Gold: The Long Game

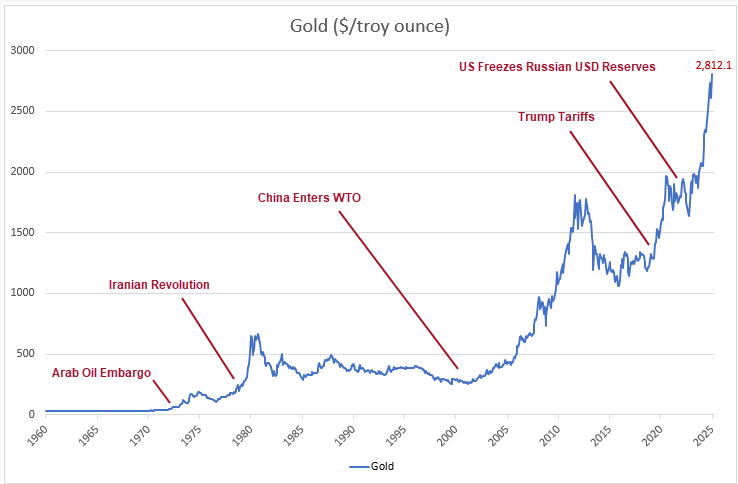

A timeline since 1960 shows that the price of gold tends to rise in waves, typically triggered by an event that unsettles global financial markets. These waves are interspersed with long periods when the Federal Reserve succeeded in suppressing the price of gold despite persistent inflation.

In the 1960s, a gold pool led by the Fed openly suppressed the price of gold, seeking to maintain a price ceiling at the official exchange rate of $35 per troy ounce. Eventually, the pool collapsed as rising US deficits under the Kennedy and Johnson administrations increased upward pressure on gold prices.

Gold Suppression

Why would the US Treasury suppress the price of gold in international markets?

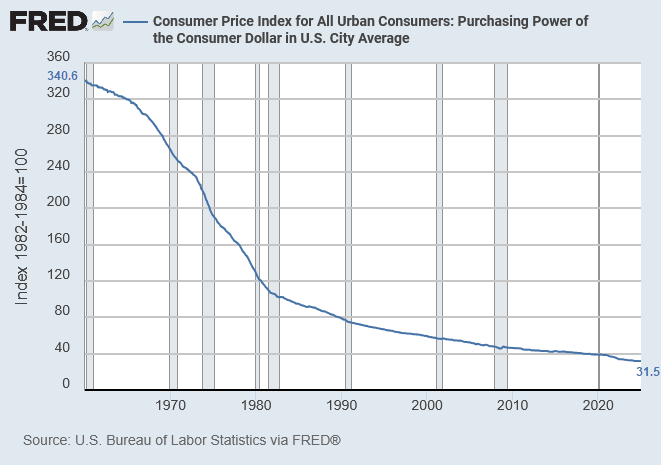

This stems from the dollar's status as the global reserve currency. By suppressing the price of gold, the US Treasury manipulated the perception of inflation caused by the expansion of the US monetary base. More importantly, poor appreciation of gold encouraged foreign central banks to reduce their gold reserves and buy US Treasuries. This lowered US interest rates, boosting the US economy, a benefit that French economist Jacques Rueff described as an "exorbitant privilege."

The RBA was among many central banks that reduced their gold reserves in the 1990s, selling 167 tonnes at around US$350 per ounce.

Gold reserves declined, and investment in US Treasuries soared.

Decline of the Dollar

The declining value of US gold reserves relative to its monetary base raised concerns that the US was debasing the dollar, the global reserve currency. In 1965, President Charles de Gaulle announced that France would convert its dollar reserves to gold at the official rate, with the French fleet crossing the Atlantic to take delivery. Foreign central bank demands for conversion eventually forced Richard Nixon to close the gold window in 1971 to prevent the depletion of US gold reserves, defaulting on its 1944 Bretton Woods commitment.

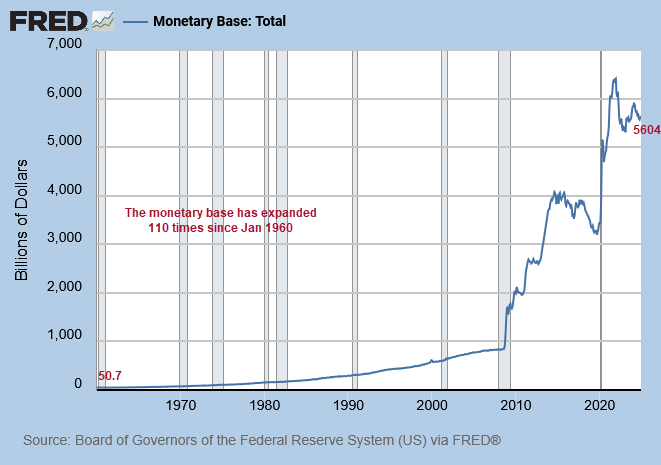

After the "Nixon shock," central banks developed a floating rate system, where exchange rates were determined by demand and supply. However, this removed the constraint on central banks to restrict the expansion of their monetary base, leading to an era of high inflation.

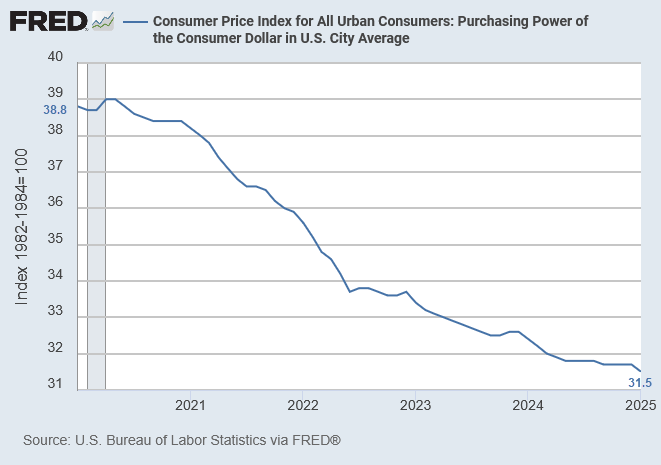

The US monetary base, for example, has expanded to 110 times its 1960 value of $50.7 billion.

Under its 1913 charter, the Federal Reserve was required to maintain gold reserves at 40% of currency in issue plus 35% of commercial bank reserves held by the Fed. Paul Warburg, its chief architect, intended to prevent government profligacy by limiting the expansion of the monetary base, thereby restricting the issue of government debt. Limited demand for credit after the Great Depression allowed Fed gold reserves to grow to 81% of its balance sheet by 1940. However, heavy government spending during World War II led Congress in 1945 to reduce minimum gold holdings to 25% of currency and reserves. Gold backing for bank reserves was later abolished in 1965 and for currency in 1968.

The dollar has lost over 90% of its value since January 1960. One dollar today buys the equivalent of 9.2 cents in 1960.

Floating exchange rates

Floating exchange rates also enabled foreign trading partners to manipulate their currency to gain an unfair trade advantage and run consistent trade surpluses with the US. Under the gold reserve system, a country whose currency was undervalued would face a run on its gold reserves. Similarly, under the Bretton Woods system, it would face a shortage of dollar reserves. However, with floating exchange rates, countries could accumulate excessive dollar reserves to help balance their trade surplus and prevent their currency from appreciating.

China

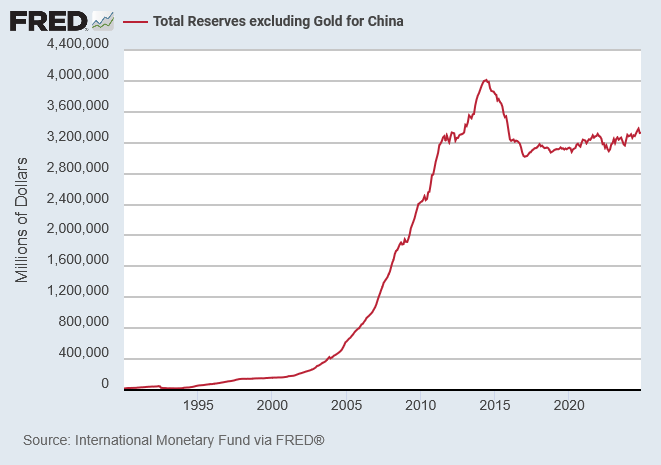

China's foreign reserves climbed to $4 trillion by 2014, mainly in US dollars.

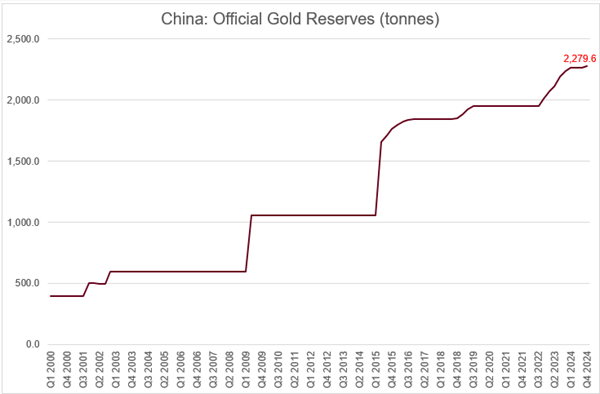

Recognizing that gold was undervalued, the PBOC also amassed 2,280 tonnes of gold in its official reserves. Much of the gold was imported, which provided the added benefit of slowing the appreciation of the Yuan.

However, China's official gold reserves vastly understate their actual government holdings, which Gold Observer Jan Nieuwenhuijs estimates to be around 5,000 tonnes.

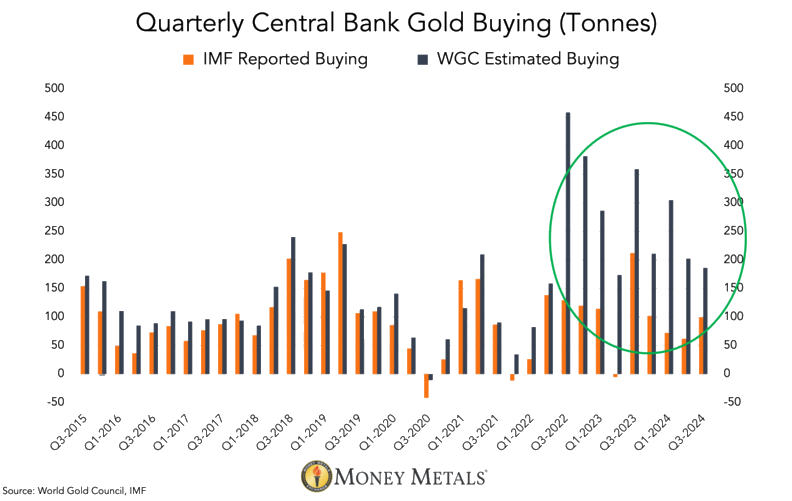

World Gold Council estimates of central bank gold purchases far exceed official figures from the IMF. Covert buying has accelerated since Russian US dollar reserves were frozen in 2022.

In his latest missive, Jan explains how PBOC buying is disguised as trade purchases:

I found the smoking gun of the PBoC’s secret gold operations in November 2024. As private demand in China declined and premiums on the Shanghai Gold Exchange (SGE) turned negative in September, Chinese imports remained robust. For those with knowledge of the Chinese market, there can only be one explanation for stout inflows when SGE gold is trading at a discount: the central bank is bringing in gold. It also fits hand in glove with the other evidence. There can be no reasonable doubt that export of large 400-ounce gold bars from the London OTC market to China reflect PBoC purchases. 400-ounce bars aren’t even traded over the Chinese central bourse (SGE).

Conclusion

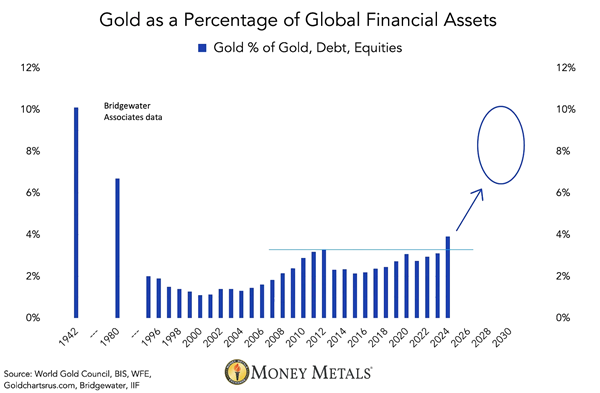

The global financial system is reverting to a monetary system backed by gold, with central banks favoring gold reserves over fiat currencies, including the dollar, as non-aligned states lose faith in the global reserve currency.

The BRICS, led by China, are stripping gold from the global financial system, buying physical gold through official channels and covertly through trade channels. This has created a physical shortage of bullion and is driving up gold prices.

The shortage will intensify if some of the official gold reserves of central banks are leased to short sellers. In the past, this arrangement may have suited the US Treasury, as it helped to suppress the price of gold. However, the situation is now reversed, with short sellers struggling to secure physical to repay the gold.

The US Treasury holds 8,133 tonnes of gold, equal to 261.5 million troy ounces, on behalf of the US Federal Reserve. The monetary base is $5.604 trillion, including currency in issue and commercial bank reserves at the Fed. That is equal to $21,430 per troy ounce.

The minimum likely gold reserves required for the dollar to maintain its global reserve status are 20 to 25 percent of the monetary base, which is equivalent to a gold price of $4,300 to $5,400 per troy ounce.

While that may seem far-fetched, we take an alternative view: that the value of gold never fluctuates. However, based on its record, the dollar in which gold is currently measured is highly likely to lose another 30% to 50% of its value. The only real uncertainty is how long it will take.

Acknowledgments

- The Gold Observer: China Continues Making Covert Gold Purchases in London

- The Gold Observer: Why Gold Will Continue to Shine in 2025 and Beyond

- Money Metals: Chinese Central Bank Just Secretly Bought 60 Tonnes of Gold

- The Gold Observer: China Secretly Snaps Up More Gold, Positions for Its Greater Global Role

- World Gold Council: Gold Reserves by Country

- International Monetary Fund: Total Reserves excluding Gold for China [TRESEGCNM052N], retrieved from FRED, Federal Reserve Bank of St. Louis

Market Analysis Subscribers

Everything contained in this email, related websites, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.