Bear market confirmed

The Dow Jones Industrial Average closed at 41,433 after marginally breaking primary support at 42,000 yesterday. This confirms a bear market in terms of Dow Theory.

Confirmation comes after an earlier bear signal, breaching primary support on the Transportation Average below.

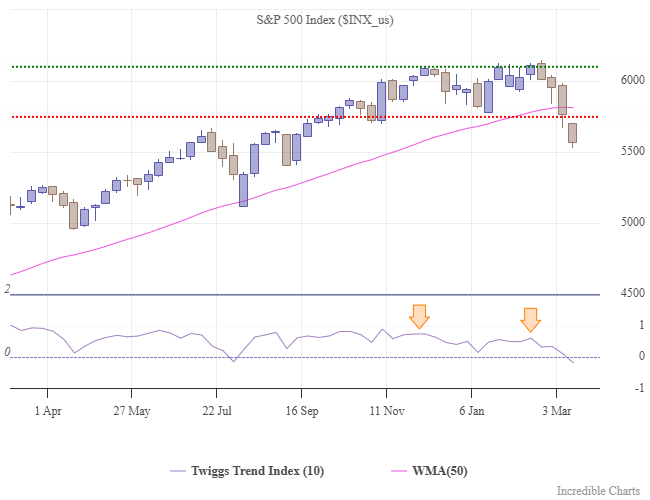

The S&P 500 also signals a primary downtrend after breaching support at 5,800, strengthening the Dow bear signal.

The equal-weighted S&P 500 index ($IQX) was the last shoe to drop, breaking primary support at 7,000 on Tuesday.

Further confirmation comes from the Russell 2000 Small Caps ETF (IWM), in a primary downtrend after breaking support at 214.

The Nasdaq QQQ ETF also broke primary support at 500, warning of a bear market.

Conclusion

We now have confirmation of a bear market from all the major indexes.

Bear markets typically result in a 30 to 50 percent drawdown. With stock valuations at extremes, this one is unlikely to disappoint.

Market Analysis Subscribers

Recent titles: It's a bear market The Last Man Standing ASX Weekly Market Snapshot US Weekly Market Snapshot A temporary reprieve

Everything contained in this email, related websites, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.