The new version with NYSE, Nasdaq and Amex charts is now available.

Please check Help >> About to confirm that your version has automatically updated.

If there are any problems with the updater,

you can download and install the latest version over your existing version.

Trading Diary

December 9, 2003

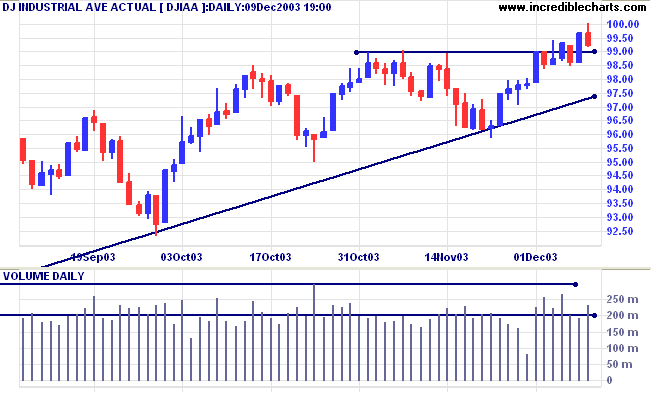

The intermediate trend is uncertain. Expect support at 9600 and 9500, resistance at 10000.

The primary trend is up. A fall below support at 9000 will signal reversal.

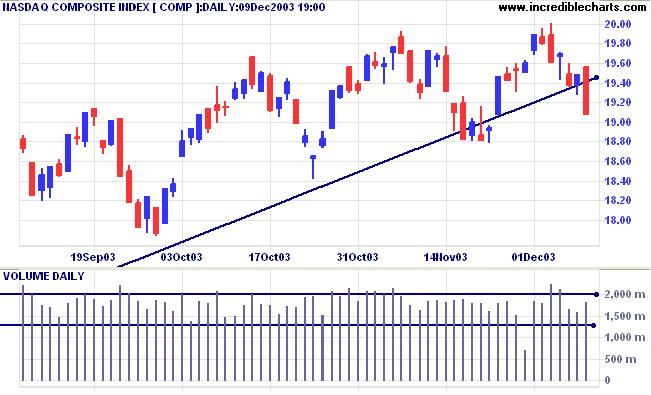

The intermediate trend is uncertain. Expect support at 1880 and 1840, resistance at 2000 to 2080.

The primary trend is up. The supporting trendline has been broken, after a false break (above the previous high) on December 3, both bearish signs. A fall below support at 1880 will be a strong bear signal, while a fall below 1640 will signal reversal.

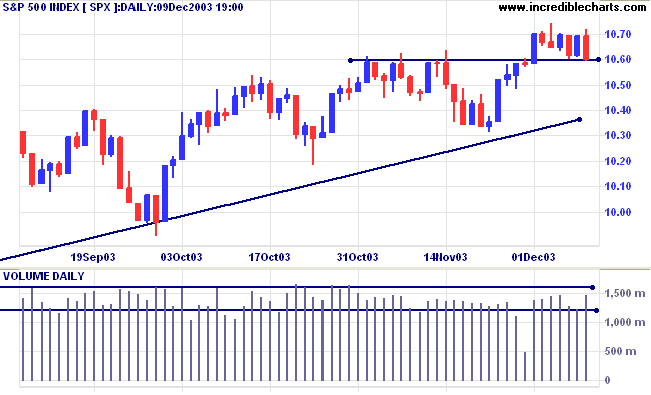

The intermediate trend is uncertain. A fall below 1060 would be bearish.

Short-term: Bullish if the S&P500 is above 1070. Bearish below 1060.

Intermediate: Bullish above 1070.

Long-term: Bullish above 960.

The Fed discounts deflation and recognizes economic improvement but will keep rates low for the foreseeable future. (more)

The yield on 10-year treasury notes rallied to 4.35%.

The intermediate trend is down.

The primary trend is up.

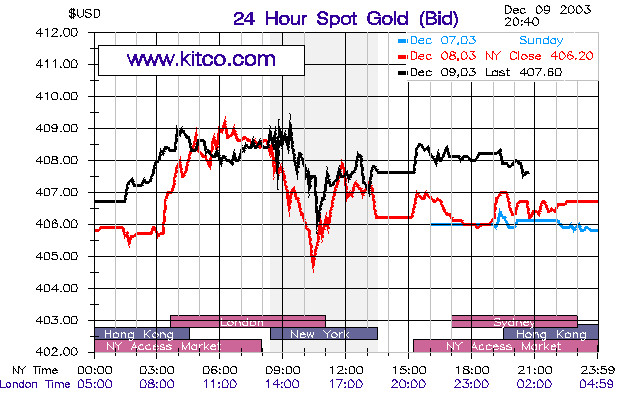

New York (20.40): Spot gold is up at $407.60.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

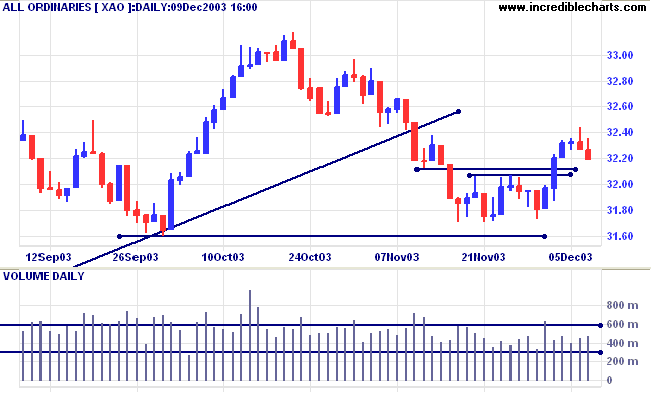

The intermediate up-trend continues.

Short-term: Bullish above 3236, Friday's high. Bearish below 3173 (Monday's low).

Intermediate term: Bullish above 3207, the high of the last peak. Bearish below 3160.

Long-term: Bearish below 3160.

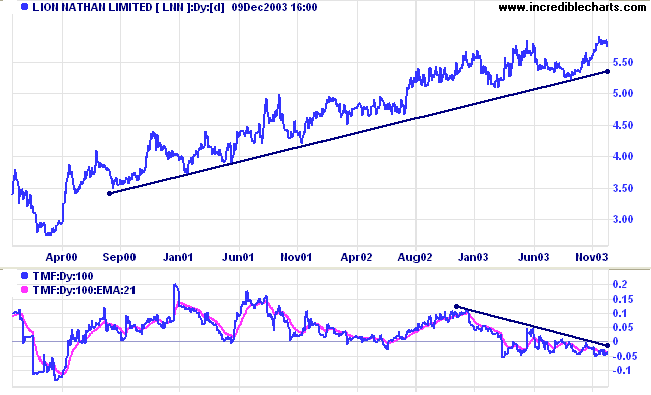

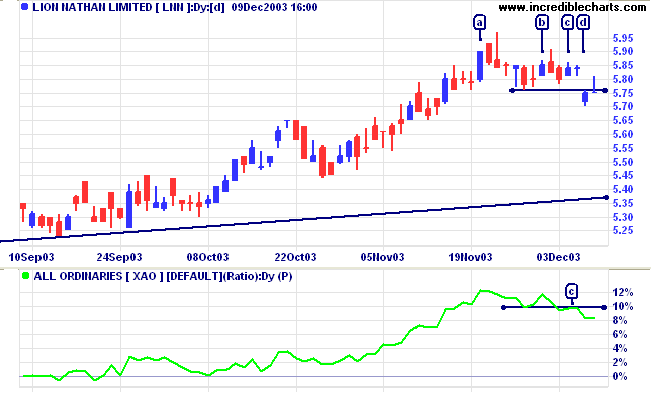

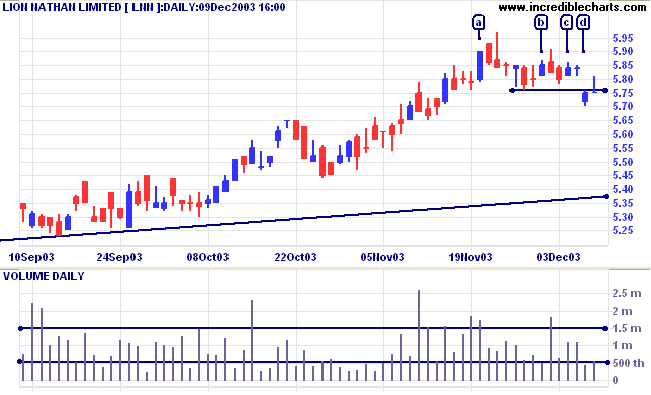

Last covered on November 4, 2002.

LNN has been in a stage 2 up-trend for more than 3 years, but in 2003 Twiggs Money Flow (100) started to decline showing a strong bearish divergence.

~ Max Ehrmann: Desiderata (1927)

US stocks and US indexes are still being added to the stock screen module

and should be available by next week.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.