Recent Breakouts

We look for shallow corrections and Trend Index troughs above zero which indicate healthy buying pressure.

Our recent breakout scan returned a few promising stocks in the USA and Canada but none in Australia or the UK.

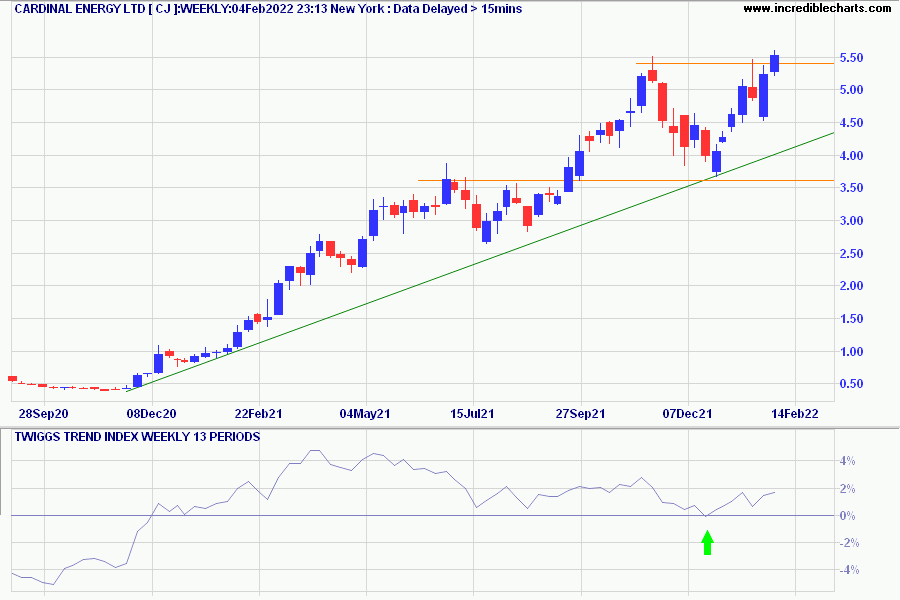

Canada

Cardinal Energy Ltd (CJ) recovered from its recent deep trough and shows a strong up-trend. Breakout above 5.50 and Trend Index troughs above zero indicate long-term buying pressure.

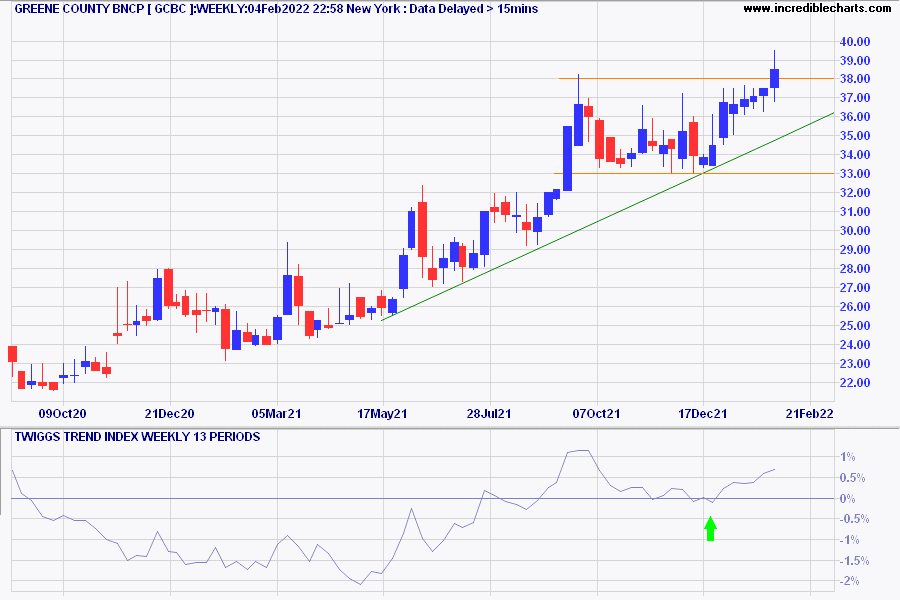

USA

Greene County BNCP (GCBC) recovered from its recent trough with a breakout above 38.00. A Trend Index trough at zero indicates buying pressure. Expect retracement to test the new support level. Respect would confirm a fresh advance.

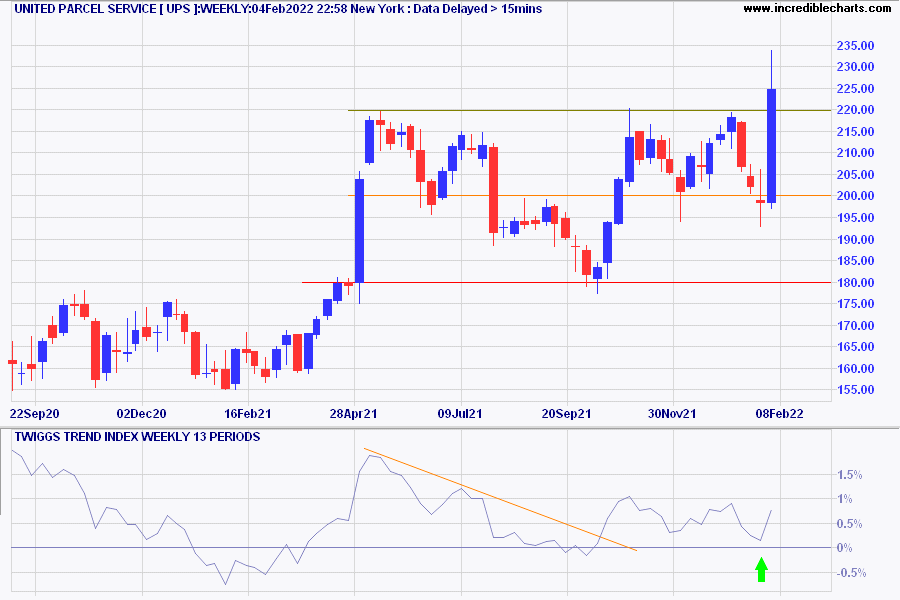

United Parcel Service (UPS) – Breakout above 220.00 completes recovery from a deep trough. Trend Index troughs above zero confirm buying pressure. Retracement that respects the new support level at 220.00 would confirm a fresh advance.

A word of caution

The above stocks are selected on the basis of technical analysis and do not consider fundamentals like sales, earnings, debt, etc. Please do your own research. They are not a recommendation to buy or sell.

Quote for the Week

Men, it has been well said, think in herds;

it will be seen that they go mad in herds,

while they only recover their senses slowly,

and one by one.~ Charles Mackay, Extraordinary Popular Delusions and the Madness of Crowds (1852)

Recent updates for Market Analysis Subscribers

If you are not a Market Analysis subscriber, please take advantage of our $1 special.

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.