Hourly updates

Some of the hourly updates are arriving late.

We have asked our data supplier to resolve this.

Use Securities>>Refresh Current Security From Server

if you want to update a chart that is already open.

Some of the hourly updates are arriving late.

We have asked our data supplier to resolve this.

Use Securities>>Refresh Current Security From Server

if you want to update a chart that is already open.

Trading Diary

July 1, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

After falling in early trading the Dow later rallied to close up 0.62% at 9040 on higher volume.

The intermediate trend is down. The false break below support at 8900 is a bullish sign.

The primary up-trend is up.

After falling in early trading the Dow later rallied to close up 0.62% at 9040 on higher volume.

The intermediate trend is down. The false break below support at 8900 is a bullish sign.

The primary up-trend is up.

The S&P 500 rallied 8 points to close at 982.

The intermediate trend is down. The false break below 972 is a bullish sign.

The primary trend is up.

The intermediate trend is down. The false break below 972 is a bullish sign.

The primary trend is up.

The Nasdaq Composite again tested support at 1600 before rallying

to close at 1640, up 1.0% on yesterday's close.

The intermediate trend is up. Equal lows on the 9th, 24th and today are a bullish sign.

The primary trend is up.

The intermediate trend is up. Equal lows on the 9th, 24th and today are a bullish sign.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator retreated

to 74.51% on June 30; 0.71% from its peak.

Market Strategy

Short-term: Long if the S&P 500 is above 989 (Friday's

high).

Intermediate: Long if the S&P is above 989.

Long-term: Long.

Intermediate: Long if the S&P is above 989.

Long-term: Long.

Short week ahead

US markets will close 1.00 p.m. Thursday ahead of Friday, Fourth of July holiday.

US markets will close 1.00 p.m. Thursday ahead of Friday, Fourth of July holiday.

Gold

New York (17.29): Spot gold rose again to $US 350.40.

On the five-year chart gold is above the long-term upward trendline.

New York (17.29): Spot gold rose again to $US 350.40.

On the five-year chart gold is above the long-term upward trendline.

ASX Australia

The monthly Coppock indicator has turned up below zero, signaling

the start of a bull market.

Twiggs Money Flow (100) signals accumulation.

Recent months display a distinct V-bottom and we may see a re-test of support levels before a real bull market develops.

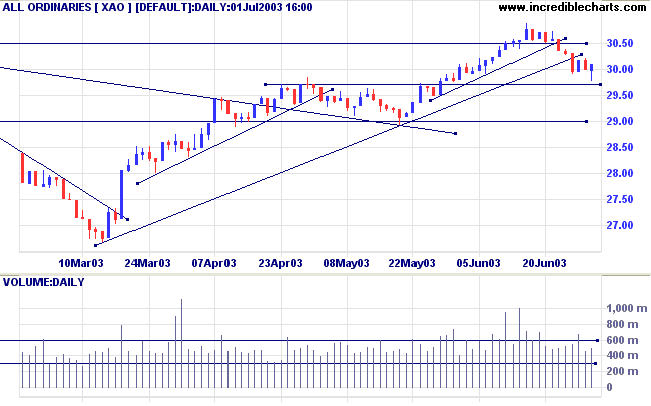

The All Ordinaries fell in early trading but later rallied to form a hammer reversal signal. The index closed 10 points up at 3009 on higher volume.

The intermediate trend is down.

The primary trend is up. If price holds above support at 2970 this will indicate that the up-trend is still strong. A fall to 2900 will signal weakness.

Twiggs Money Flow (100) signals accumulation.

Recent months display a distinct V-bottom and we may see a re-test of support levels before a real bull market develops.

The All Ordinaries fell in early trading but later rallied to form a hammer reversal signal. The index closed 10 points up at 3009 on higher volume.

The intermediate trend is down.

The primary trend is up. If price holds above support at 2970 this will indicate that the up-trend is still strong. A fall to 2900 will signal weakness.

Market Strategy

Short-term: Long if the All Ords is above 3021 (Monday's

high).

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3021.

Long-term: Long.

Intermediate: The primary trend has reversed up; Long if the All Ords is above 3021.

Long-term: Long.

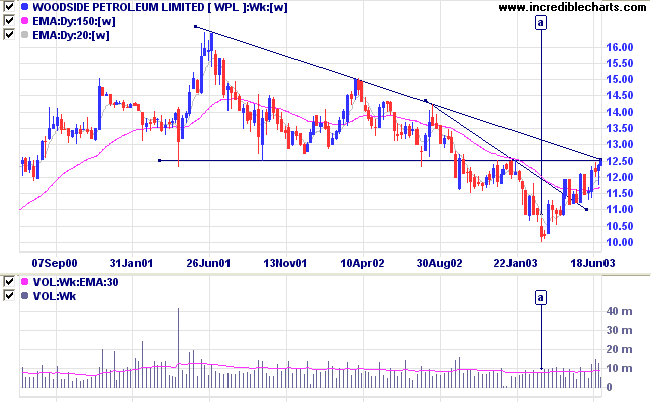

Woodside Petroleum [WPL]

Energy stocks are improving, with the sector index [XEJ] forming a 6-month high.

Woodside has formed a V-bottom in recent months and now approaches a critical point: the conjunction of the 12.50 resistance level and the primary (downward) trendline. There was no cathartic volume spike at [a] so resistance can be expected to be fairly heavy.

Energy stocks are improving, with the sector index [XEJ] forming a 6-month high.

Woodside has formed a V-bottom in recent months and now approaches a critical point: the conjunction of the 12.50 resistance level and the primary (downward) trendline. There was no cathartic volume spike at [a] so resistance can be expected to be fairly heavy.

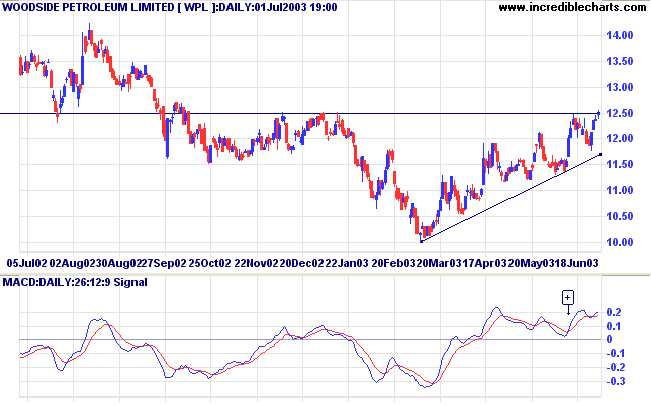

Twiggs Money Flow shows a bullish divergence at [a]; while MACD

has completed a trough above zero at [+], a bullish sign.

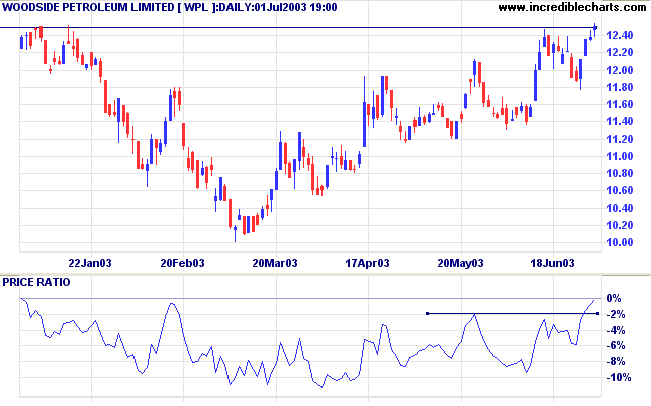

Relative Strength (price ratio: xao) has reached a new 3-month

high, another bull signal..

A close above 12.50 will be a bullish sign, especially if

accompanied by strong volume.

Conservative traders will wait for a pull-back to the new support level before entering long positions.

V-bottoms are always fragile and a fall below the recent trough at 11.76 would be bearish, signaling a possible re-test of support at 10.00.

Conservative traders will wait for a pull-back to the new support level before entering long positions.

V-bottoms are always fragile and a fall below the recent trough at 11.76 would be bearish, signaling a possible re-test of support at 10.00.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers.

Colin Twiggs

How does a lamp burn?

Through the continuous input of small drops of oil.

If the drops of oil run out, the light of the lamp cease.

What are these drops of oil in our lamps?

They are the small things of daily life;

faithfulness, punctuality, small words of kindness,

a thought for others, our way of being silent,

of looking, of speaking, and of acting.

These are the true drops of love...

Be faithful in small things because it is in them that your strength lies.

~ Mother Theresa.

Through the continuous input of small drops of oil.

If the drops of oil run out, the light of the lamp cease.

What are these drops of oil in our lamps?

They are the small things of daily life;

faithfulness, punctuality, small words of kindness,

a thought for others, our way of being silent,

of looking, of speaking, and of acting.

These are the true drops of love...

Be faithful in small things because it is in them that your strength lies.

~ Mother Theresa.

Stock Screens:

Liquidity

To filter out illiquid stocks you can either:

Limit your screen to the ASX 200 or ASX 100 (select under Indexes and Watchlists),

To filter out illiquid stocks you can either:

Limit your screen to the ASX 200 or ASX 100 (select under Indexes and Watchlists),

or set up a Volume Filter.

Example: A volume filter of 200,000 returned 480 ASX stocks (including 173 of the ASX 200).

Example: A volume filter of 200,000 returned 480 ASX stocks (including 173 of the ASX 200).

Back Issues

Access the Trading Diary Archives.