Deal or No Deal

By Colin Twiggs

January 25, 2019 9:00 p.m. ET (1:00 p.m. AEDT)

First, please read the Disclaimer.

Brexit

No one knows what the outcome of Brexit will be but, whatever the outcome, it is unlikely to send global markets into a tail-spin. There is bound to be short-term pain on both sides but the long-term costs and benefits are unclear.

China

Far more likely to send investors scuttling for shelter is a 'no deal' outcome on US trade negotiations with China. I would be happy to be proved wrong but I believe that a deal is highly unlikely. There may be press photos with beaming officials shaking hands and tweets from the White House promising a rosy future for all (with or without a wall). But what we are witnessing is not straight-forward negotiations between trading partners, which normally take years to resolve, but a hegemonic power struggle between two super-powers, straight out of Thucydides.

Thucydides wrote "When one great power threatens to displace another, war is almost always the result." In his day it was Athens and Sparta but in the modern era, war between great powers, with mutually assured destruction (MAD), is most unlikely. Absent the willingness to use military force, the country with the greatest economic power is in the strongest position.

One of the key battlefronts is technology.

"China is now almost wholly dependent on foreign chipsets. And that makes leaders nervous, especially given a series of actions by foreign governments to limit the ability of Huawei and ZTE to operate internationally and acquire Western technology." ~ Trivium China

�To address this risk, President Xi Jinping aims to increase China's semiconductor self-sufficiency to 40% in 2020 and 70% in 2025 as part of his �Made in China 2025� initiative to modernize domestic industry.� ~ Nikkei

Xi is unlikely to abandon his �Made in China 2025� plans and the US is unlikely to settle for anything less.

USA

The US economy remains robust despite the extended government shutdown and concerns about Fed tightening.

"Federal Reserve officials are close to deciding they will maintain a larger portfolio of Treasury securities than they had expected when they began shrinking those holdings two years ago, putting an end to the central bank�s portfolio wind-down closer into sight." ~ The Wall Street Journal

This is just spin. As I explained last week. Fed run-down of assets is more than compensated by repayment of liabilities (excess reserves on deposit) on the other side of the balance sheet. Liquidity is unaffected.

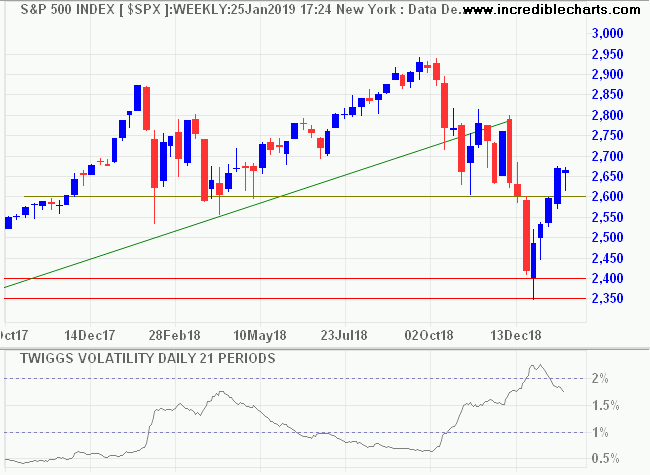

Charts remain bearish as the market views global risks.

Volatility is high and a large (Twiggs Volatility 21-day) trough above zero on the current S&P 500 rally would signal a bear market. Retreat below 2600 would strengthen the signal.

Asia

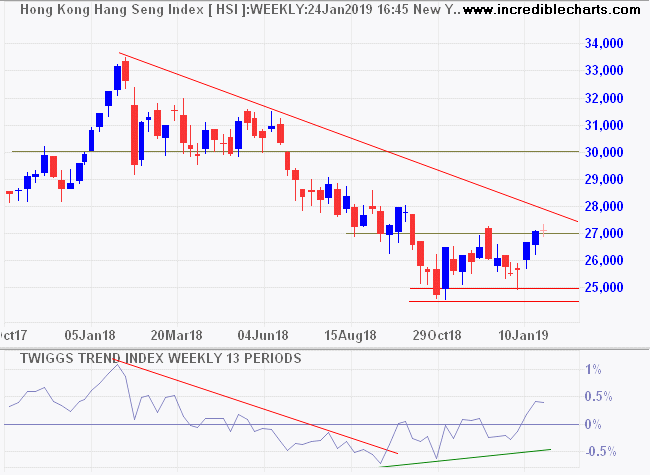

Hong Kong's Hang Seng Index is in a bear market but shows a bullish divergence on the Trend Index. Breakout above 27,000 would signal a primary up-trend. This seems premature but needs to be monitored.

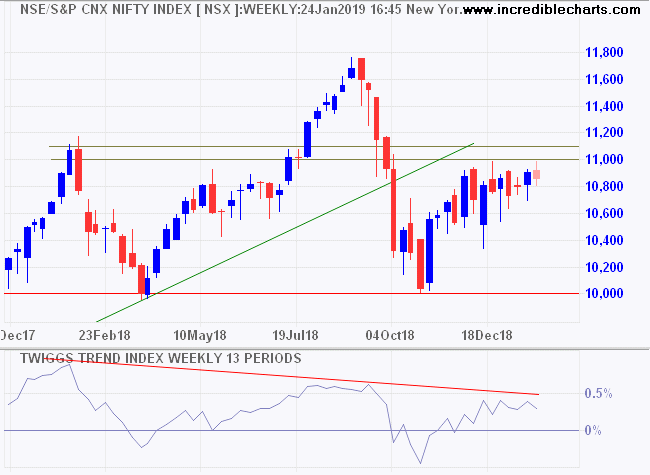

India's Nifty has run into stubborn resistance at 11,000. Declining peaks on the Trend Index warn of selling pressure. Retreat below 10,000 would complete a classic head-and-shoulders top but don't anticipate the signal.

Europe

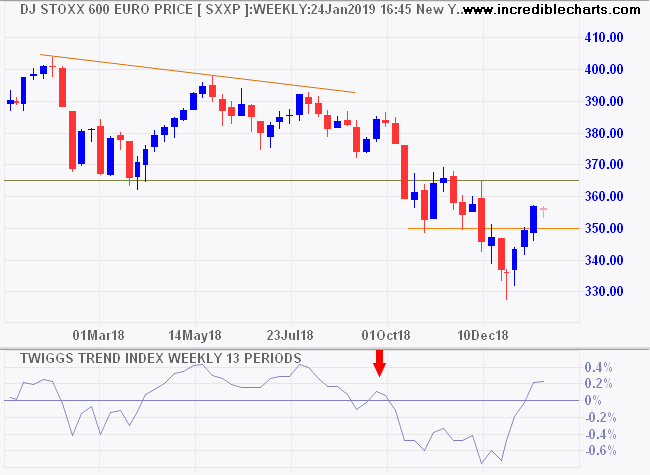

DJ Stoxx Euro 600 is in a primary down-trend. Reversal below 350 would warn of another decline.

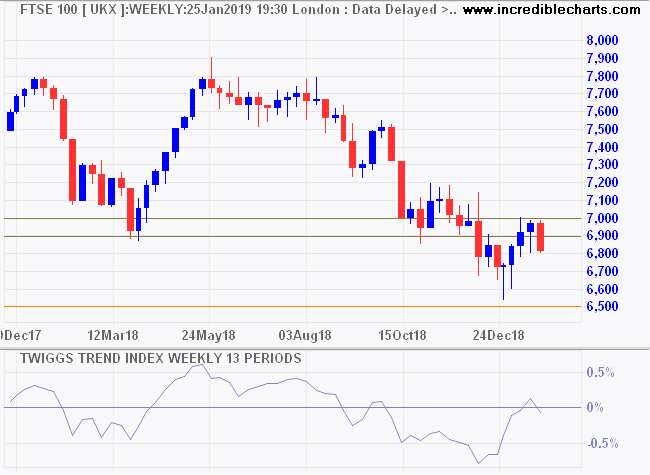

The UK's Footsie has retreated below primary support at 6900. Declining Trend Index peaks warn of selling pressure. This is a bear market.

This is a bear market. Recovery hinges on an unlikely resolution of the US-China 'trade dispute'.

War is a matter not so much of arms as of money. ~ Thucydides (460 - 400 B.C.)

Latest

-

ASX 200

Hanging Man. -

Dow

Dow

Bullish in a bull market, bearish in a bear market -

China

China

Get ready for economic slowdown | Trivium China -

Australian Economy

Quietly falling apart -

PEmax

why you should be wary of Robert Shiller's CAPE -

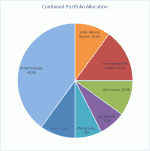

Portfolio

Investing in a volatile market - April 2018 -

Yield Curve

Does the yield curve warn of a recession? - September 2018

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.