CPI warns of strong inflation but Treasury yields fall

First, please read the Disclaimer.

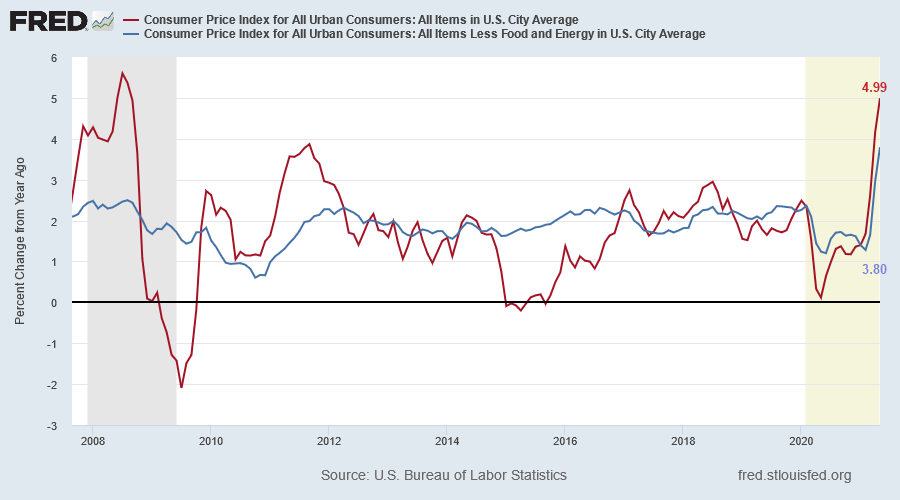

The Consumer Price index (CPI) for May climbed to 4.99% (YoY change), while core CPI (excluding food and energy) jumped to 3.80%.

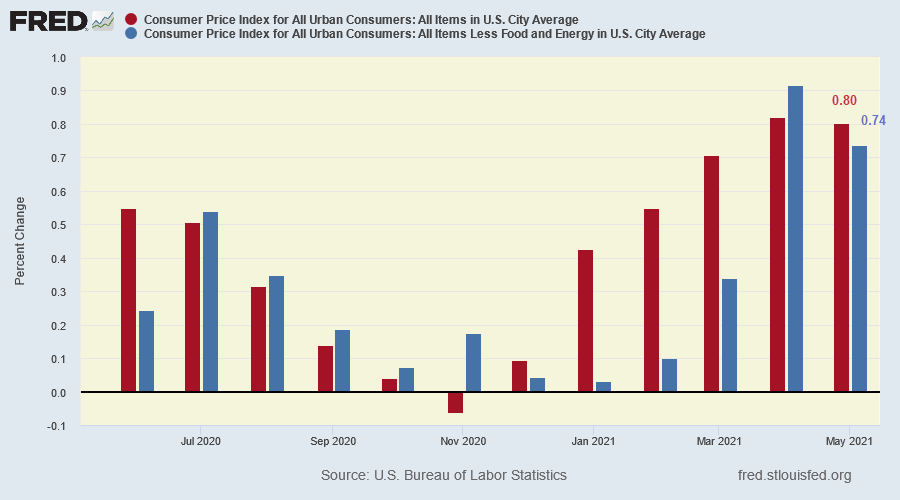

Part of the annual change may be due to base effects but monthly percentage change of 0.80% (CPI) and 0.74% (core CPI) convert to annualized rates of 9.60% and 8.88% respectively.

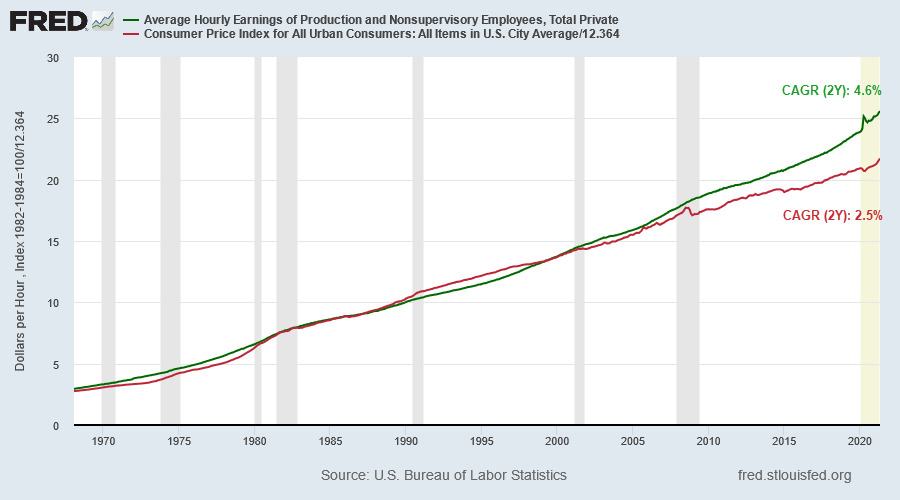

Measured over two years, the compound annual growth rate (CAGR) of CPI is only 2.5% but sharp acceleration in recent months warns of stronger inflation ahead. Hourly wages growth of 4.6% CAGR over the last two years is our expected target for CPI.

10-Year Treasury yields ignored the high inflation numbers, falling to 1.444% in after-hours trading. Breach of support at 1.50% (and subsequent respect) warns of a correction to test support at 1.0%.

Conclusion

Strong annual CPI growth is partly due to base effects, from low readings in May 2020, but the sharp acceleration in recent months is a warning that the Fed should not ignore. The fall in long-term Treasury yields is not a sign that inflation expectations are easing but rather that price signals are broken. The Fed is purchasing $80 billion per month of Treasuries (and a further $40 bn of MBS) to support demand, while Treasury has slowed issuance by running down its $1.6 trillion general account (TGA) at the Fed. Between the two, they can set prices wherever they please.

We expect strong inflation, with a target of 4.60% p.a., and real interest rates deeply negative as the Fed and Treasury do their best to suppress bond yields. We are therefore underweight bonds and growth equities and overweight precious metals and commodities.

Quote for the Week

The ideas of economists and political philosophers, both when they are right and when they are wrong are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually slaves of some defunct economist.

~ John Maynard Keynes

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

- ASX: Financials suffer, A-REITs advance on lower rates

- Australia: Investment & Employment

- Gold dips despite falling Treasury yields

- China enacts "anti foreign investment" law

- CPI warns of strong inflation but Treasury yields fall

- Treasury yields fall ahead of May CPI

- Jobs galore but no applicants

- S&P 500 trend: When will it end?

- ASX breakout

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.