Stock breakouts

First, please read the Disclaimer.

This is just a view of stock market activity, based on technical analysis. It does not take into account fundamentals — like sales growth, margins, return on invested capital, debt and expected dividend streams — and is not a recommendation to buy/sell.

There were two notable breakouts this week in the Russell 3000:

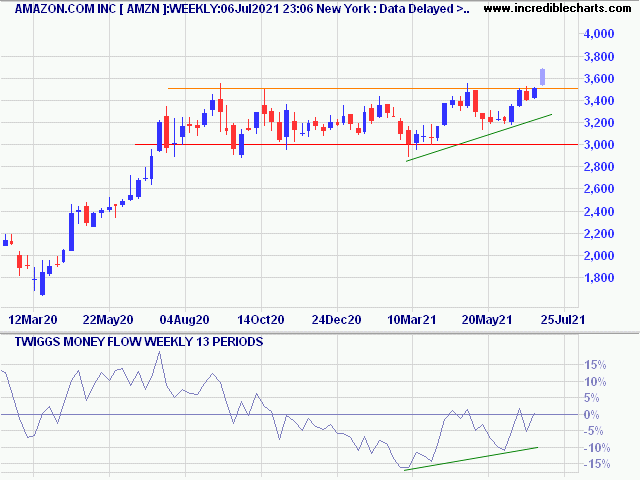

Amazon (AMZN) was the clear winner, breaking resistance at 3500 after forming a solid base (between 3000 and 3500) over the past 10 months. Rising Money Flow troughs signal increased interest from buyers as Jeff Bezos handed over as CEO to Andy Jassy.

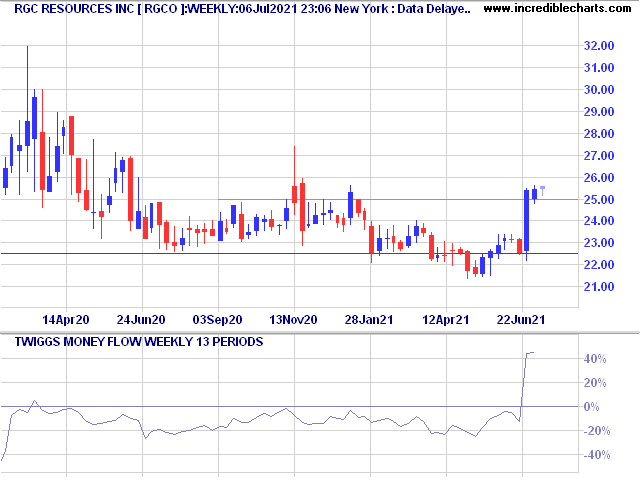

RGC Resources (RGCO) was runner up, breaking resistance at 25 at end of the June quarter. The base is not as well-defined as for Amazon, with penetration of support at 22.50 in April '21 before a strong recovery. Respect of support at 25, however, would confirm the bull signal.

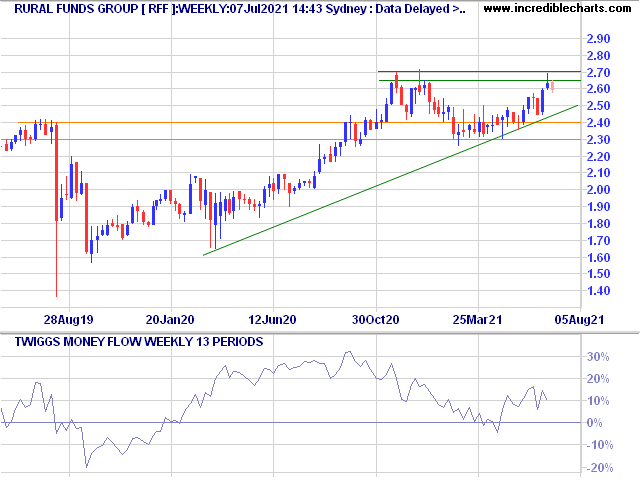

The closest we have to a breakout this week on the ASX 300 is Rural Funds Group (RFF). After breaking resistance at 2.40 RFF formed a loose "cup and handle" pattern1, with a sharp pullback to test support at 2.30 followed by a rally to test resistance at 2.65/2.70. Divergence on Twiggs Money Flow, with a lower TMF peak, however warns of stubborn resistance and another test of support is likely.

The closest we have to a breakout this week on the ASX 300 is Rural Funds Group (RFF). After breaking resistance at 2.40 RFF formed a loose "cup and handle" pattern1, with a sharp pullback to test support at 2.30 followed by a rally to test resistance at 2.65/2.70. Divergence on Twiggs Money Flow, with a lower TMF peak, however warns of stubborn resistance and another test of support is likely.

Quote for the Week

One of the most helpful things that anybody can learn is to give up trying to catch the last eighth — or the first. These two are the most expensive eighths in the world. They have cost stock traders, in the aggregate, enough millions of dollars to build a concrete highway across the continent.

~ Jesse Livermore

Notes

- The "cup" on RFF runs from August '19 to October '20; the "handle" from November '20 to the present.

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.