Canada and Australia tied their economies to housing and failed

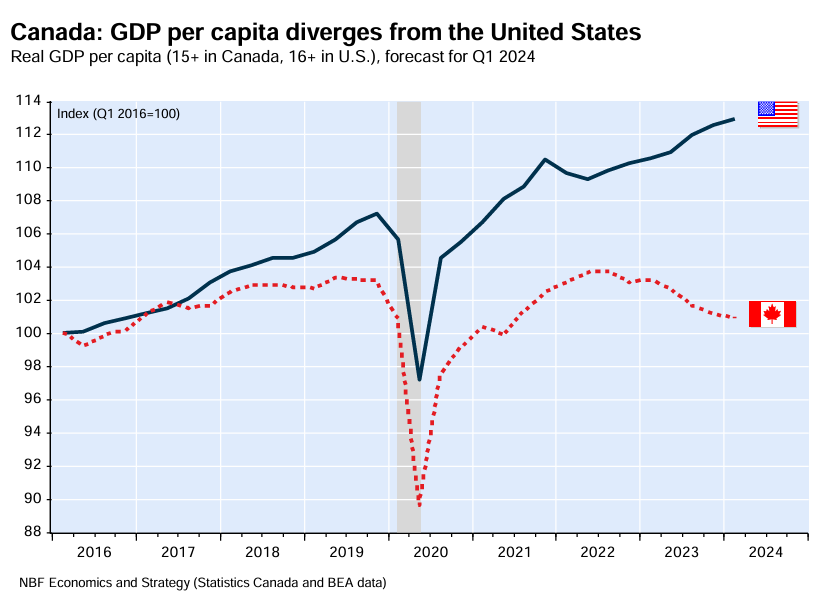

Canada has experienced a shocking decline in labour productivity in recent years, decoupling sharply from its neighbour to the south, the United States:

The decline in Canadian labour productivity has been matched with growth in real GDP per capita, which unlike the United States, has barely experienced any growth in a decade:

The situation is similar in Australia, where productivity growth has also plummeted, tracking at similar levels to 2016:

Arguably, one of the reasons why Canadian and Australian labour productivity has lagged so badly is because both economies have become so heavily dependent on housing and immigration to drive growth.

A few week’s ago, the chief economist at IFM Investors, Alex Joiner, posted the following chart showing the growth in household debt across Australia and Canada since the Global Financial Crisis (GFC) in 2008:

In contrast, United States households have deleveraged since the GFC.

Because of these gargantuan debt loads, alongside the prevalence of variable rate mortgages, Australians and Canadians are sacrificing a significantly larger share of their incomes to debt servicing compared to Americans:

Housing valuations in Australian and Canada also dwarf the United States.

The total value of Australia’s residential housing stock was worth 3.9 times GDP in 2023, whereas residential housing was valued at 3.1 times GDP in Canada.

In contrast, residential housing was valued at only 1.8 times GDP in the United States:

Australia and Canada doubled-down on housing after the GFC, whereas the United States chose to focus on the real economy instead.

Meanwhile, Australia and Canada have grown their populations at a rapid pace through net overseas migration, whereas the United States has grown its population more moderately.

Between 2005 and 2023, Australia’s population swelled by 32% and Canada’s by 24%. Both easily eclipsed the 13% increase in the United States’ population over the same period:

This stronger population growth has required Australia and Canada to dedicate a larger share of their economy’s output on housing construction:

Given the above data, it should not be a surprise that the United States has posted much stronger labour productivity growth than either Australia or Canada.

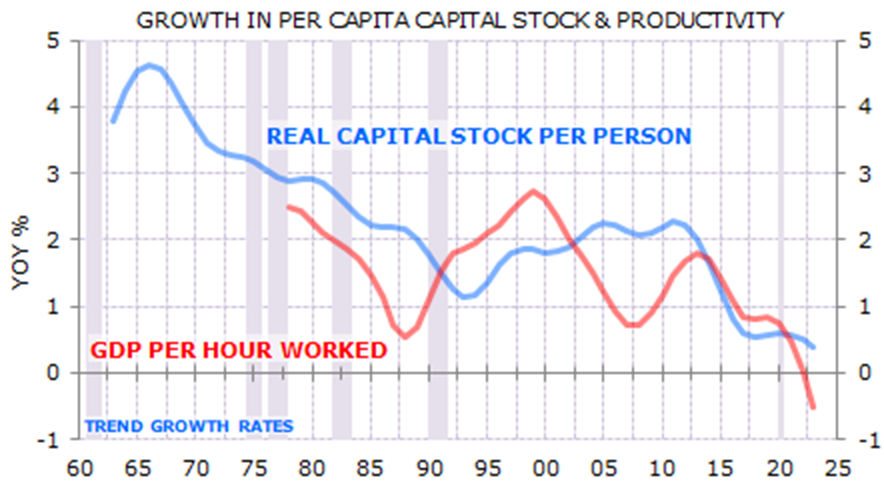

Both Australia and Canada have experienced “capital shallowing”, which occurs when business and infrastructure investments fail to keep up with population expansion, resulting in less capital per worker.

The chart below shows Canada’s capital shallowing, as reported by economists at the National Bank of Canada:

Leading independent economist Gerard Minack created a similar chart for Australia illustrating capital shallowing:

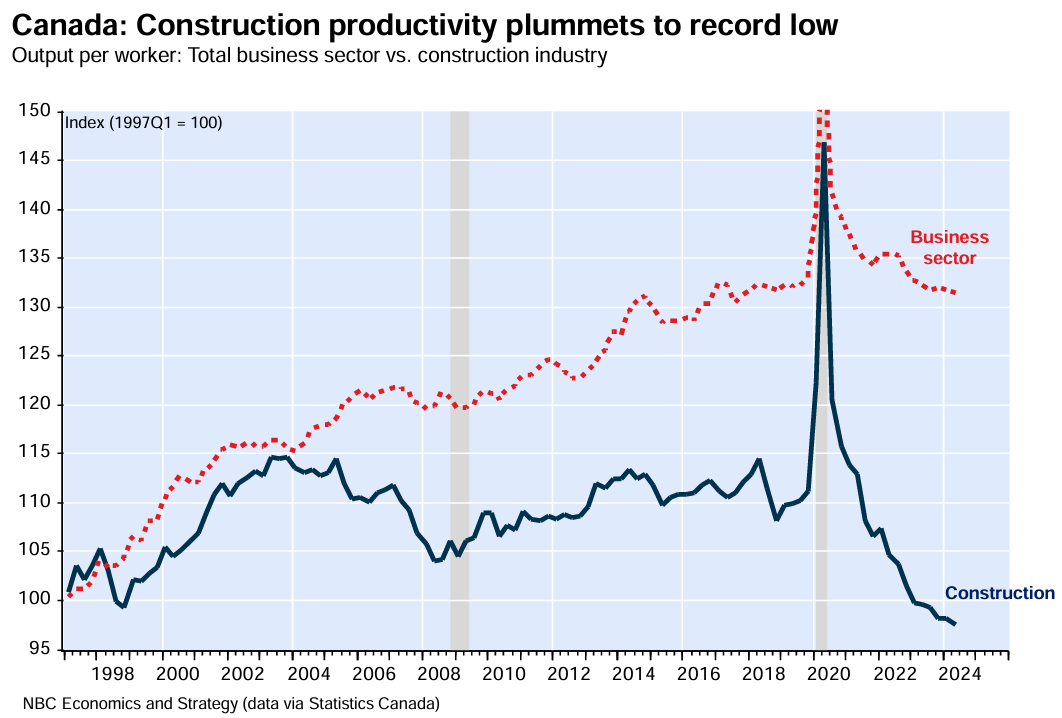

To add further insult to injury, labour productivity in Canada’s construction industry has collapsed to its lowest recorded level in Q2 2024:

“This is particularly alarming given the urgent need to build more homes in the country, with productivity in construction now lower than it was 30 years ago”, the National Bank of Canada economists wrote.

“It’s especially troubling when considering the significant funds governments plan to allocate to housing development”.

Last month, The AFR reported that multifactor productivity in Australia’s construction sector has also cratered over the past decade as the number of professionals employed surged:

Both Australia and Canada have tied their economies to housing and immigration, with deleterious results for productivity and living standards.

Commentary from Colin Twiggs

The government's disastrous housing and immigration policies have not only caused an upsurge in inflation and harmed long-term economic growth. They damage the economic prospects of young Australians, harming the very fabric of our society.

House prices soar as result of immigration, outstripping wages growth which is suppressed by the increased supply of labor. Ultra-low interest rates stripped away the last remaining constraint on the housing bubble. Plunging housing affordability has seen a dramatic fall in new household formation, and in the birth rate, as young Australians struggle to afford their own home. Low birth rates in turn lead to even greater reliance on immigration, reinforcing the downward spiral.

Everything contained in this email, related websites, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.