The S&P 500 Earnings Challenge

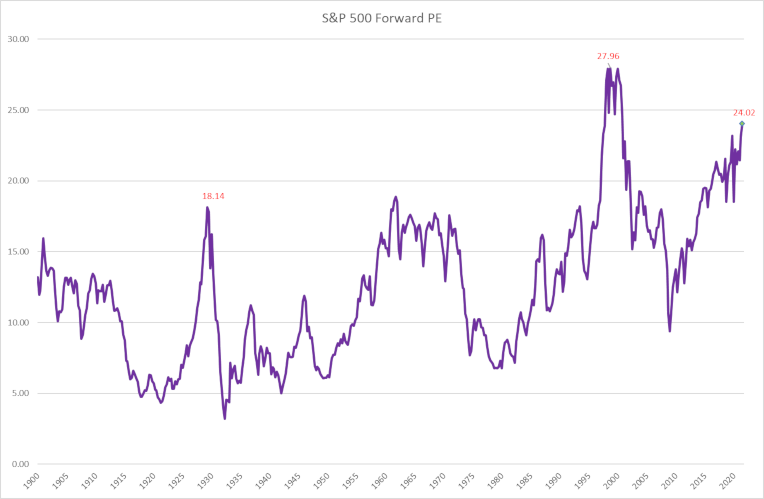

The S&P 500 is trading at a forward PE of 24.0, higher than any previous reading in the past 120 years apart from the Dotcom bubble.

Downside risk far exceeds upside potential, with earnings multiples likely to fall as projected growth disappoints, while earnings forecasts are also based on unrealistic margins.

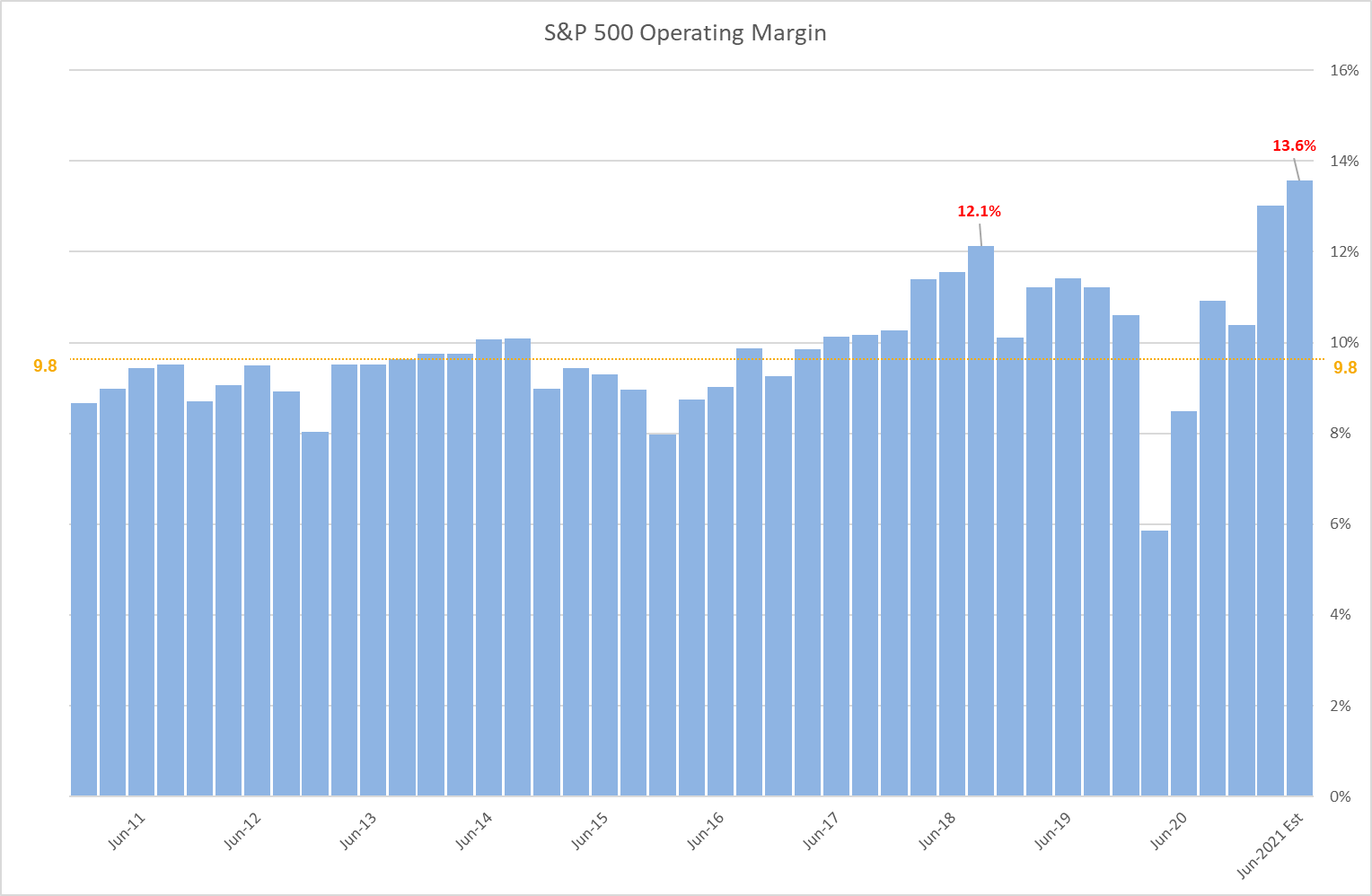

Operating Margins

Operating margins climbed to a high of 13.6%, compared to the 10-year average of 9.8%. Not only is the forward earnings multiple at an extreme level but the earnings to which that multiple is applied are based on operating margins that are unlikely to last.

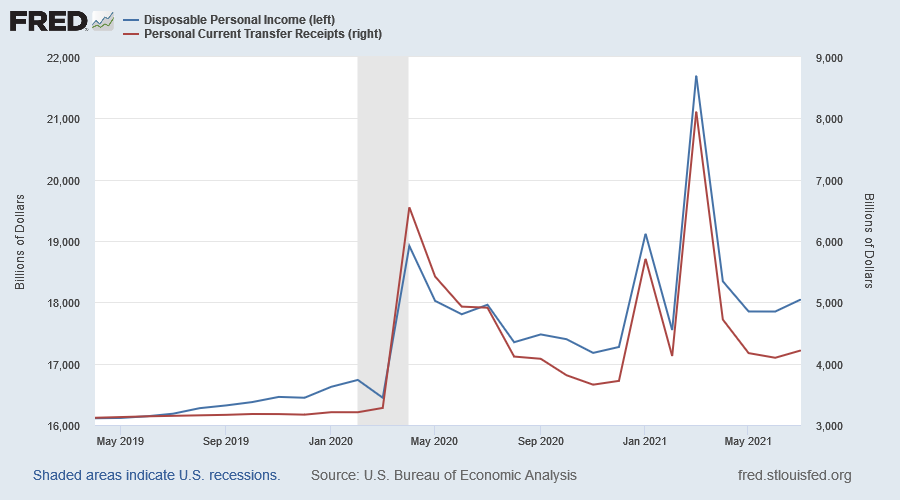

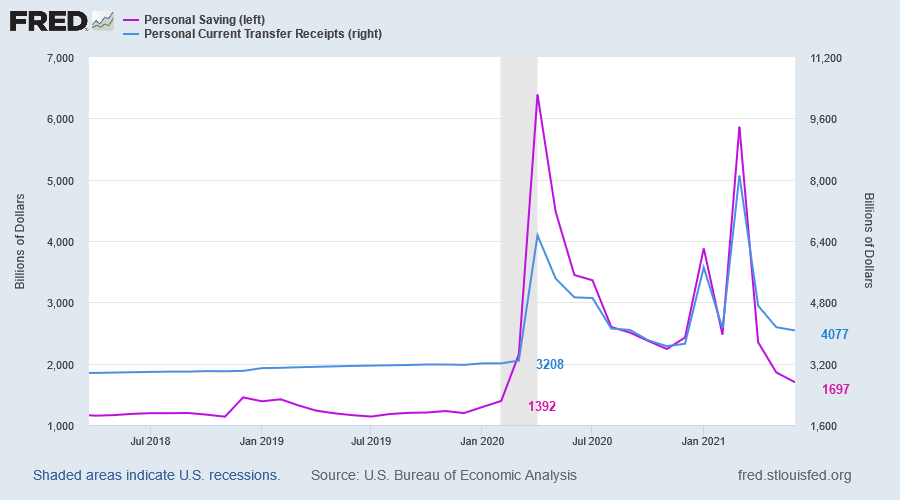

Corporations are taking advantage of supply shortages to increase margins. Apart from supply chain interruptions caused by the pandemic, demand has been boosted by massive government stimulus (brown below), lifting personal income (blue).

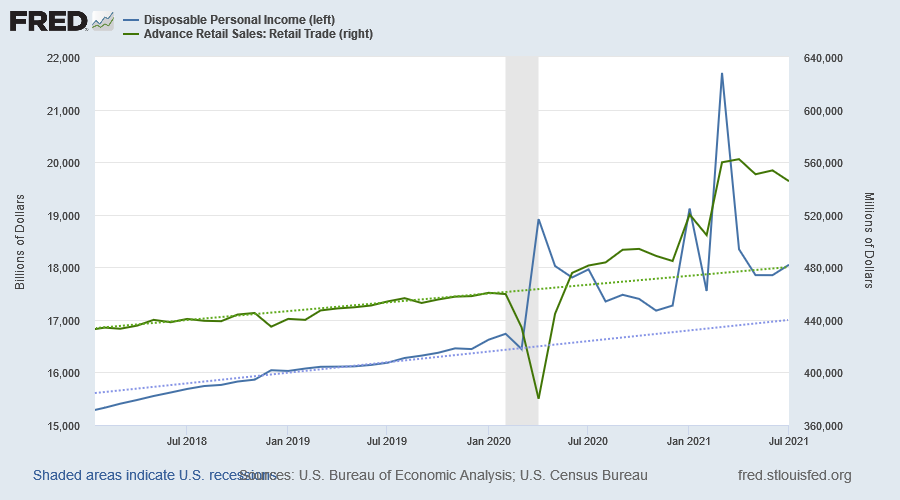

The result has been a sharp rise in retail sales (green below) but this is about to end as stimulus declines and personal income falls. Disposable personal income (blue) is likely to revert to its pre-pandemic trend, around $17 trillion annualized, while retail sales are expected to fall to $480 billion per month.

Not only are sales likely to fall but operating margins are expected to narrow as demand shrinks and supply chains recover.

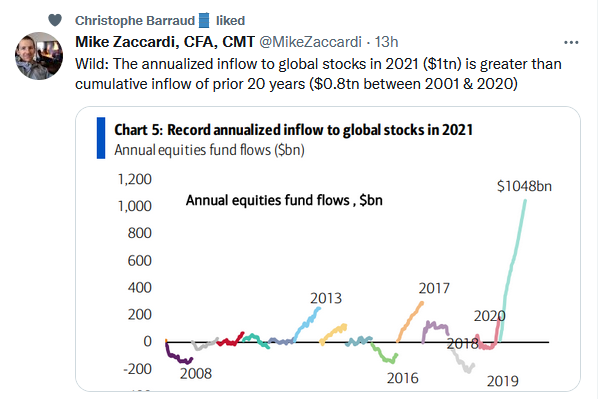

Capital Inflows

Distortion in the stock market has been fueled by massive capital inflows from private investors.

Personal saving spiked upwards by more than $2.5 trillion since the start of the pandemic, the result of falling consumption coupled with rising disposable income from government stimulus.

Personal saving (pink above) is now falling as government transfers (blue) return to normal levels (figures shown are for June '21 and February '20 before the pandemic).

Conclusion

The engine driving stock prices higher is now running on empty. We expect earnings multiples to fall, causing a major correction in stock prices, when capital inflows fueled by government transfers come to an end.

We also expect earnings to fall when supply chains eventually recover and operating margins are squeezed.

Acknowledgements

- Reported earnings, forward estimates, and operating margins are from S&P Dow Jones Indices

- Mike Zaccardi: Equity inflows

Quote for the Week

No amount of sophistication is going to allay the fact that all your knowledge is about the past and all your decisions are about the future.

~ Ian Wilson, former GE Chairman

Recent updates for Market Analysis Subscribers

If you are not a Market Analysis subscriber, please take advantage of our $1 special.

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.