Challenged by gravity

By Colin Twiggs

May 19, 2016 6:00 p.m. AEST (4:00 a.m. EDT)

Advice herein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no reader should act on the basis of any information contained herein without first having consulted a suitably qualified financial advisor.

91 Percent of the S&P 500 have reported earnings for the first quarter 2016, with estimated earnings (as reported) of $21.53 compared to $21.81 for Q1 2015, a fall of 1.3%. And trailing 12-month earnings of $86.25 versus $86.53 for 2015, a fall of 0.3%. Earnings estimates are provided by Standard & Poors.

Comparing Q1 2016 sector earnings (as reported) to Q1 2015, standout sectors were Health Care (+28%) and Industrials (+98% albeit off a low base), while Energy (losses increased by 177%) and Materials (-63%) were once again the worst performers. Financials, Information Technology and Utilities also struggled with more than 10% fall in earnings.

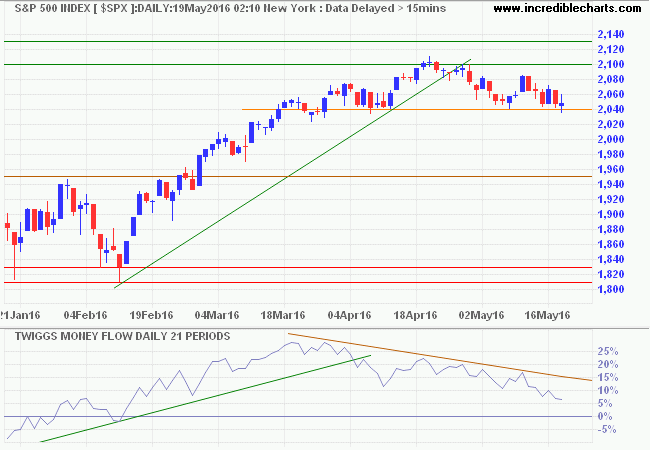

Poor results, especially in Retail have dragged on stock performance, with the S&P 500 struggling to maintain upward momentum. Declining 21-day Money Flow indicates medium-term selling pressure. Breach of medium-term support at 2040 would warn of another correction. Primary support (1800 - 1830) at this stage, however, looks secure.

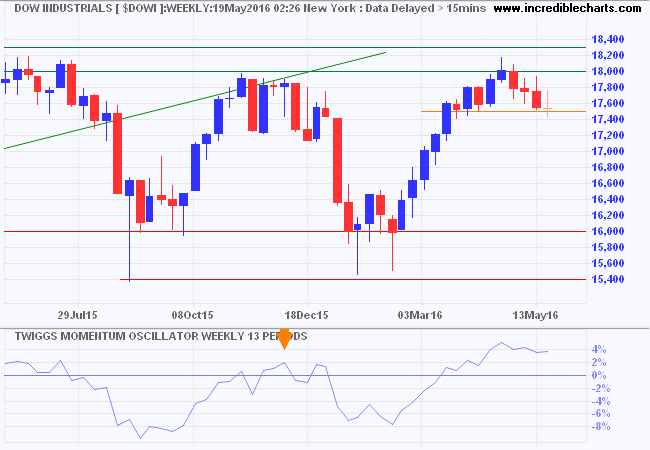

Dow Jones Industrial Average faces a similar challenge, testing support at 17500.

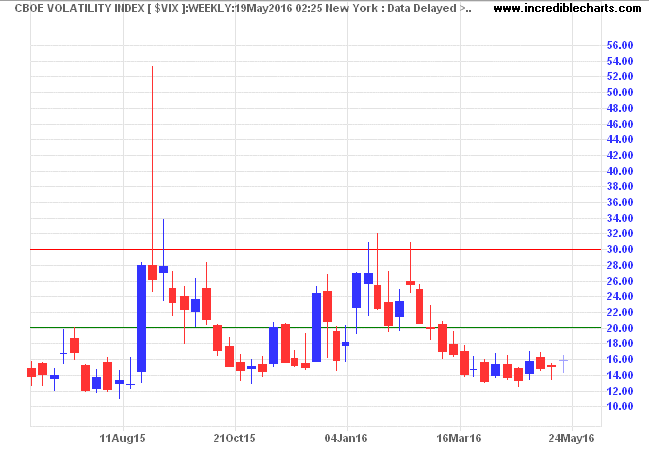

A CBOE Volatility Index (VIX) at 16 indicates low (short-term) market risk. Long-term measures have also eased.

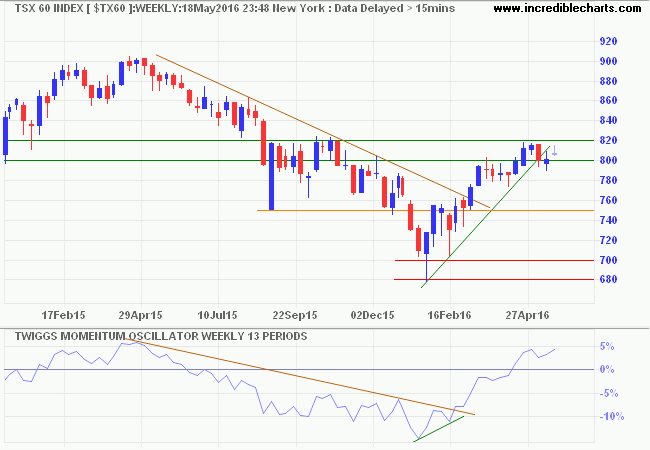

Canada's TSX 60 is testing resistance at 820. Respect is likely and would warn of another test of primary support at 680 - 700. Rising 13-week Twiggs Momentum is encouraging but a low peak above zero would indicate that bears still dominate.

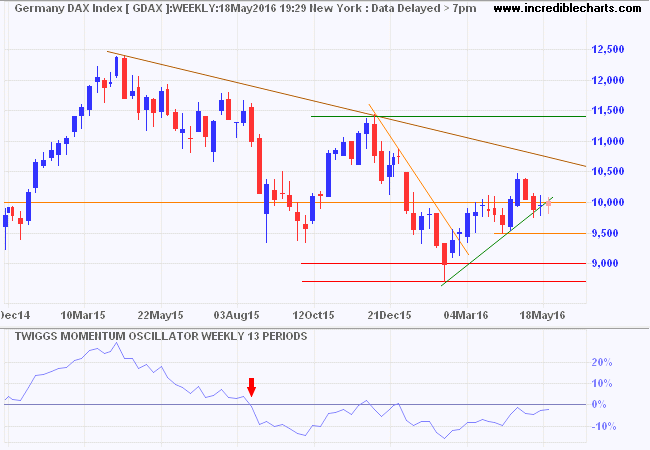

Europe

Germany's DAX slipped back below 10000, warning of another correction. Breach of 9500 would confirm. Respect of the zero line by 13-week Twiggs Momentum (from below) would confirm continuation of the primary down-trend.

* Target calculation: 9500 - ( 11000 - 9500 ) = 8000

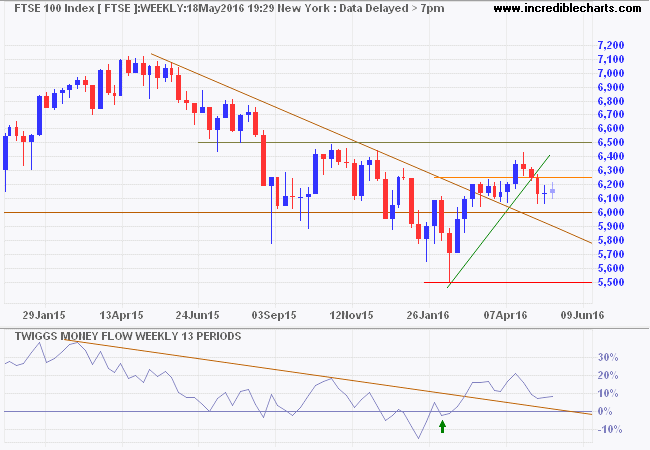

The Footsie is more bullish, with rising 13-week Money Flow signaling buying pressure. Respect of support at 6000 would suggest another advance.

* Target calculation: 6400 + ( 6400 - 6000 ) = 6800

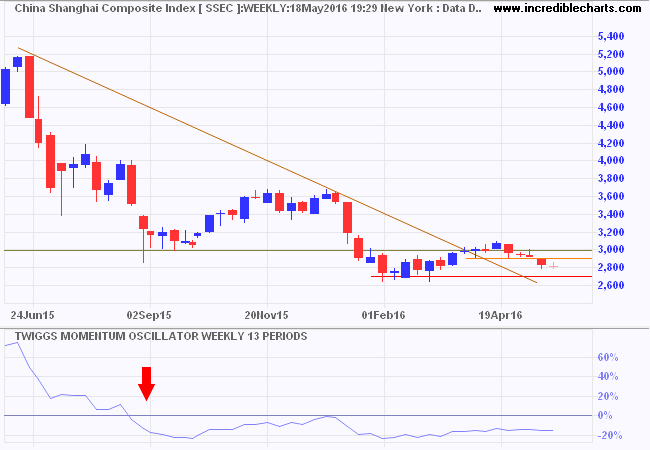

Asia

The Shanghai Composite Index is headed for another test of support at 2700 despite a surge of activity in the housing (and commodities) markets. Indications that the Fed may raise interest rates in June will increase pressure on the Yuan. Declining 13-week Twiggs Momentum below zero continues to indicate a strong primary down-trend.

* Target calculation: 3000 - ( 3600 - 3000 ) = 2400

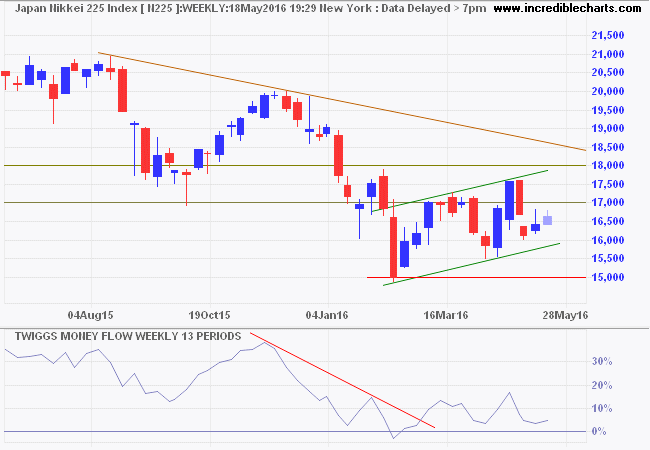

Japan's Nikkei 225 Index is gradually lifting off primary support at 15000. But the rally lacks conviction and a break below the channel would warn of another decline.

* Target calculation: 15000 - ( 18000 - 15000 ) = 12000

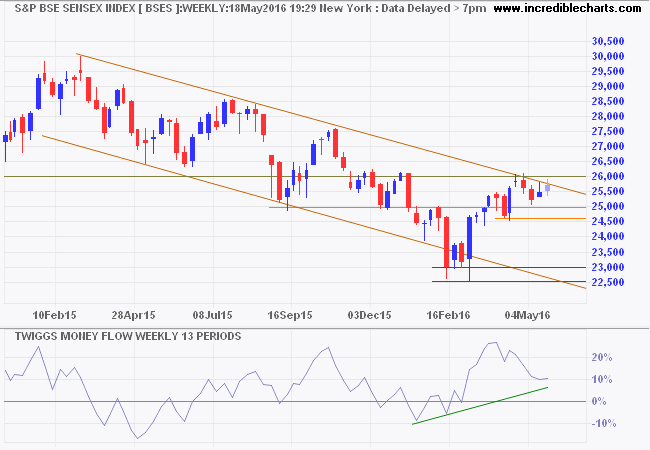

India's Sensex is more bullish, testing resistance at 26000, with rising 13-week Money Flow. Breakout would suggest that a bottom is forming. Although there could be another test of primary support at 22500 - 23000, signaled by retreat below 25000.

Australia

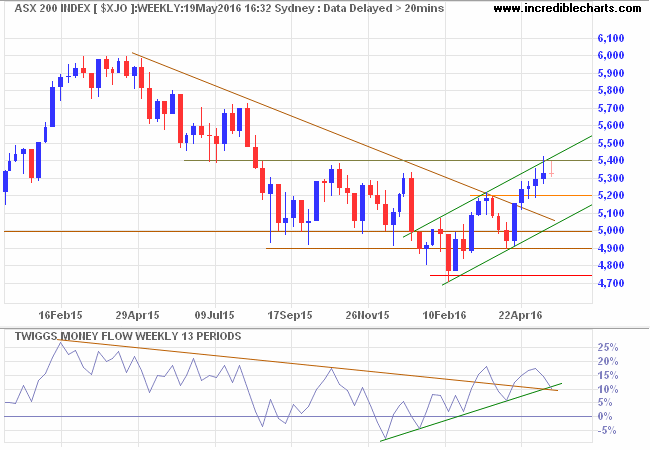

A weaker Australian Dollar and declining wage growth both support a bearish view of the Australian economy. The ASX 200 encountered resistance at 5400 and reversal below 5200 would warn of another test of primary support. Penetration of the rising trendline by 13-week Money Flow that buying pressure is easing. Reversal below zero would warn of another decline — as would retreat below 5000.

* Target calculation: 4700 - ( 5400 - 4700 ) = 4000

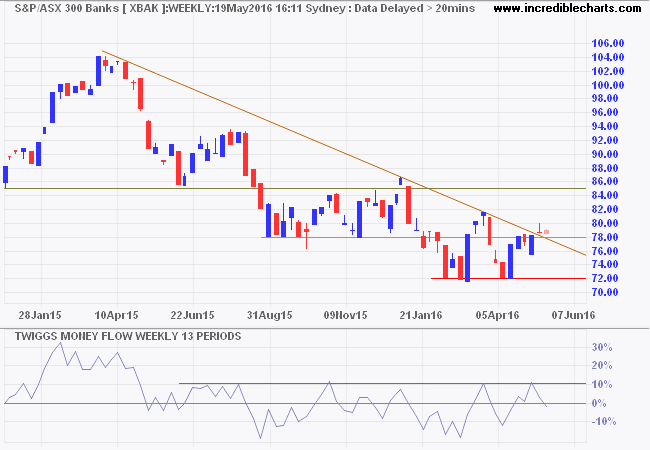

Banks difficulties are not yet over and reversal below 78.00 would warn of another test of primary support. Reversal of 13-week Twiggs Money Flow below zero warns of another decline.

Adlai Stevenson was campaigning against Eisenhower in 1952 when a supporter called out "Governor Stevenson, all thinking people are for you!" Stevenson answered, "That's not enough. I need a majority."

Disclaimer

Porter Private Clients Pty Ltd, trading as Research & Investment ("R&I"), is a Corporate Authorized Representative (AR Number 384 397) of Andika Pty Ltd which holds an Australian Financial Services Licence (AFSL 297069).

The information on this web site and in the newsletters is general in nature and does not consider your personal circumstances. Please contact your professional financial adviser for advice tailored to your needs.

R&I has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites and newsletters. Our research is based upon information known to us or which was obtained from sources which we believe to be reliable and accurate.

No guarantee as to the capital value of investments, nor future returns are made by R&I. Neither R&I nor its employees make any representation, warranty or guarantee that the information provided is complete, accurate, current or reliable.

You are under no obligation to use these services and should always compare financial services/products to find one which best meets your personal objectives, financial situation or needs.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information. If the law prohibits the exclusion of such liability, such liability shall be limited, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Important Warning About Simulated Results

Research & Investment (R&I) specialise in developing, testing and researching investment strategies and systems. Within the R&I web site and newsletters, you will find information about investment strategies and their performance. It is important that you understand that results from R&I research are simulated and not actual results.

No representation is made that any investor will or is likely to achieve profits or losses similar to those shown.

Simulated performance results are generally prepared with the benefit of hindsight and do not involve financial risk. No modeling can completely account for the impact of financial risk in actual investment. Account size, brokerage and slippage may also diverge from simulated results. Numerous other factors related to the markets in general or to the implementation of any specific investment system cannot be fully accounted for in the preparation of simulated performance results and may adversely affect actual investment results.

To the extent permitted by law, R&I and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information offered by R&I whether or not caused by any negligent act or omission.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.