Chinese bear hug

A bear market with Chinese characteristics.

Sun Bear: Taronga Zoo

The bearish outlook for China's economy is impacting stocks, precious metals, crude oil, and base metals. Semiconductors are also on the sell list.

Semiconductors

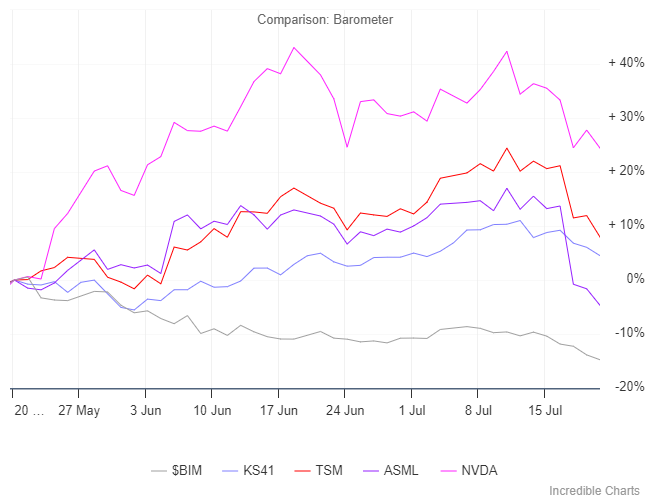

Not just base metals are affected by shrinking Chinese demand; semiconductors are also falling. The chart below shows a declining Dow Jones Industrial Metals Index ($BIM) [silver], accompanied by a weakening South Korean Electric & Electronics Index (KS41) [blue] and falling market leaders in the semiconductor industry: Nvidia (NVDA), Taiwan Semiconductor (TSM), and Dutch photo-lithography specialist ASML Holdings (ASM). All three (NVDA, TSM and ASM) fell steeply during the week.

Broader technology stocks are also affected, with the Nasdaq QQQ ETF testing support at 475. Breach of support is likely and would offer a short-term target of 450.

To continue reading - try it for a Dollar

Access to the Patient Investor requires a subscription. Try our special offer of $1 for the first month.

Subscribers enjoy full access to a comprehensive discussion of each risk measure and regular market risk updates.

Market Analysis Subscribers

Recent titles in Market Analysis

Market Risk Update

Biden withdraws, Bitcoin rises

Uranium stutters

Copper falls

Stocks and precious metals headed for a correction

Everything contained in this email, related websites, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.