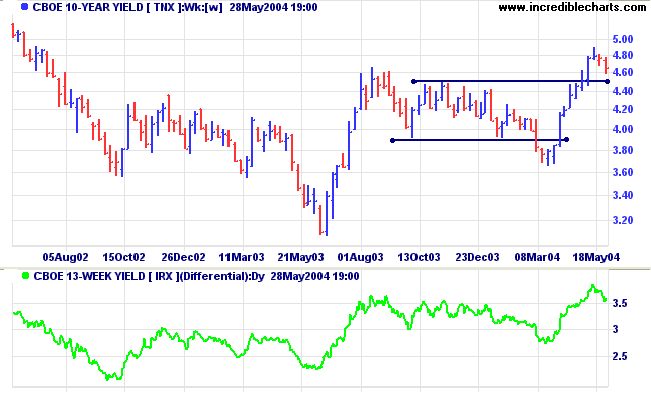

The yield on 10-year treasury notes has retraced to 4.655%. A correction that respects support at 4.50% will confirm the strength of the primary up-trend.

The yield differential (10-year T-notes minus 13-week T-bills) at 3.6% reflects imminent rates increases.

New York: Spot gold has recovered to $393.70, above resistance at 390. This does not indicate a change in trend; the primary trend continues downwards; but it does increase uncertainty. A pull-back that respects support at 390 would signal a likely re-test of resistance at the previous 2004 highs. A fall through support at 390 would indicate a bearish consolidation or slow down-trend.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

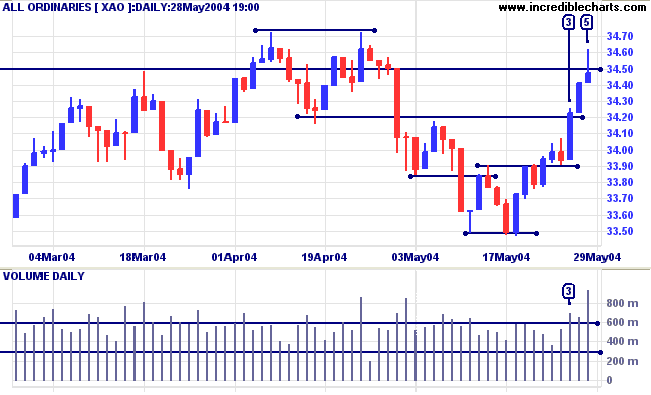

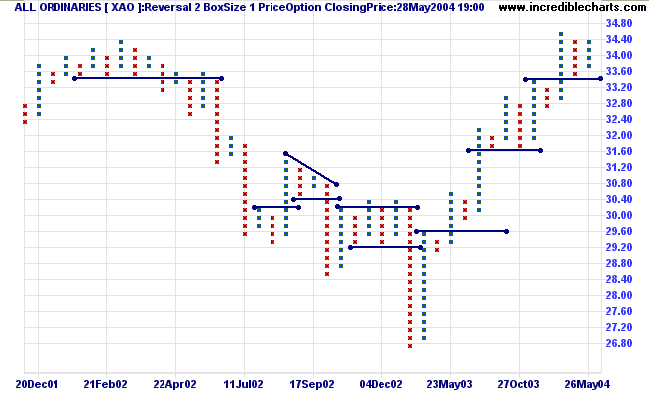

If the index is able to overcome resistance at 3450 this will be a strong bull signal. Failure to do so may result in consolidation between 3350 and 3450.

Twiggs Money Flow (not shown) continues to display a bearish divergence.

Basic point and figure chart patterns are explained at the Trading Guide: P&F Chart Patterns.

- Support and resistance;

- Trendlines;

- Breakouts;

- Bull and Bear signals; and

- Bull and Bear traps.

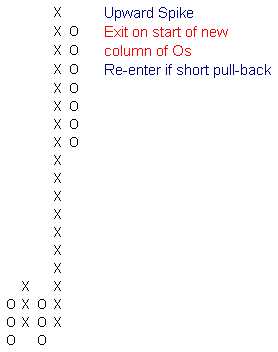

An upward spike, where a rally exceeds the previous column of Xs by a large number: at least 10 boxes or 10% of the starting price. This is a signal to take profits: spikes can reverse sharply and there is nothing worse than seeing those hard-earned profits disappearing before your eyes.

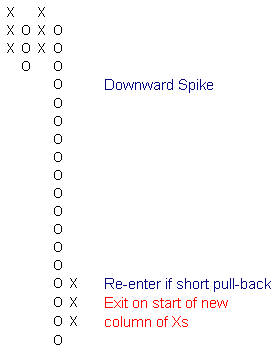

Thomas Dorsey (Point & Figure Charting) mentions a long tail down pattern, where a single column of Os is 20 or more boxes, which he uses as a buy signal. I would not be that adventurous. I suspect that successive downward spikes are more common (than successive upward spikes). If, however, a column of Os exceeds the previous trough by at least 10 boxes (or 10% of price), it is clearly a signal to take profits on short positions. Exit on the start of a new column of Xs. Re-enter if there is a short retracement.

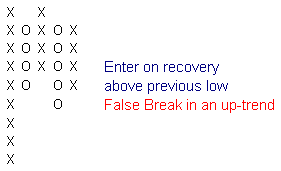

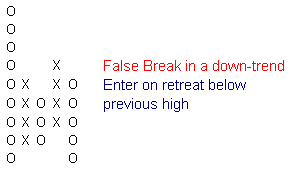

Similar to bull and bear traps, false breaks should be sought in an established trend.

In an up-trend, if price falls below the previous low by only a small margin (normally only one box) and then promptly reverses upwards, buy on recovery above the previous low. This is one weakness with point and figure charts: you will not see the recovery until price has increased by the reversal amount.

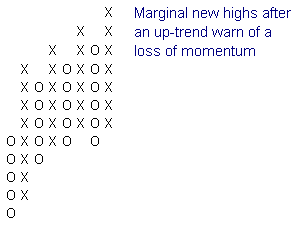

After an up-trend, marginal new highs (especially where accompanied by equal or lower lows) indicate a loss of momentum and may evolve into a stage 3 top.

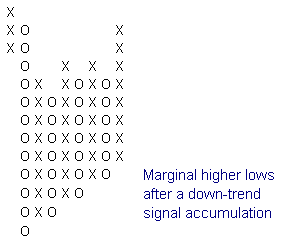

In a down-trend, a series of higher lows indicate accumulation. Equal or rising highs are a further bullish sign. Enter on completion of the third higher low: the start of the fourth column of Xs.

whatever follies I have witnessed in private and public life

have been the consequence of action without thought.

~ Bernard Baruch

Click here to access the Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.