Recent Breakouts

Our recent breakout scan returned a number of promising stocks for review.

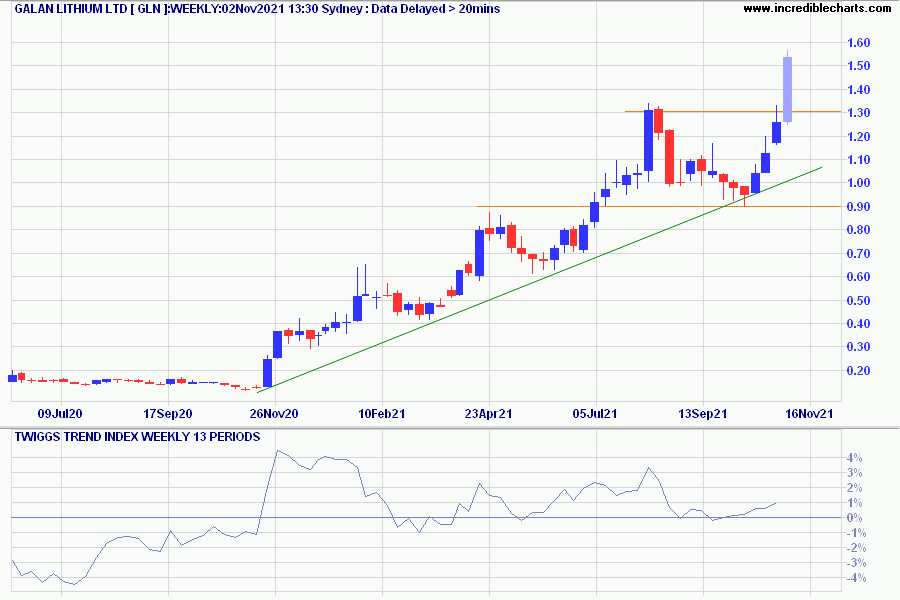

Australia

Galan Lithium (GLN) – Turnover of over $1million per day, has recovered from its recent trough and shows a strong up-trend.

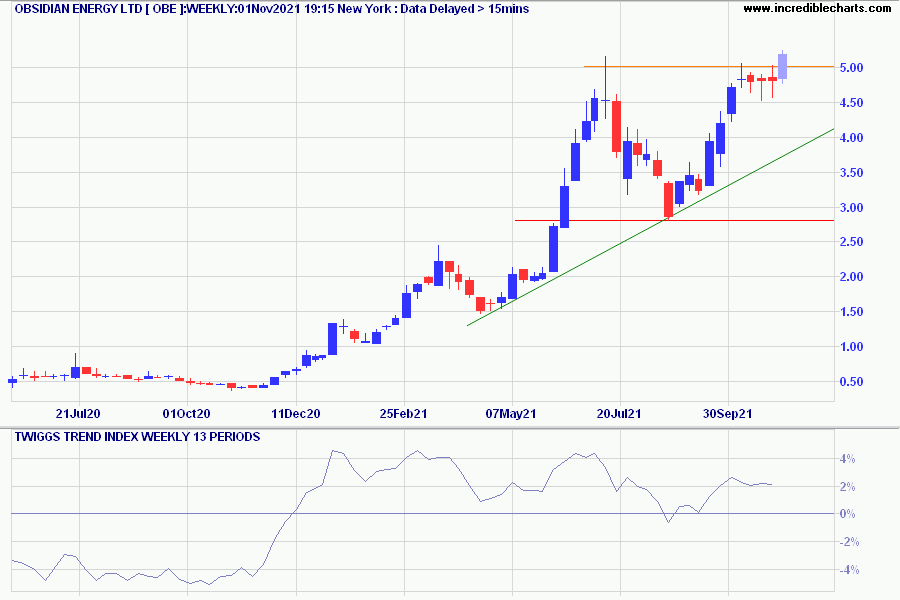

Canada

Obsidian Energy (OBE) – Breakout above 5.00 completes a bullish cup-and-handle pattern.

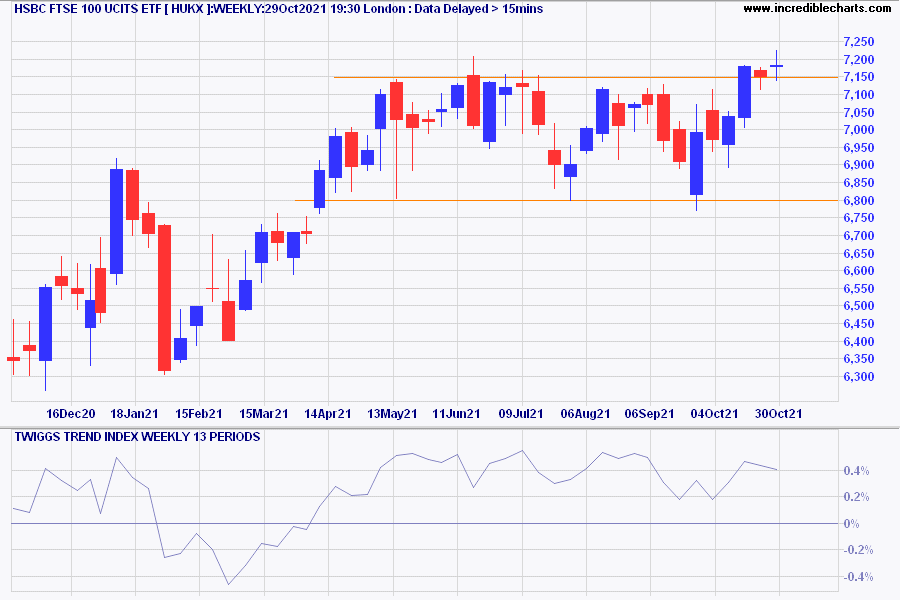

UK

HSBC FTSE 100 ETF (HUKX) – Breakout above 7,150 with Trend Index troughs above zero indicate buying pressure.

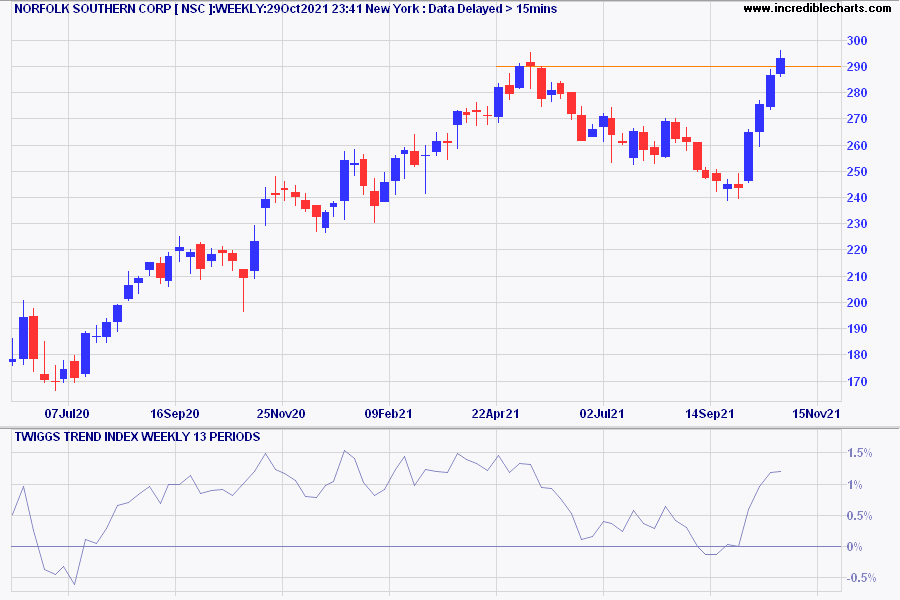

USA

Norfolk Southern (NSC) – Has made a strong recovery from a deep trough.

More breakout charts below

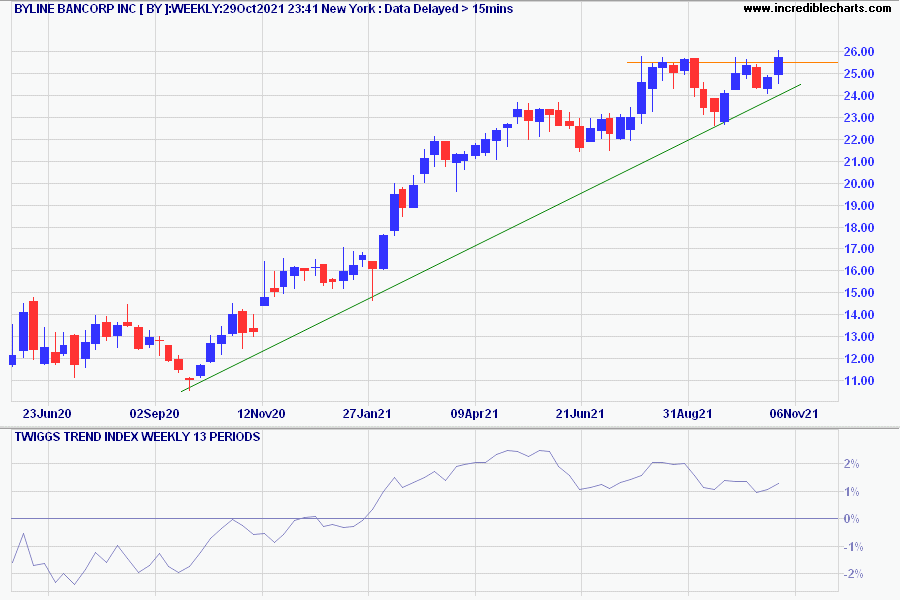

Byline Bancorp (BY) – Shallow trough and Trend Index holding above zero indicates long-term buying pressure. Follow-through above 26.00 would confirm a fresh advance.

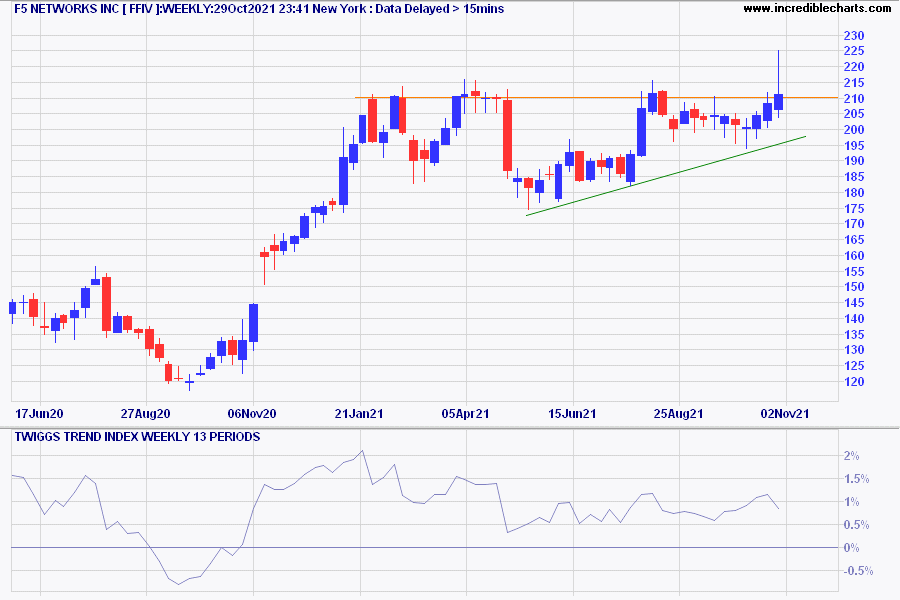

F5 Networks (FFIV) – Bullish ascending triangle and Trend Index troughs above zero indicate long-term buying pressure. Follow-through above 215 would signal a fresh advance.

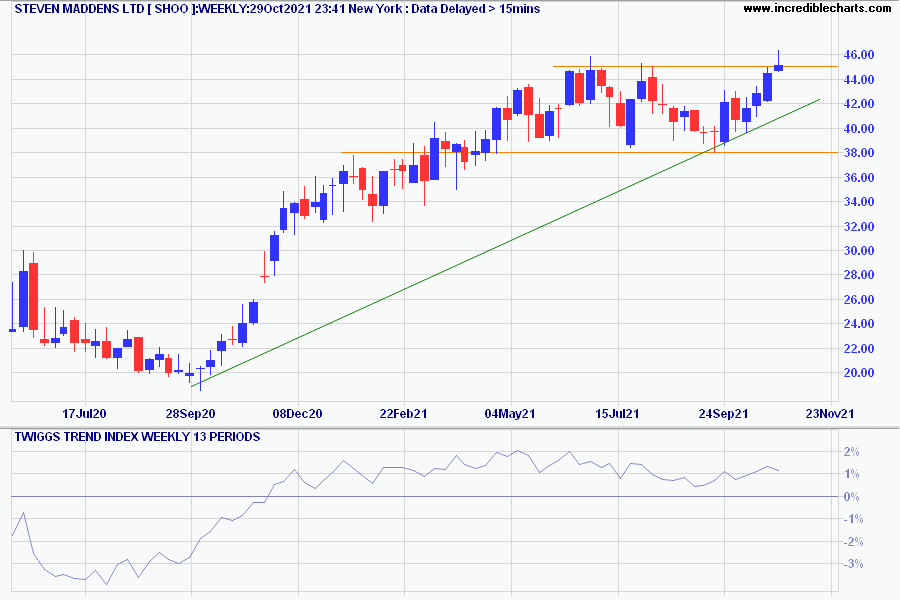

Steven Maddens (SHOO) – Trend Index troughs above zero indicate long-term buying pressure. Follow-through above 46.00 would signal a fresh advance.

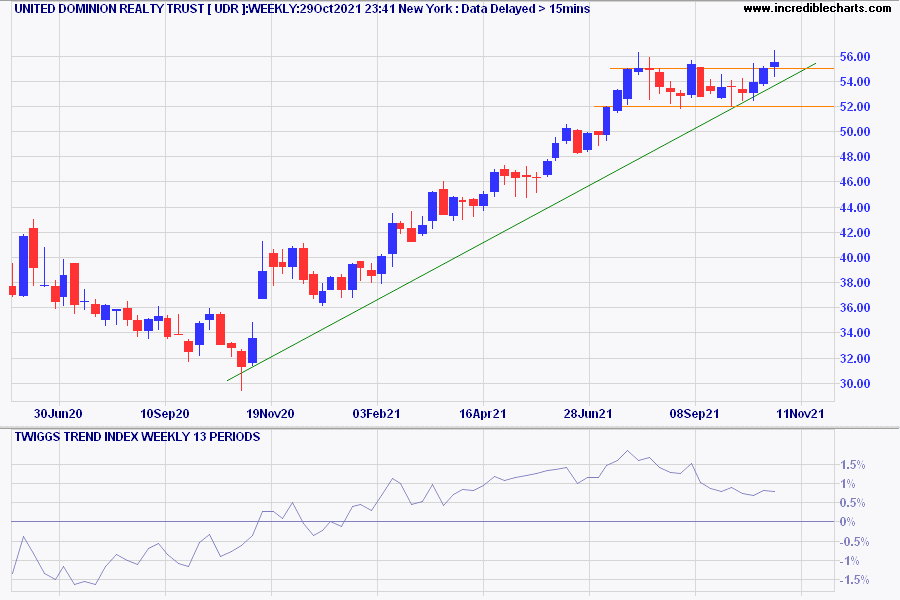

United Dominion Realty Trust (UDR) – Shallow trough and Trend Index above zero indicate buying pressure. Follow-through above 56.00 would signal a fresh advance.

Notes

Shallow corrections and Trend Index troughs above zero indicate healthy buying pressure.

A word of caution: the above stocks are selected on the basis of technical analysis and do not consider fundamentals like sales, earnings, debt, etc. Please do your own research. They are not a recommendation to buy or sell.

Quote for the Week

If you always do what you've always done,

you'll always get what you've always got.~ Henry Ford

Recent updates for Market Analysis Subscribers

If you are not a Market Analysis subscriber, please take advantage of our $1 special.

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.