"We have the tools but are scared to use them"

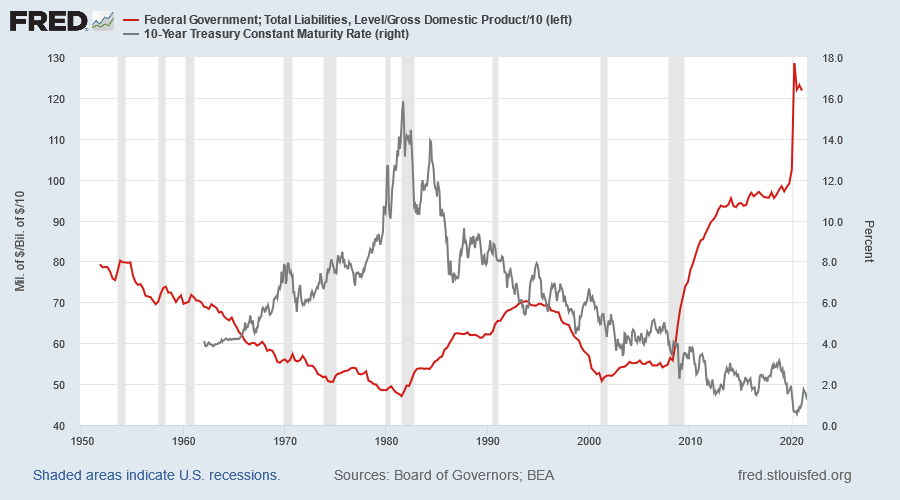

Jay Powell and Janet Yellen are not fools. They know exactly what they are doing. Federal debt is at a precarious level of more than 120% of GDP. Inflation is the only viable course to restore government solvency.

Default is another option, but that would be a political and economic catastrophe. Far easier to inflate GDP through massive deficits funded by Fed bond purchases — reducing the ratio to a sustainable level — while soothing the bond market with talk of "transitory" supply shortages.

"We have the tools if we need to use them"

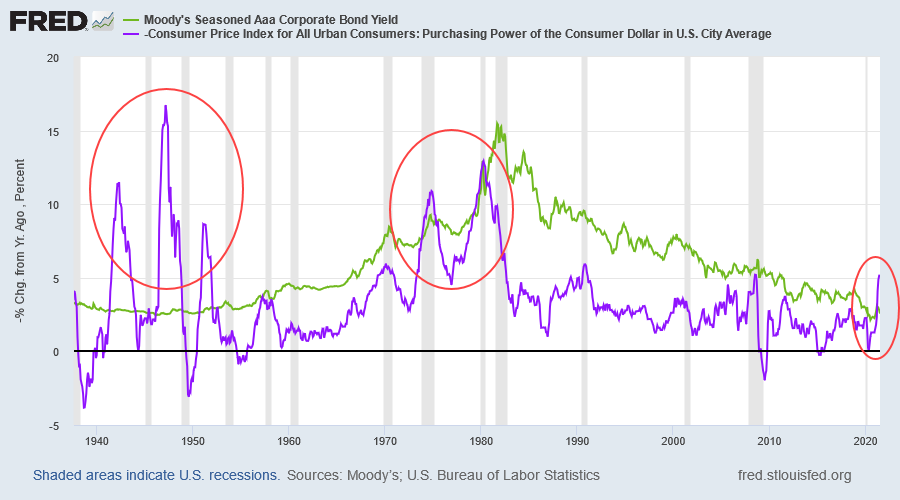

The consumer price index (CPI) broke above the AAA corporate bond yield, warning of another "transitory" inflation spike — like the last two below.

Previous Fed Chairs would be reaching for the blunderbuss but Powell and Yellen are slow-walking this, talking about a response without actually doing much.

There are no free lunches

Central banks have only one tool to tame inflation. That is to raise interest rates to destroy jobs. Only by destroying jobs can the Fed take the heat out of the job market, raising unemployment to eliminate rising wages pressure. The problem is that raising interest rates is likely to plunge a still fragile economy into recession — slowing GDP growth needed to restore fiscal solvency.

That is why Fed officials are reluctant to talk about raising rates until 2023:

Boston Federal Reserve President Eric Rosengren said Monday he would be prepared to start rolling back some of the central bank's easy monetary policy this fall but isn't ready yet to start thinking about raising interest rates. (CNBC)

Conclusion

Interest rates are likely to remain low until late 2023.

Inflation is expected to spike higher, boosting GDP and reducing the federal Debt-to-GDP ratio to sustainable levels (below 80%).

Real long-term interest rates, in turn, are likely to remain deeply negative for several years.

Sell bonds. Buy Gold and precious metals.

Quote for the Week

.....Managing narratives has replaced actually solving pressing problems. It's now impossible in America to actually address pressing problems without stepping on the toes of one politically powerful and politically sacrosanct cartel or another, and so problems fester and multiply to the point they cannot be solved within the status quo, regardless of how many trillions are conjured and squandered.

To mask the coming collapse, narratives must be tightly controlled. Since collapse can't be forestalled without making powerful enemies, the only politically expedient option left is to eliminate any dissent that questions the officially sanctioned happy-stories.

When a society and a state give up the search for solutions because real solutions will negatively impact politically powerful cartels, collapse is only one step away...... managing narratives isn't the same as managing the real world, and the real world eventually crushes the happy-story narratives and those who actually believed them.~ Charles Hugh Smith, Why The Wheels Are Coming Off

Recent updates for Market Analysis Subscribers

If you are not a Market Analysis subscriber, please take advantage of our $1 special.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.