Bear Market Ahead

Some of our most reliable indicators warn that we are headed for a bear market:

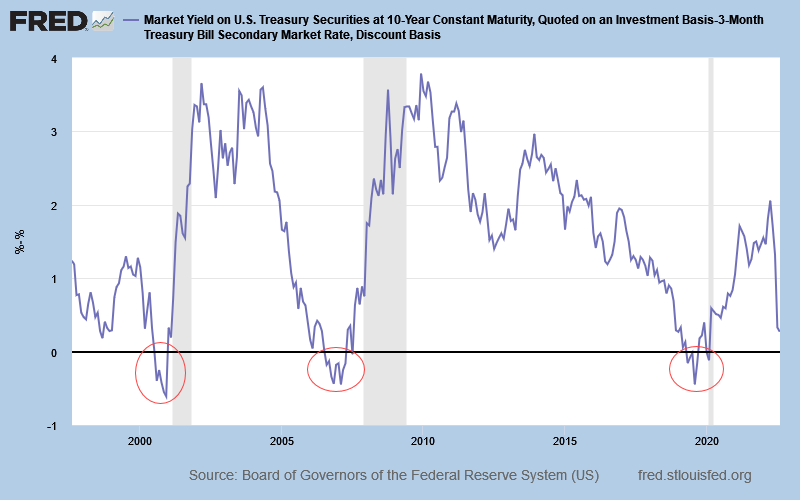

Yield curve

The 10-Year/3-Month Yield Differential is plunging towards zero. An inverted yield curve is one of the most reliable indicators of a coming recession but it is always early. A more timely warning is when the inverted yield differential recovers above zero. This is a bull trap as it normally occurs shortly before the start of a recession – when the Fed pauses rate hikes or cuts interest rates as the economy is weakening.

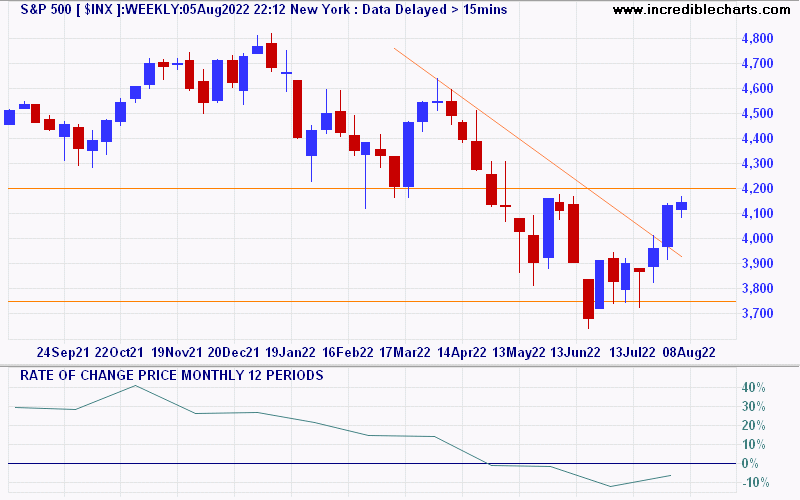

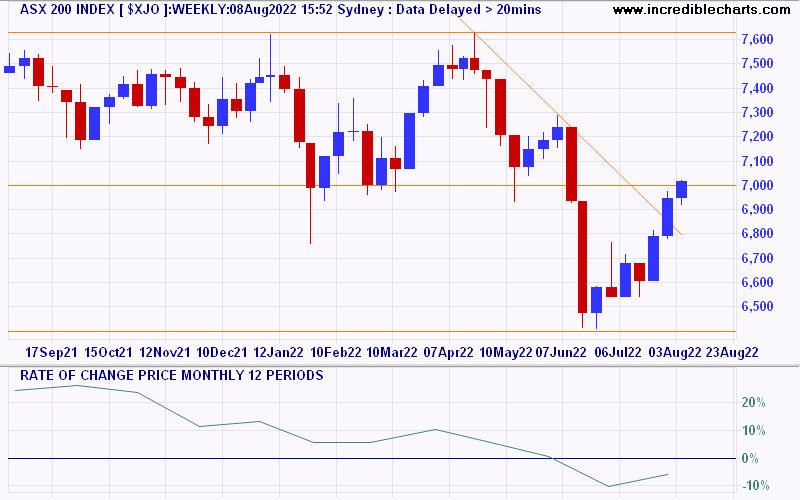

12-Month Rate of Change

Broad market indices, like the S&P 500 and ASX 200, will show a negative rate of change during a bear market. Recovery of 12-month ROC to a positive number is normally an early warning that the bear market is over.

S&P 500

The S&P 500 12-month ROC of -6.03% suggests that the bear market has not ended. Respect of resistance at 4200 would confirm, signaling another test of support at 3700.

ASX 200

The ASX 200 is similarly bearish, with a 12-month ROC of -6.05%. Respect of resistance at 7000 would again confirm, signaling another test of support at 6400.

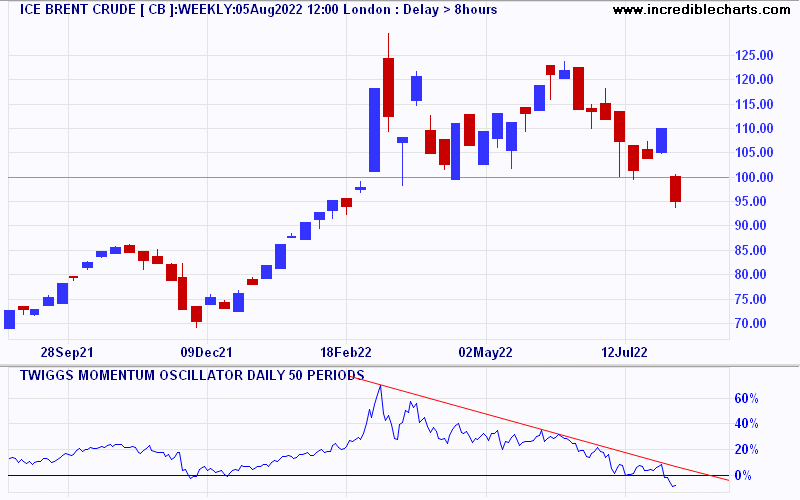

Key commodities

Crude oil

Brent crude oil broke primary support at $100 per barrel, warning of a strong decline. 50-Day Momentum falling below zero strengthens the bear signal.

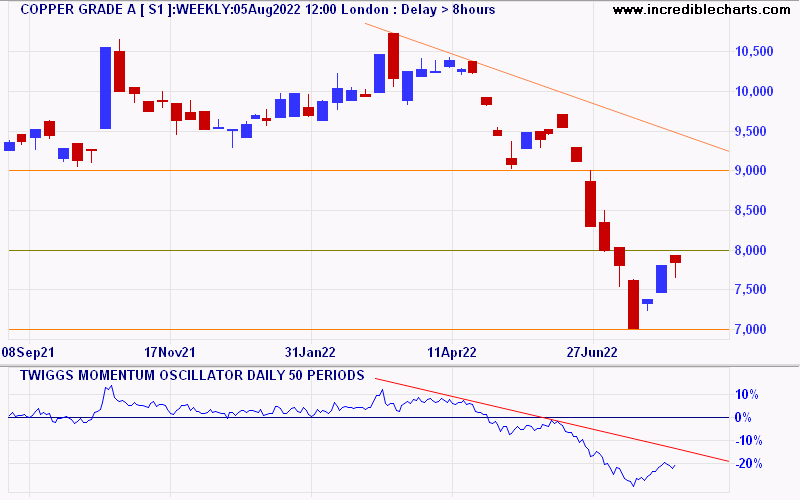

Copper

Copper is in a strong-down-trend, having broken primary support at 9000 per tonne. Respect of resistance at 8000, after the recent rally, would warn of another test of support at 7000. 50-Day Momentum well below zero further reinforces the strong bear signal.

Conclusion

Four reliable indicators all warn of a bear market ahead. Investors should be cautious, while short-term traders need to be nimble to take advantage of strong volatility and exercise sound position-sizing to limit potential losses.

Quote for the Week

We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.

~ Warren Buffett

Recent updates for Market Analysis Subscribers

Take advantage of our $1 special. New subscribers only.

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.