|

|

|

WineOrb, Australia’s premium fine wine

broker, are offering a free Masterclass for you and your

partner, to show you what to look for when making an

investment in wine. Complete the form on our site and tell us

in less than 25 words why you would like to attend. The best

entries will be invited to join us at the Masterclass on the

16th May 2003. Click here to enter. |

Trading Diary

April 7, 2003

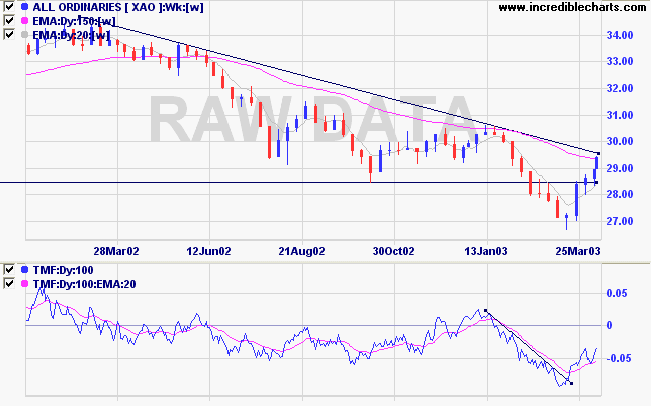

Monday 17th's follow through signal remains valid (as long as the index holds above 7763).

The intermediate cycle is down; a rise above 8552 will signal a reversal; a fall below 7903 will signal continuation.

The primary trend is down.

The Nasdaq Composite formed an open-close reversal: the index gapped up at the opening to reach a high of 1430, but retreated sharply to close only 6 points up at 1389.

The intermediate trend is down; a rise above 1430 will signal a reversal.

The primary trend is up.

The S&P 500 also shows a gravestone reversal, closing 1 point higher at 879.

The intermediate trend is down, until the index breaks above 895.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 44% (April 4), after a Bull Correction buy signal.

The market surged on news that coalition forces had entered Baghdad, but strong selling emerged before the close. (more)

New York (17.40): Spot gold is lower at $US 323.10.

The intermediate up-trend continues.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) crossed to above its signal line; Twiggs Money Flow (21) is positive.

Long-term: Wait for the March 18 follow through and April 3 Bullish % signal to be confirmed by the intermediate signal.

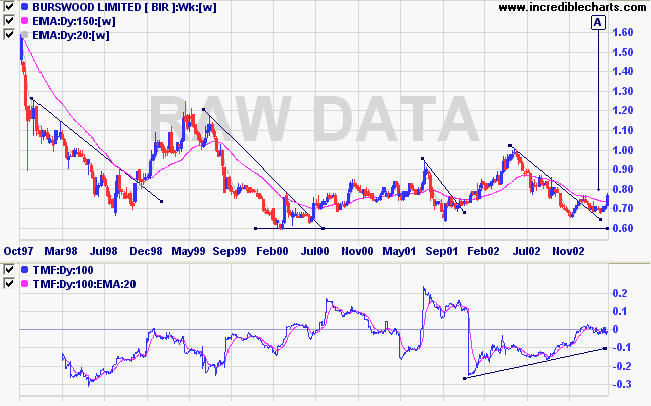

Last covered on September 19, 2002.

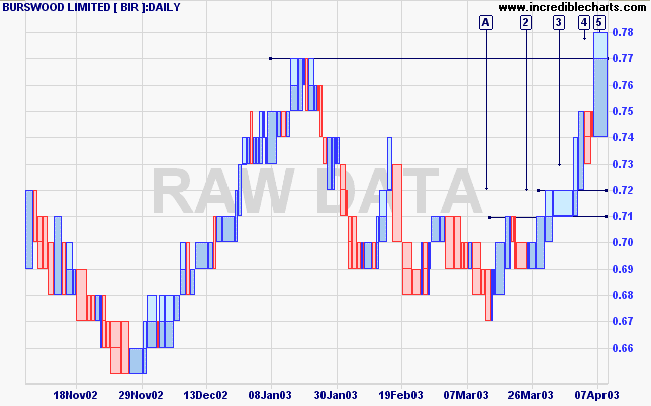

BIR has formed a broad base above support at 0.60. We now see a higher low at [A] after a successful test of the support level.

Twiggs Money Flow (100-day) shows signs of accumulation.

Relative Strength (price ratio: xao) is rising; MACD is positive; while Twiggs Money Flow (21-day) hovers around the zero line after completing a bullish divergence in November.

The target for a breakout above 0.77 would be the 1.00 resistance level.

Opportunities flit by while we sit

regretting the chances we have lost.

- Jerome K Jerome.

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.