Recent Breakouts

Our recent breakout scan returned a number of promising stocks for review.

We look for shallow corrections and Trend Index troughs above zero which indicate healthy buying pressure.

Australia

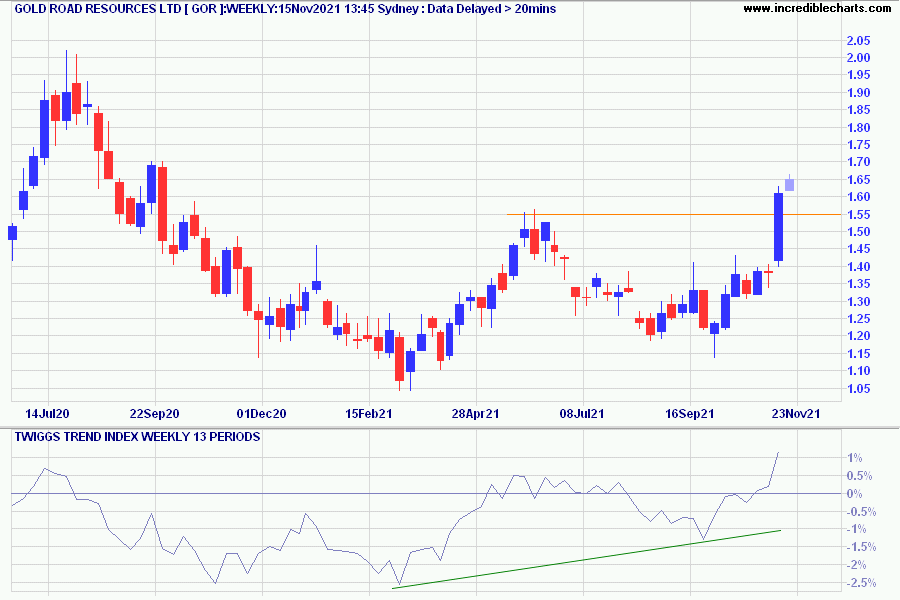

Gold Road Resources Ltd (GOR) – Breakout above 1.55 signals a fresh advance, while Trend Index indicates rising buying pressure.

Canada

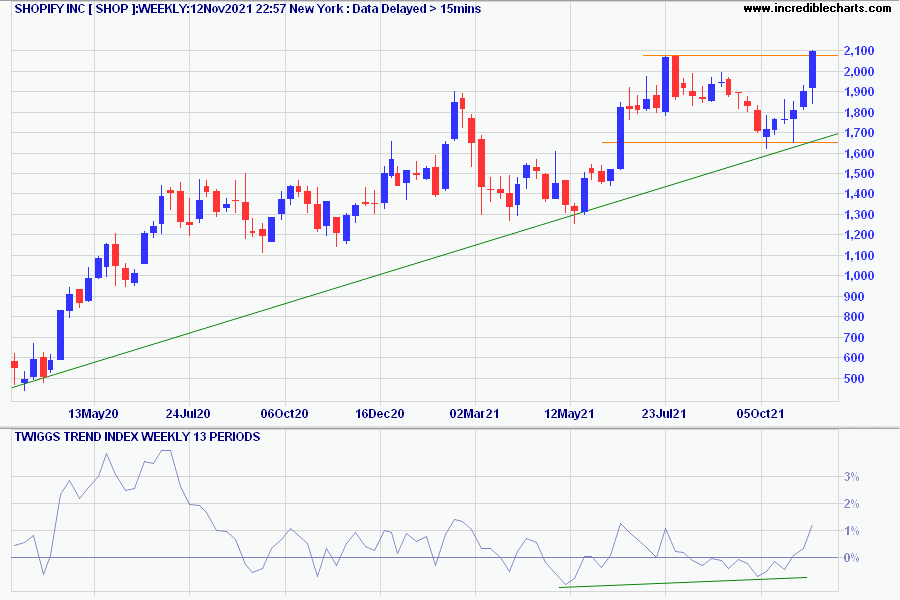

Shopify Inc (SHOP) – Follow-through above 2,100 would signal a fresh advance.

UK

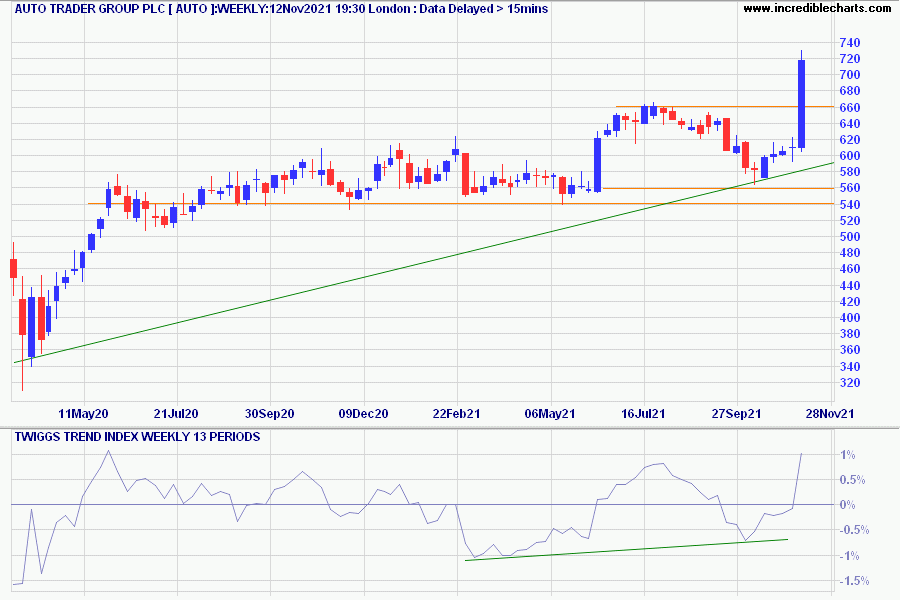

Auto Trader Group Plc (AUTO) – Strong breakout after this news:

(Alliance News) Auto Trader Group PLC said Thursday it delivered its highest ever six-monthly revenue and profit, with consumer engagement and retailer numbers at record levels. Auto Trader was 11% higher in London on Thursday morning at 689.80 pence each, the biggest gainer in the FTSE 100 index. (lse.co.uk, 11th Nov 2021).

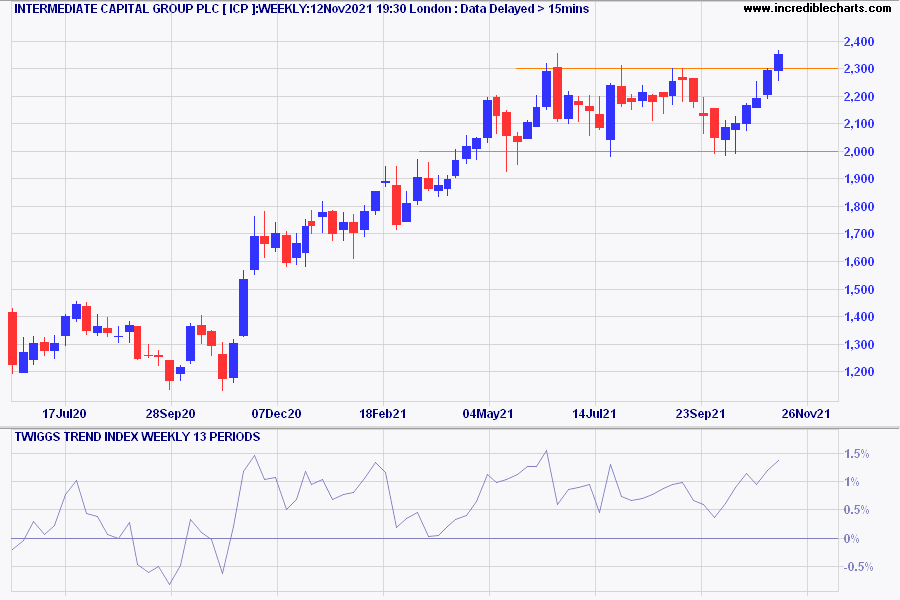

Intermediate Capital Group Plc (ICP) – Shallow trough and Trend Index holding above zero indicate long-term buying pressure. Breakout above 2,300 signals a fresh advance.

USA

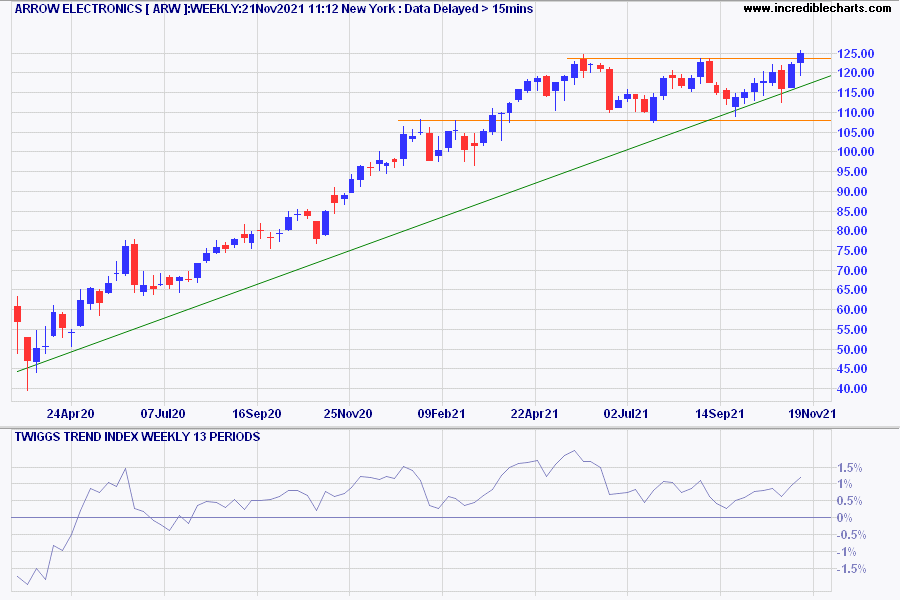

Arrow Electronics (ARW) – Strong trend and a shallow trough, with Trend Index troughs above zero signalling long-term buying pressure. Follow-through above 125.00 would confirm a fresh advance.

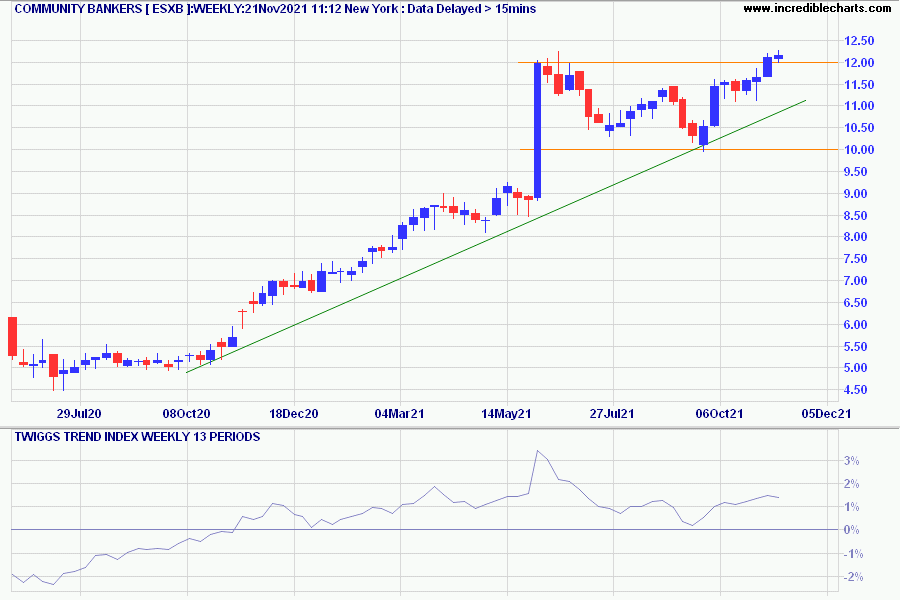

Community Bankers (ESXB) – Trend Index troughs holding above zero indicate long-term buying pressure. Breakout above 12.00 signals a fresh advance.

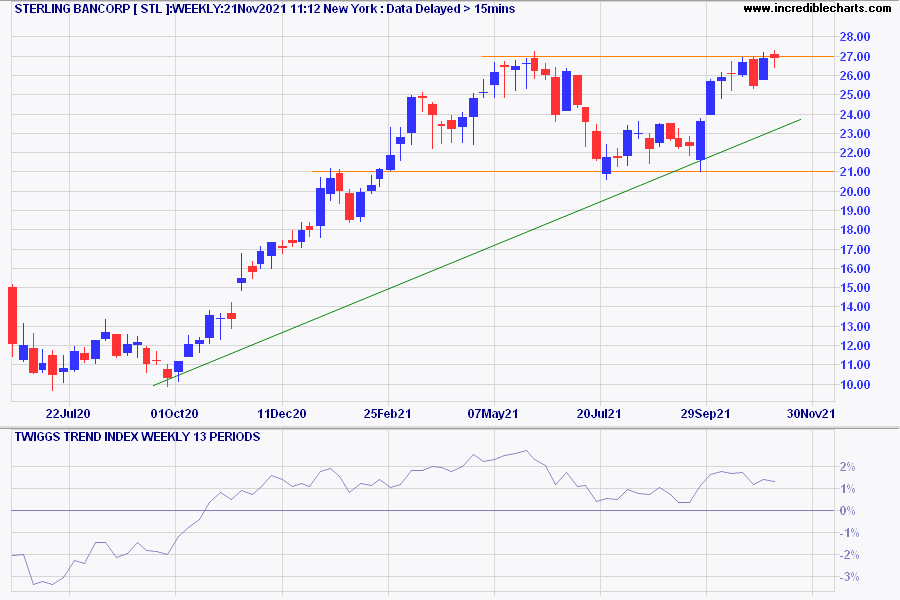

Sterling Bancorp (STL) – Recovery from a deep trough. Trend Index troughs above zero indicate long-term buying pressure. Follow-through above 27.00 would signal a fresh advance.

A word of caution

The above stocks are selected on the basis of technical analysis and do not consider fundamentals like sales, earnings, debt, etc. Please do your own research. They are not a recommendation to buy or sell.

Quote for the Week

Where wealth and freedom reign, contentment fails,

And honor sinks, where commerce long prevails.~ Oliver Goldsmith, The Traveller (1764)

Recent updates for Market Analysis Subscribers

If you are not a Market Analysis subscriber, please take advantage of our $1 special.

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.