Gold and Copper: Towards a new measuring stick

First, please read the Disclaimer.

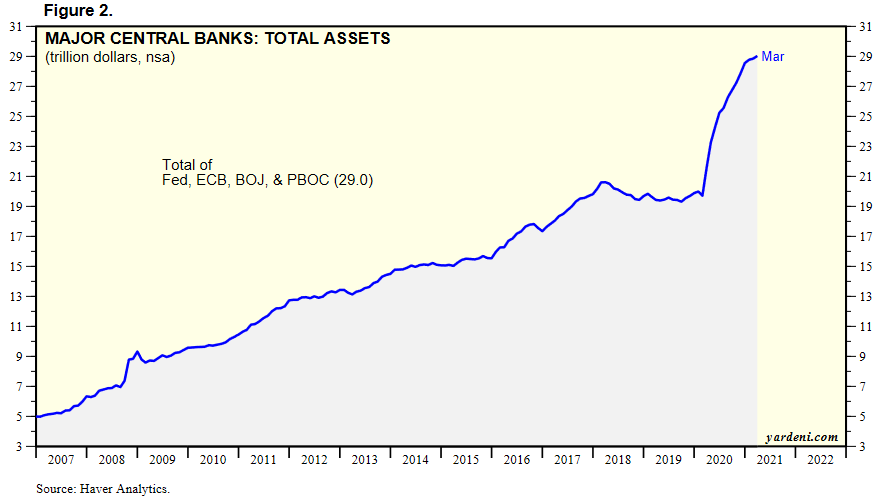

Our old measuring stick, the Dollar, is broken and no longer fit-for-purpose. The Fed and other major central banks have consistently eroded the value of their national currencies through quantitative easing; expanding their balance sheets by 580% — from $5T to $29T — over the past 14 years, as the chart from Ed Yardeni below shows.

Currency debasement is easily hidden from view by simultaneous policies across central banks, affecting all major currencies.

Gold as a benchmark

Attempts to use Gold as an independent benchmark are frequently interfered with by government attempts to suppress the Gold price, dating back to the London Gold Pool of the early 1960s. Alan Greenspan even went so far as to base Fed monetary policy on Gold, not so much to suppress the Gold price but as an early warning of inflation (measured inflation figures are lagged and therefore useless in setting proactive monetary policy). The result was similar, however, suppressing fluctuations in the Gold price.

A new benchmark

Earlier than Greenspan, Paul Volcker had used a benchmark based on a whole basket of commodities to measure inflation.

Our goal is derive a similar but simpler benchmark that can be applied to measure performance across a wide range of asset classes.

Copper and other industrial metals, on their own, are not a viable alternative because demand tends to fluctuate with the global economic cycle.

Gold and Silver also tend to fluctuate but their cyclical fluctuations, especially Gold, tend to run counter to industrial metals. Demand for Gold is driven by safe haven demand which tends to be highest when the global economy contracts.

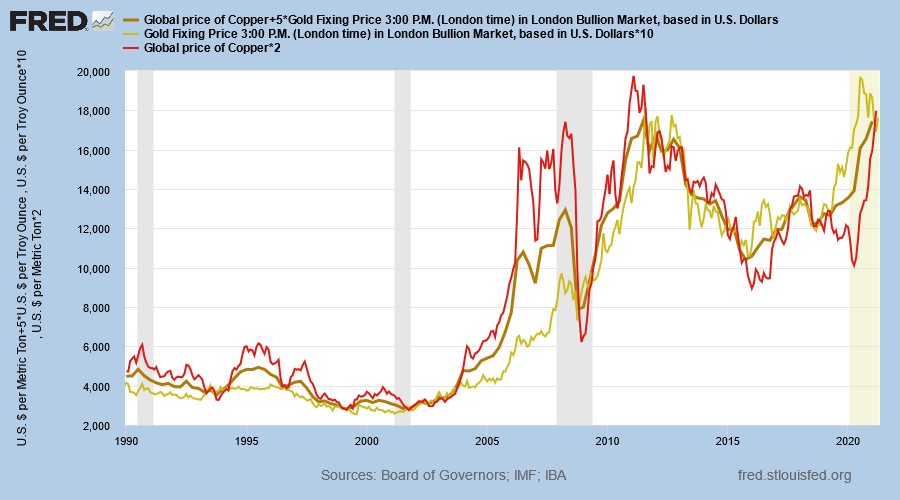

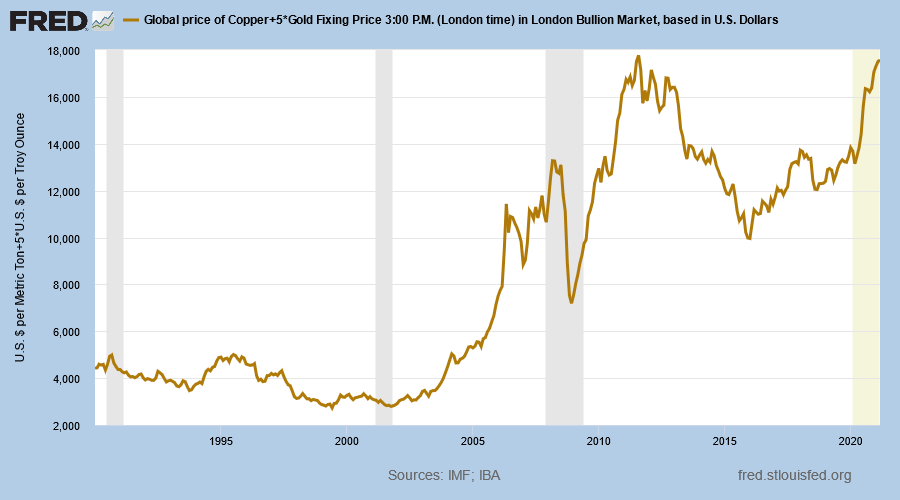

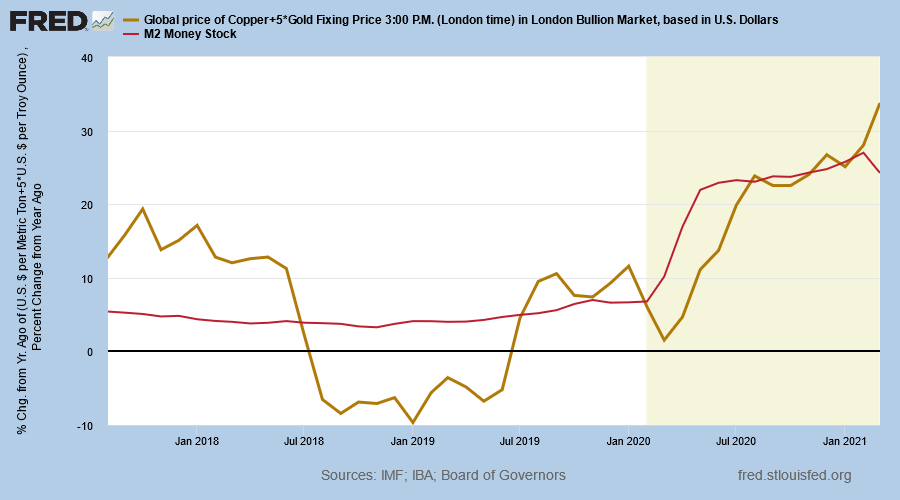

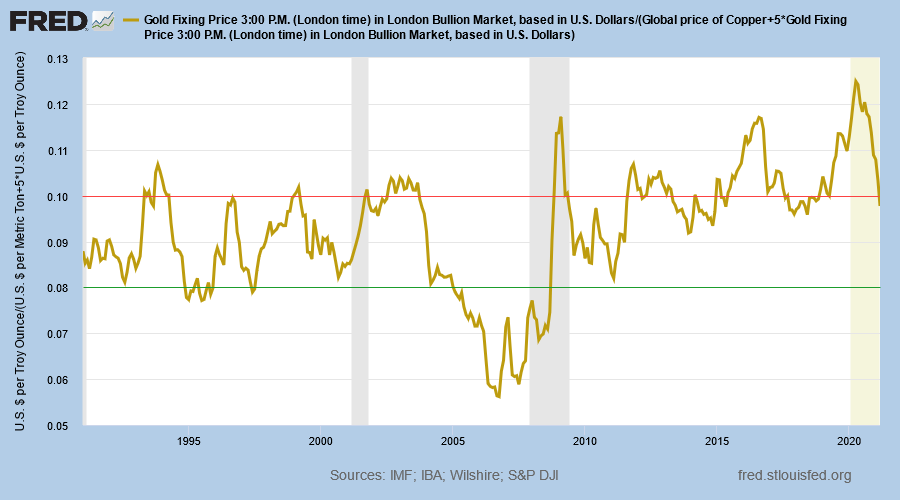

We therefore selected Gold and Copper as the two components of our benchmark because their fluctuations tend to offset each other, providing a smoother and more reliable measure. A mix of 5 troy ounces of Gold and 1 metric ton of Copper provides a fairly even long-term balance between the two components as illustrated by the chart below. The middle line is our new benchmark.

Copper (red) leads in times of inflation, when industrial demand is expanding rapidly, while Gold (yellow) leads in times of deflation, when the global economy contracts.

First, let's address the weaknesses. China's entry to the World Trade Organization (WTO) in the early 2000s, a once-in-a-century event, caused a surge in the price of both Copper and Gold. The change drove up commodity prices but drove down prices of finished goods; so we are undecided whether this is truly inflationary.

The sharp fall in 2008, however, is accurately depicted as a massive deflationary shock, caused by private debt deleveraging during the global financial crisis (GFC). Central banks then intervened with balance sheet expansion (QE). Accompanied by fiscal stimulus, QE caused a huge inflationary spike lasting from 2009 to 2011.

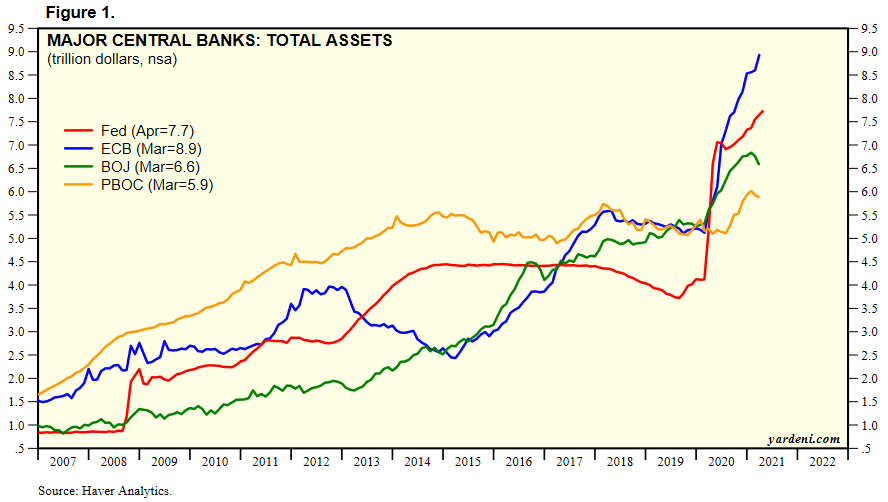

Fed expansion paused in 2011-2012 and was followed by a sharp contraction by the European Central Bank (ECB), causing deflation, as the breakdown from Ed Yardeni below shows. The ECB then reversed course — following Mario Draghi's now famous "whatever it takes" — and, accompanied by the Bank of Japan (BOJ), engaged in another rapid expansion.

The Fed attempted to unwind their balance sheet in 2018-19, causing a brief deflationary episode before all hell broke loose in September 2019 with the repo crisis. Fed balance sheet expansion in late 2019 was, however, dwarfed by the expansion across all major central banks during the pandemic. Fed QE caused a sharp spike in the M2 money supply as well as in our Gold-Copper index (GCI), warning of strong inflation.

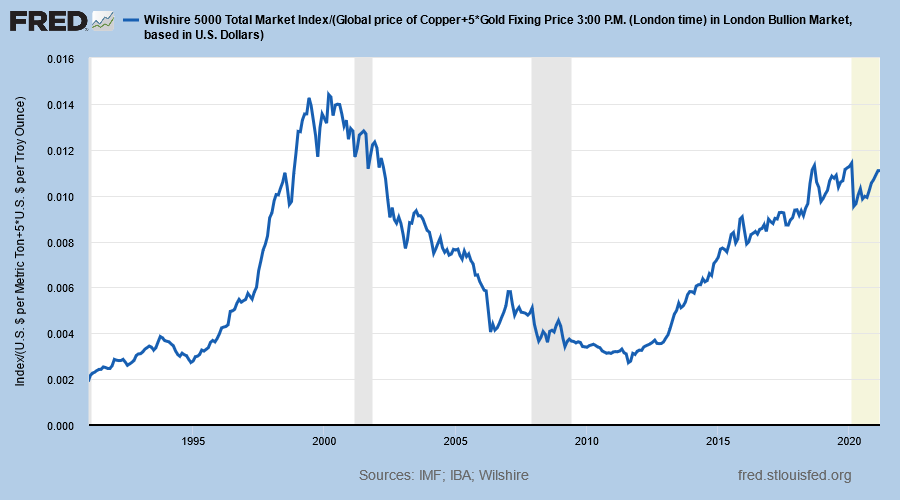

Market Values using our GCI benchmark

While not as high as some valuation measures (PE or Market Cap/GDP), plotting the Wilshire 5000 Total Market Index against the GCI shows stocks trading at levels only exceeded during the 1999-2000 Dotcom bubble.

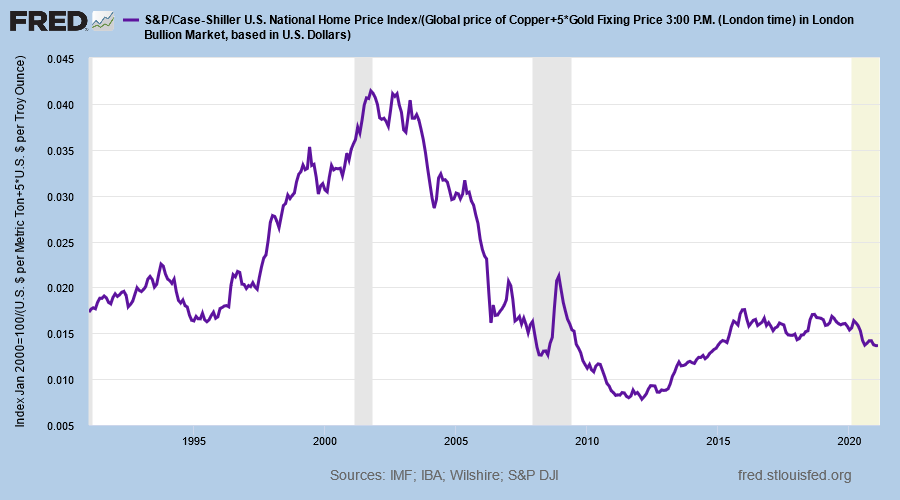

The Case-Shiller Index plotted against GCI shows home prices are relatively low in real terms, most of the froth being created by a shrinking Dollar.

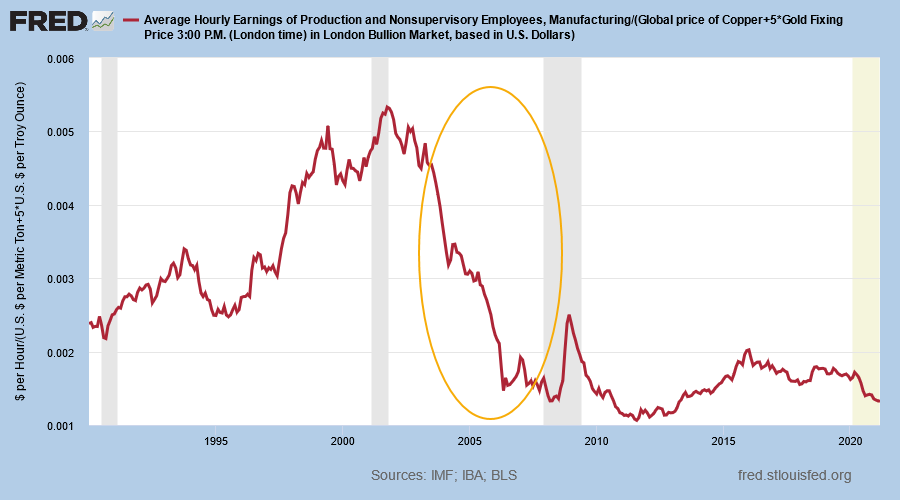

But if you think housing is cheap — after the China-shock — look what happened to wages.

Precious Metals

Plotting Gold against the GCI might seem counter-intuitive but it highlights, quite effectively, periods when Gold is highly-priced relative to its historic norm. The yellow metal retreated to within its normal trading range in March 2021.

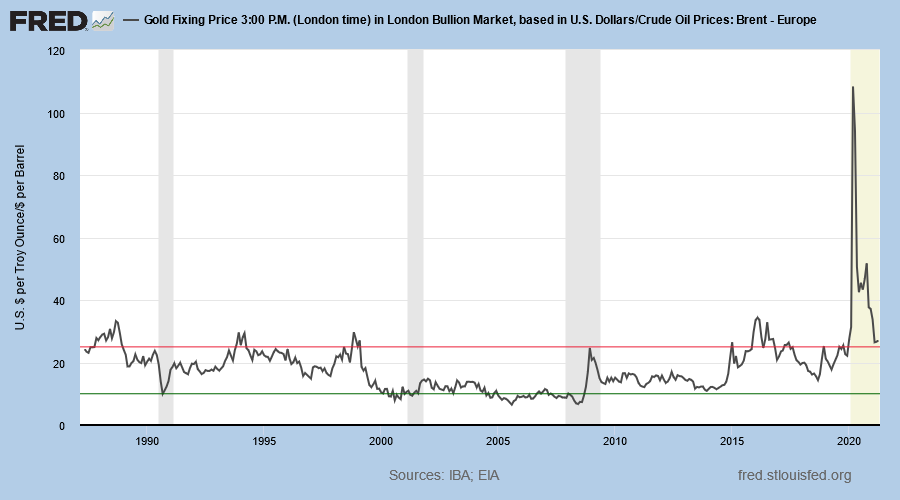

The plot against GCI offers far less distortion than the Gold-Oil ratio below.

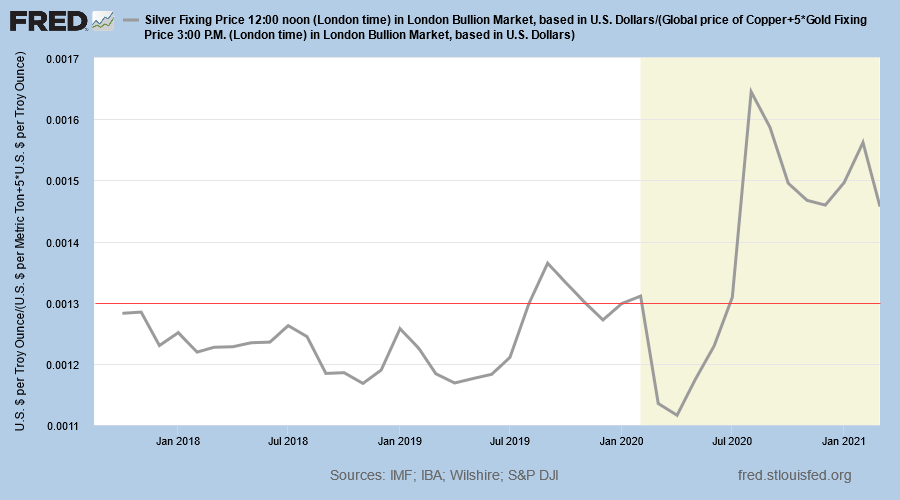

We only have 4 years of data for Silver (on FRED). Plotting against GCI warns that silver is highly-priced at present but we will need to source more data before drawing any conclusions.

Conclusion

Stock prices are high and overdue for a major correction but this is only likely to occur when: (a) government stimulus slows; and/or (b) the Fed tapers its Treasury purchases, allowing long-term Treasury yields to rise. Market indications — and dissenting voices (Robert Kaplan) at the Fed — suggest that the taper could occur sooner than Jay Powell would have us believe.

The Gold-Copper index (GCI) warns of strong inflation ahead, which should be good for both commodities and precious metals. But bad for stocks and bonds.

Quote for the Week

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

~ Benjamin Graham.

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.