A bear market for bonds?

First published January 23, 2023 at https://thepatientinvestor.com. Excerpt published with permission.

In 2009, Warren Buffett wrote:

"Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once-unthinkable dosages will almost certainly bring on unwelcome aftereffects. Their precise nature is anyone's guess, though one likely consequence is an onslaught of inflation....."

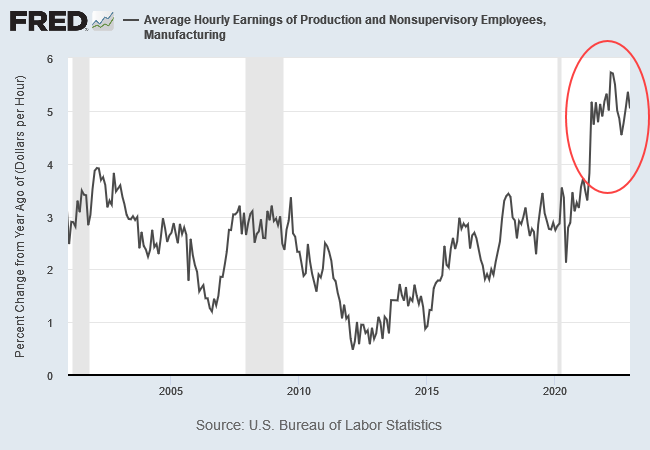

He was wrong about inflation. The next decade enjoyed low inflation, despite loose monetary policy, for two reasons. First, globalization had flooded the global economy with hundreds of millions of Chinese workers -- earning a fraction of Western wages -- a huge deflationary shock that depressed wages growth. Second, a contracting US economy, after the global financial crisis, added to deflationary pressures. The combined effect offset the inflationary impact from profligate monetary policy.

The world has now changed. On-shoring of critical supply chains and geopolitical tensions with Russia and China are stoking inflationary pressures. Warren Buffett's warning now seems prescient as the Fed struggles to cope with inflation fueled by combined fiscal and monetary policy during the pandemic.

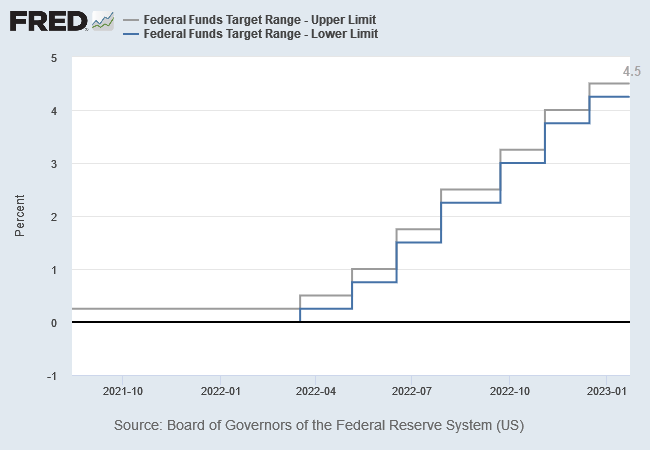

The abrupt reversal in Fed monetary policy has increased the risk of recession. All traces of the word "transitory" have disappeared from press announcements, switching to the mantra "higher for longer". The Fed funds rate is expected to reach 5.0% in the next few months, causing job losses later in the year.

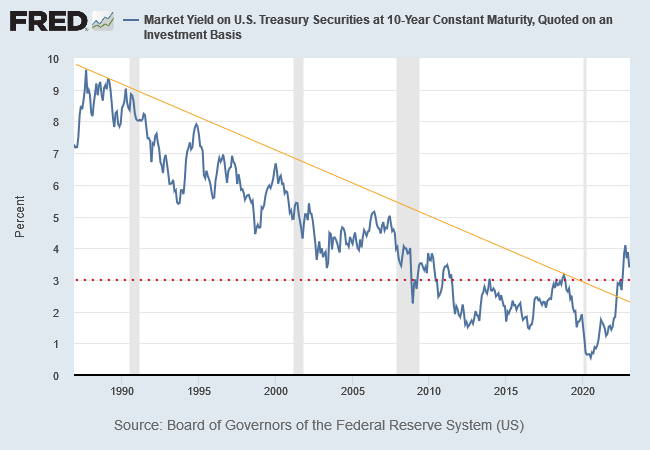

10-Year Treasury yields broke former resistance at 3.0%, reaching 4.0% before retracing. Respect of support at 3.0% would confirm that the almost forty-year bull market in bonds is over.

Quote for the Week

You only find out who is swimming naked when the tide goes out.

~ Warren Buffet, 2001 Chairman's Letter to Shareholders

Recent updates for Market Analysis Subscribers

If you are not already a Market Analysis subscriber, please take advantage of our $1 special.

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.