Trading Diary

July 9, 2003

The Dow retreated 0.73% to close at 9156 on higher volume.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

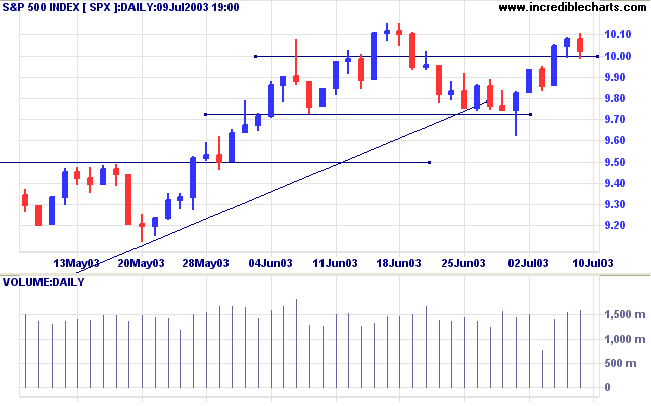

Intermediate: Increase long positions if the S&P is above 1010.

Long-term: Increase long positions.

Yahoo stock fell more than 6.0% in after-hours trading, despite announcing positive results. (more)

The Nikkei has rallied 31% since April. (more)

New York (18.25): Spot gold appears to have stabilized at $US 344.50.

On the five-year chart gold is above the long-term upward trendline.

The intermediate trend is up.

The primary trend is up.

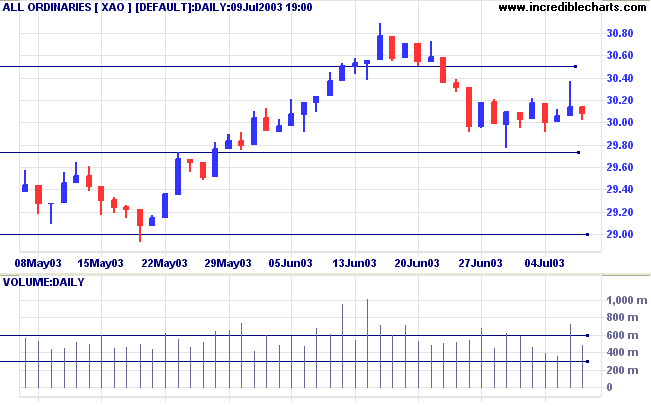

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has turned up; Twiggs Money Flow (21) signals accumulation.

Intermediate: The primary trend is up; Long if the All Ords is above 3022.

Long-term: Long.

Last covered on July 1, 2003.

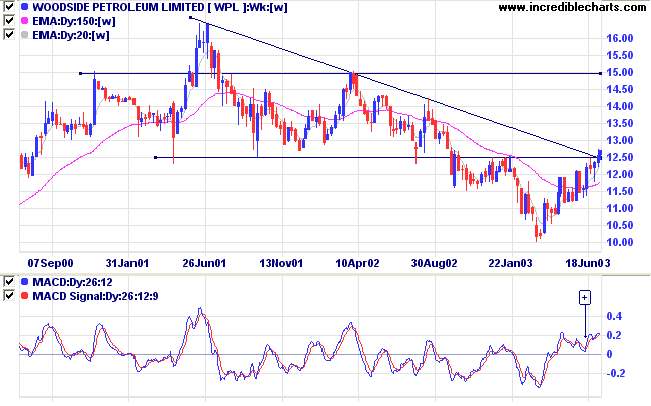

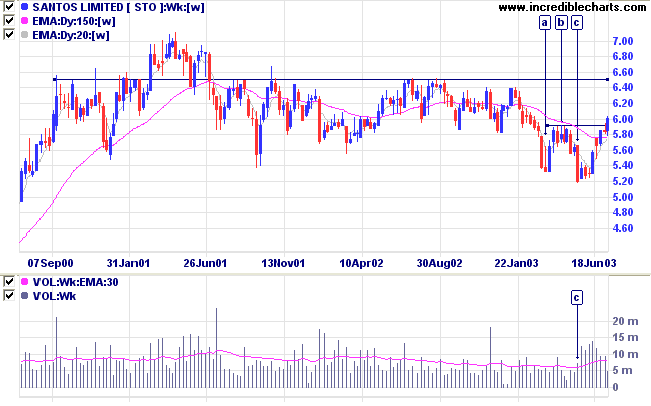

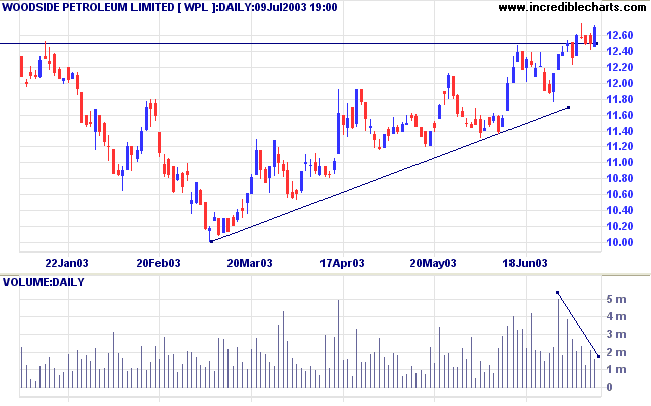

Woodside [WPL] and Santos [STO] have both made new 3-month highs.

Woodside has broken above resistance at 12.50 as well as the long-term downward trendline.

Relative Strength (price ratio: xao) is rising, having made a 3-month high.

Twiggs Money Flow (100-day) is rising but still below zero.

MACD has completed a bullish trough above zero.

Heavy volume is clearly visible in the weeks following the low at [c].

Relative Strength (price ratio: xao) is rising but has yet to make a new 3-month high.

Twiggs Money Flow (100-day) and MACD are both bullish.

Act on the large while it is minute.....

Those who regard many things as easy

will encounter many difficulties.

Therefore, the Sage regards things as difficult,

And as a result, has no difficulty.

~ Lao Tse.

To screen for stocks making new highs:

(1) Open % Of Price High;

(2) Enter 98 as the Minimum%;

(3) Sort the Return by clicking on the %H heading.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.