Trading Diary

July 15, 2002

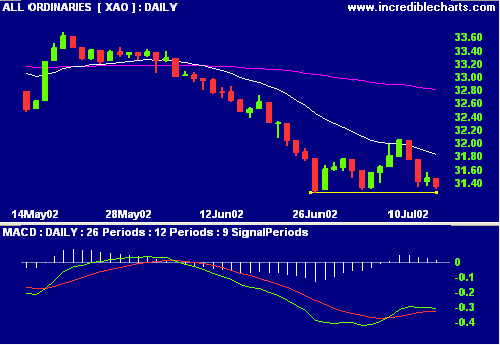

This is a bear market, with primary and secondary cycles trending down.

The late rally on the Nasdaq Composite was

stronger with the index closing up 0.66% at 1382.

The primary and secondary cycles are in a down-trend.

The S&P 500 imitated the Dow, closing

down 4 points at 917.

Primary and secondary cycles trend downwards.

The largest US drug company is to buy Pharmacia for $US 60 billion, boosting research and development and giving Pfizer control of Celebrex and Bextra arthritis medication. (more)

Investing in bonds

Some analysts are punting

bonds, discounting the risk of an interest rate rise.

(more)

Preston Resources [PSR]

The West Australian nickel miner has agreed to purchase a 1

million ounce Malaysian gold project. (more)

PSR has been suspended from quotation since 25 October

1999.

It takes a wise man to sell in a boom. Any fool can sell in a recession. - V.J.Naipaul

Back Issues

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.