Asia-Pacific: ASX 200 selling pressure

By Colin Twiggs

June 30th, 2014 4:00 a.m. EDT (6:00 p.m. AEST)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

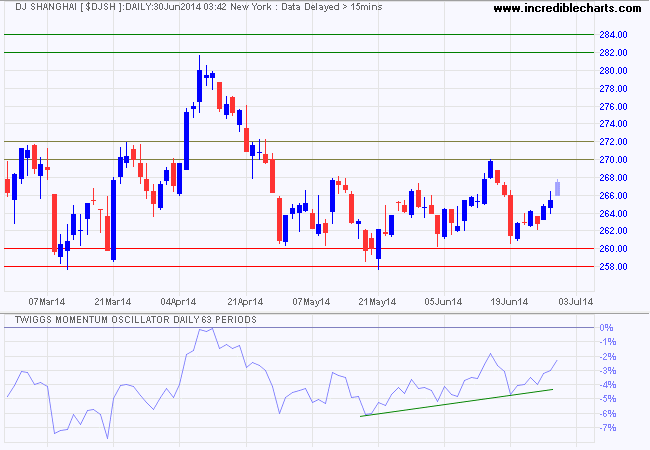

Dow Jones Shanghai Index rallied Monday, headed for another test of resistance at 270/272. Momentum is rising, but only recovery above 282/284 (with TMO above zero) would signal a trend change. Further consolidation is more likely, ranging between 258 and 284. Downward breakout, unlikely at present, would warn of a decline to 240*.

* Target calculation: 260 - ( 280 - 260 ) = 240

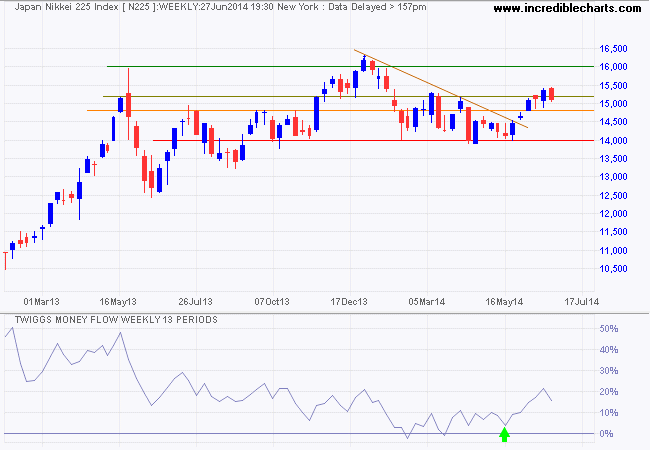

Japan's Nikkei 225 retraced to test its new support level around 15000. Respect would confirm a a rally to 16000. Completion of a 13-week Twiggs Money Flow trough above zero indicates long-term buying pressure. Reversal below 14800 is unlikely, but would warn of another test of primary support at 14000.

* Target calculation: 16000 + ( 16000 - 14000 ) = 18000

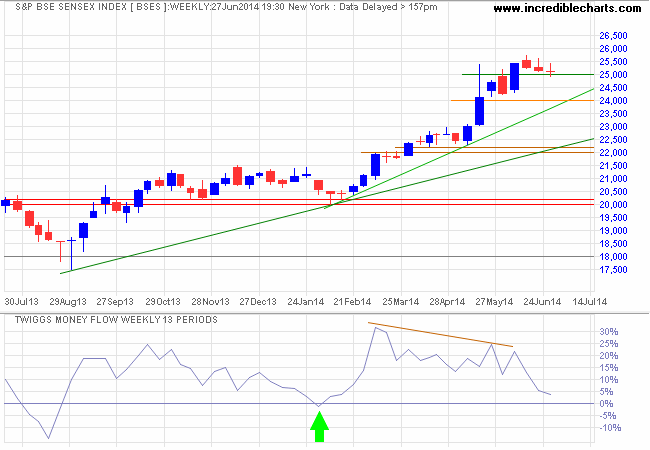

India's Sensex is far stronger — retracing to test its new support level at 25000. Bearish divergence on 13-week Twiggs Money Flow warns of medium-term selling pressure. Breach of support would warn of a correction to 24000. But the primary trend is upward and recovery above 25500 would signal another advance.

* Target calculation: 21000 + ( 21000 - 16000 ) = 26000

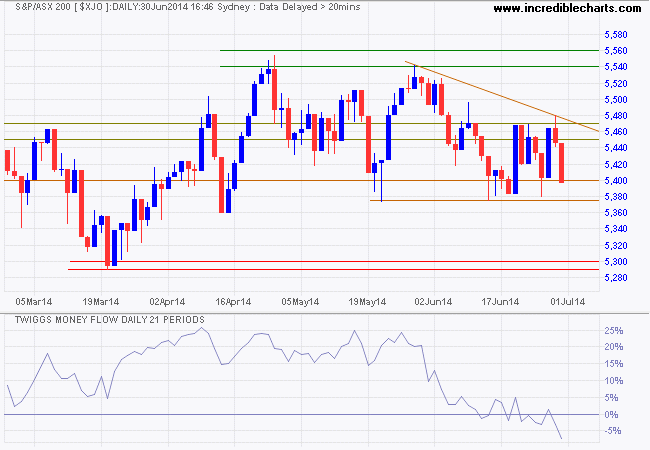

The ASX 200 is once again testing support at 5380/5400. Declining 21-day Twiggs Money Flow below zero indicates medium-term selling pressure. Correction to 5300 is likely. The primary trend remains upward and this should prove a good entry point for long-term investors. Recovery above 5470 is unlikely at present, but would signal another primary advance.

* Target calculation: 5550 + ( 5550 - 5400 ) = 5700

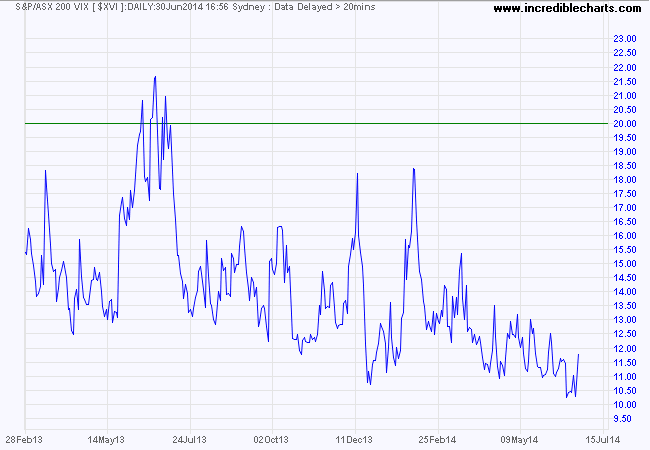

ASX 200 VIX remains low, indicative of a bull market.

The worst form of inequality is to try to make unequal things equal.

~ Aristotle