S&P 500 losing touch with reality

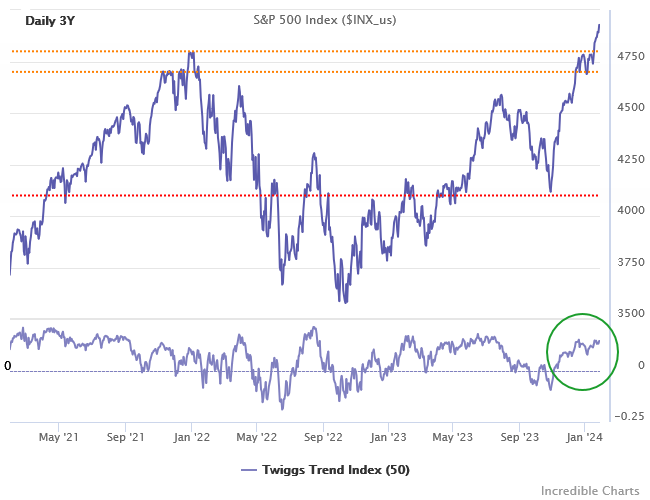

The S&P 500 climbed to a new high of 4928 after breaking resistance at its January '22 high of 4800. Rising Trend Index troughs warn of strong buying pressure. Pricing seems to be losing touch with reality.

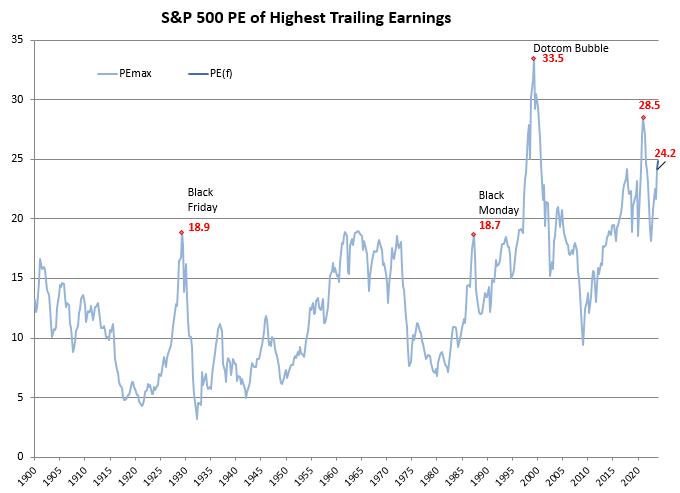

The S&P 500 Price-Earnings ratio climbed to 24.2 on December 31st and is forecast to reach 24.9 at the end of the quarter (based on the current index price and forecast Q1 earnings). The chart below shows the pricing history of the index (and its predecessors) over the past 120 years. We use highest trailing earnings to eliminate distortion caused by sharp falls in earnings during past recessions. Prior to the Dotcom bubble, PE had never exceeded 20 times earnings -- even during the heady booms preceding the Black Friday crash in 1929 and Black Monday in 1987. The long-term average PE of 16.5 (since 1973) suggests that the index is currently over-priced by close to 50%.

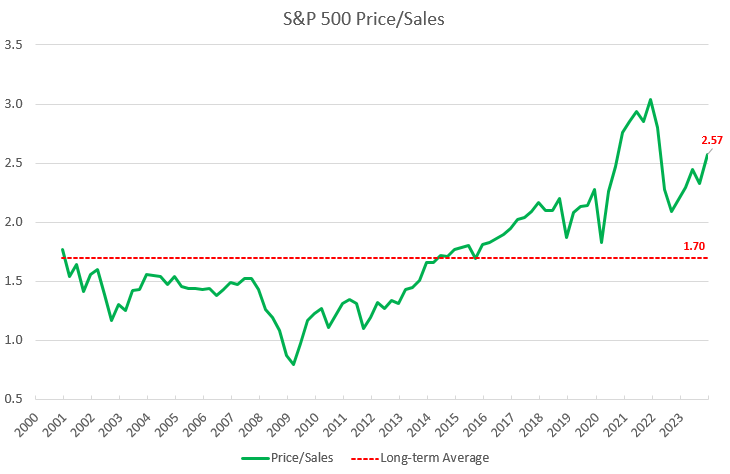

The price-to-sales ratio of 2.57 shows a similar excess compared to the average of 1.70.

Market Analysis Subscribers

Everything contained in this email, related websites, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.