ASX Technology stocks fall

First, please read the Disclaimer.

The ASX 200 continues to test its February 2020 high at 7200. Narrow consolidation below resistance is a bullish sign but we need to keep a weather eye on the US and China.

Financial Markets

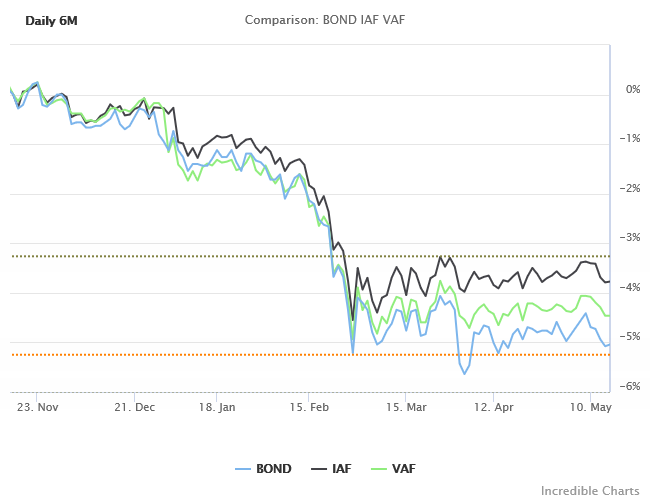

Bond ETFs, in a sideways consolidation, indicate that long-term interest rates are holding steady. Inflation remains muted and the RBA is following through on their stated intention to suppress long-term yields.

A-REITs are testing resistance at 1500. Reversal below 1340 is unlikely but would warn of a double-top reversal.

Financials are testing resistance at 6500. A rising 13-week Trend Index -- with troughs above zero -- flags buying pressure, suggesting that a breakout is likely.

Health Care, Discretionary & Technology

Health Care is testing resistance at 42500. The rising Trend Index is bullish but failure to cross above zero would confirm long-term selling pressure. Breach of 40000 would complete a bull-trap (a bear signal for investors) and warn of another test of primary support at 37500.

Technology broke support at 1900 to signal a primary down-trend, imitating the pattern in US markets. Breach offers a medium-term target of 14001.

Consumer Discretionary is testing its rising trendline. We expect a test of support at 2900 as the impact of government stimulus fades.

Mining

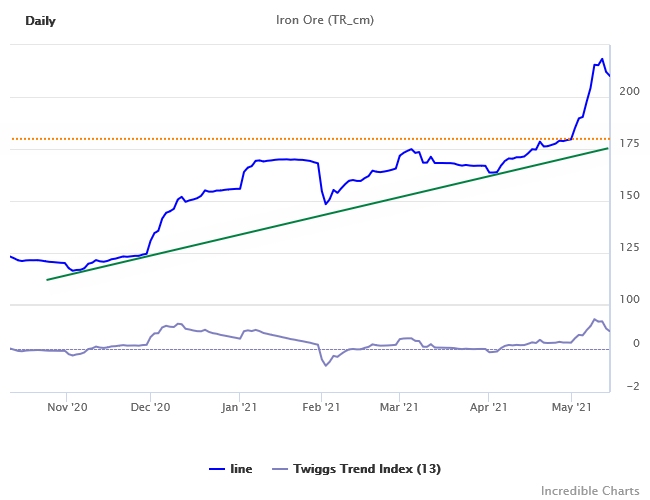

Iron ore retreated slightly, to $210/metric ton. Chinese steel mills are stockpiling -- due to rising tensions with Australia and anticipated production curbs in China (to reduce pollution levels). The boom is only expected to last as long as stockpiling continues. Then prices are likely to fall steeply as mills run down stockpiles. Reversal below support at $175-$180 would warn of a sharp decline.

The ASX 300 Metals & Mining found resistance at 6000. A tall shadow on this week's candle warns of short-term selling pressure. Another test of support at 5000 is likely.

The All Ordinaries Gold Index (XGD) continues to test its new support level at 7000. Follow-through below recent lows would warn of another test of 6000, while recovery above 7300 would signal a fresh advance. Breakout above the long-term descending trendline would strengthen the bull signal. Gold bullishness is fueled by rising inflation fears.

The Gold price, in Australian Dollars, is testing its descending trendline and resistance at 2400. Breakout above the two would deliver a strong bull signal.

Conclusion

Technology stocks have commenced a primary down-trend. Metals & Mining look highly-priced and susceptible to a sharp reversal. They have looked that way for months but sooner or later we are bound to see a rapid re-pricing.

Steady long-term interest rates and a buoyant housing market are lifting REITs and Financials respectively. Health Care and Consumer Discretionary look hesitant, while Gold stocks are making a tentative rally.

Notes

- Target for XIJ is its 2400 peak extended below 1900.

Quote for the Week

The Fed is trying to ride two horses with one a$$ — trying to convince the world that it will simultaneously:

- Allow US nominal GDP to grow rapidly enough to allow the US to de-lever the US government debt/GDP from its current 130% toward a level that will allow the Fed to normalize policy without blowing up the UST market, the US government, and global markets.....; and

- Try to convince the bond market that the Fed will not inflate away the debt.

~ Luke Gromen

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.