Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

January 14, 2003

The average is ranging between 8161 and 9076, at the top end of the base that has been forming since July 2002; a bullish sign.

The primary trend is down and will only reverse up if the average rises above 9076 (the high from December 02).

The Nasdaq Composite formed an inside day, closing up 1% at 1461.

The primary trend is up.

The S&P 500 closed up 0.6% at 931.

The index ranges between 965 and 768, establishing a base. It has recently held above 867 and failed to re-test support at 768; a bullish sign.

The Chartcraft NYSE Bullish % Indicator increased to 52% (January 13).

The chip maker made after-hours gains after announcing fourth-quarter earnings of 16 cents per share, compared to expectations of 14 cents. (more)

Gold

New York: Spot gold lost 320 cents to $US 350.90

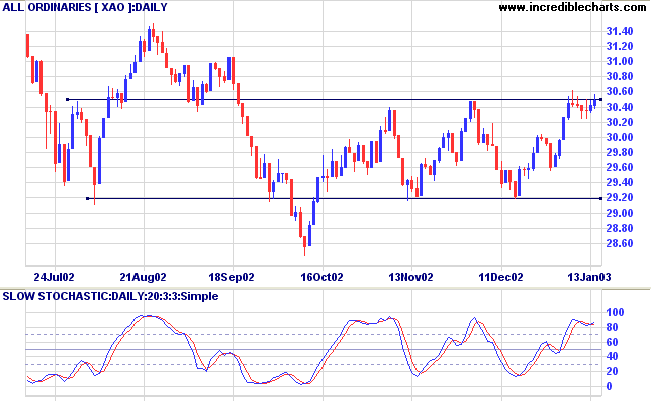

The index ranges between 2915 and 3050, forming a base. A break above 3050 will signal a primary trend change to an up-trend. Look for volume confirmation.

Slow Stochastic (20,3,3) has crossed to above its signal line; MACD (26,12,9) is above; Twiggs money flow signals accumulation.

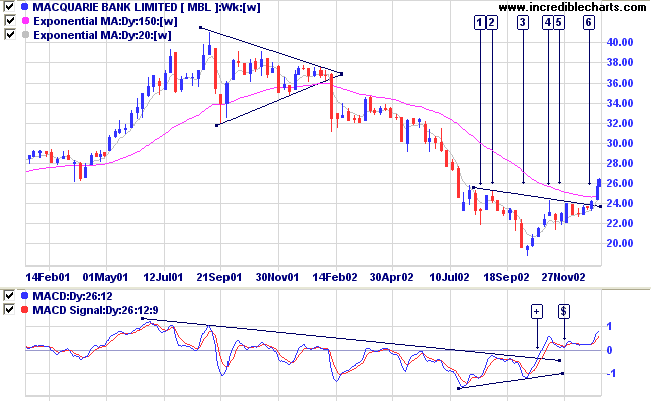

MBL formed a stage 3 top in the form of a triangle, followed by a stage 4 down-trend for the next 12 months. The stock has recently completed an inverted head and shoulders reversal pattern, from [1] to [6].

Relative strength (price ratio: xao) is rising and Twiggs money flow signals accumulation. MACD broke its downward trendline at [+] after completing a bullish divergence. The subsequent trough did not cross below zero [$], a further bullish signal.

-

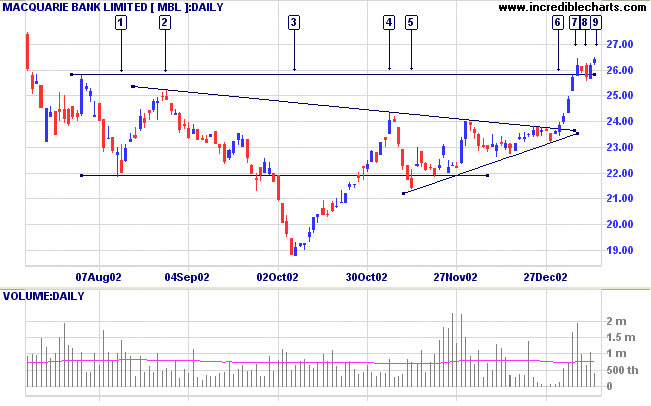

On the breakout from the inverted

head-and-shoulders/triangle at [6], with a stop below the

recent low, 2 days earlier.

Some traders may have chosen to enter a day earlier, spurred by the dry-up in volume and the short duration of the counter-trend. - The rally to $26 was accompanied by a reassuring surge in volume. The subsequent congestion from [7] to [9] showed a dry-up of volume and the counter-trend at [8] was of very short duration. Entry can be taken at [9] with a stop below the low of [8]. A break back below the low would be a bearish sign.

For further guidance see Understanding the Trading Diary.

rather it is the ability to take action in the face of fear.

- Nancy Anderson: Work With Passion

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.