USA Sales up, daily COVID-19 cases down but jobs still scarce

First, please read the Disclaimer.

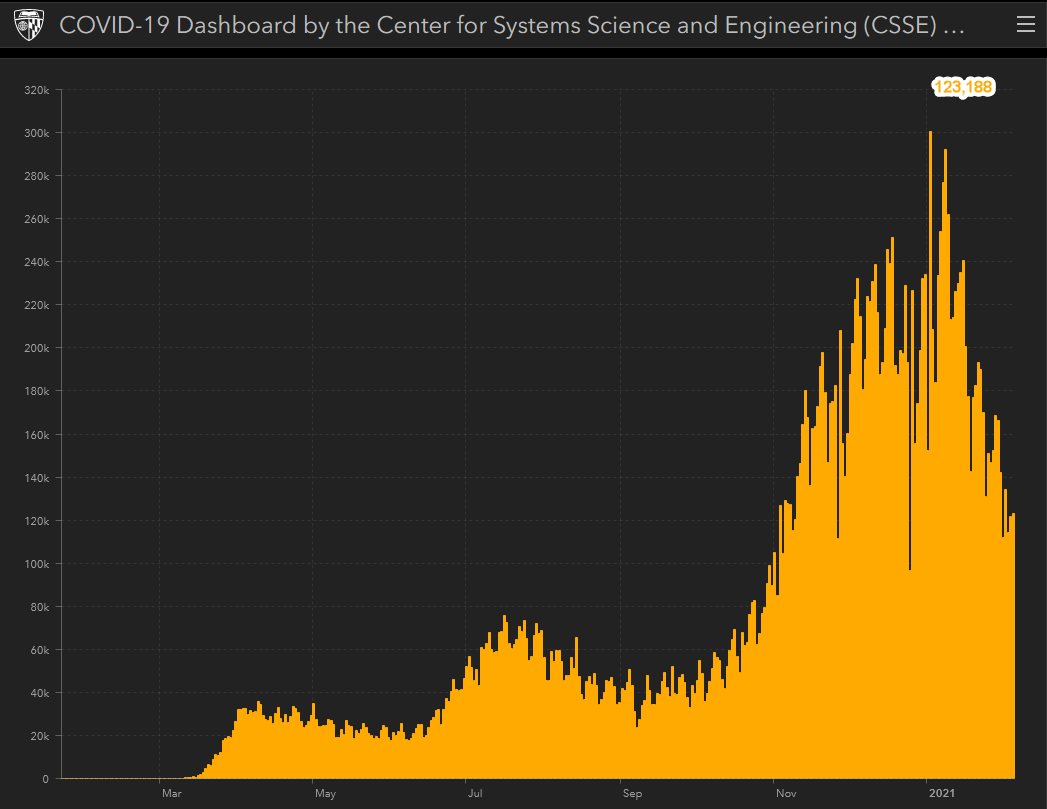

Daily new COVID-19 cases in the US are clearly falling as the vaccine roll-out takes effect.

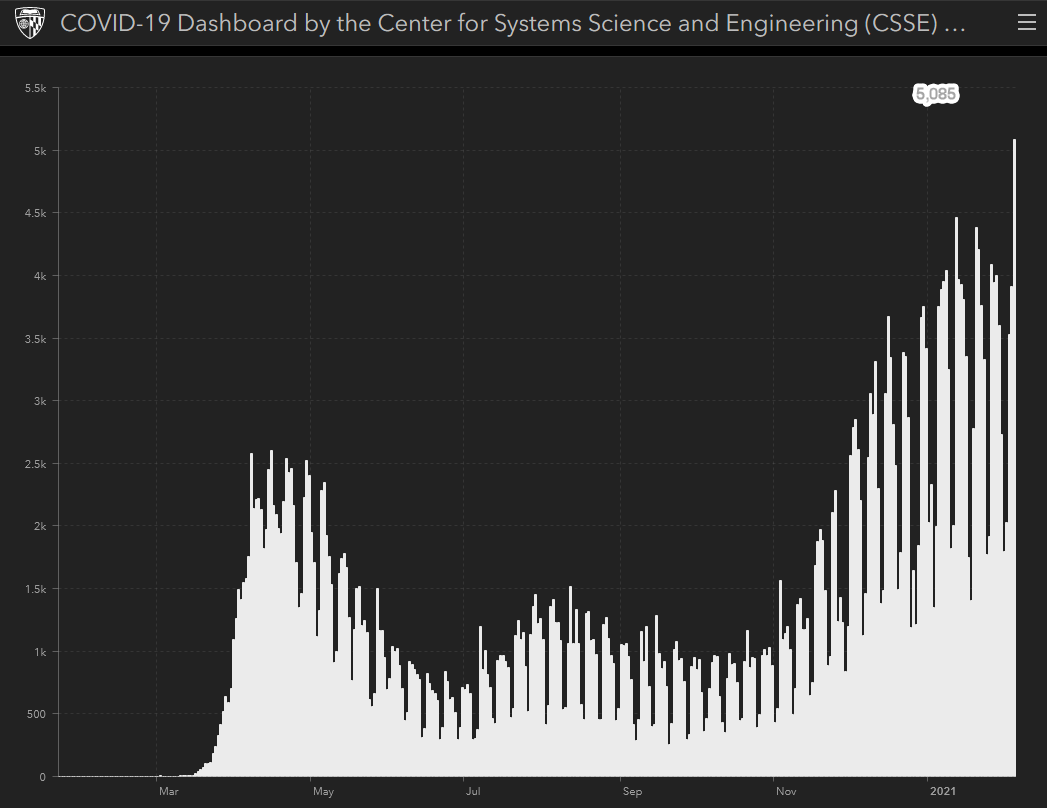

But daily deaths are still rising and may take another few weeks to level off.

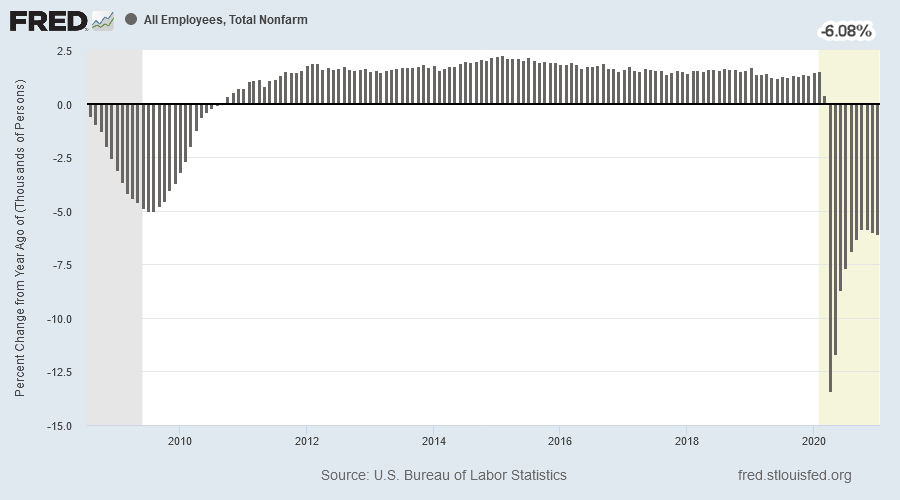

January payroll figures show the economic recovery has stalled, with total jobs contracting by 6.08% compared to January 2020.

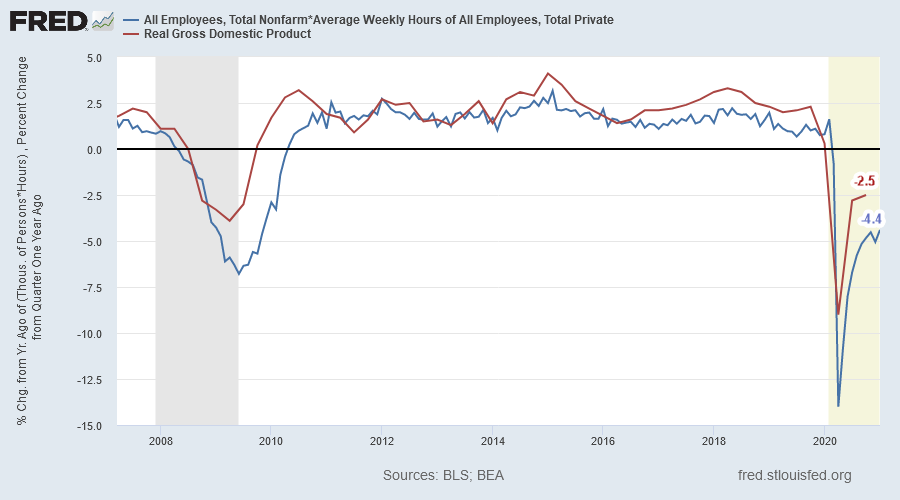

Hours worked are down 4.4% compared to last year.

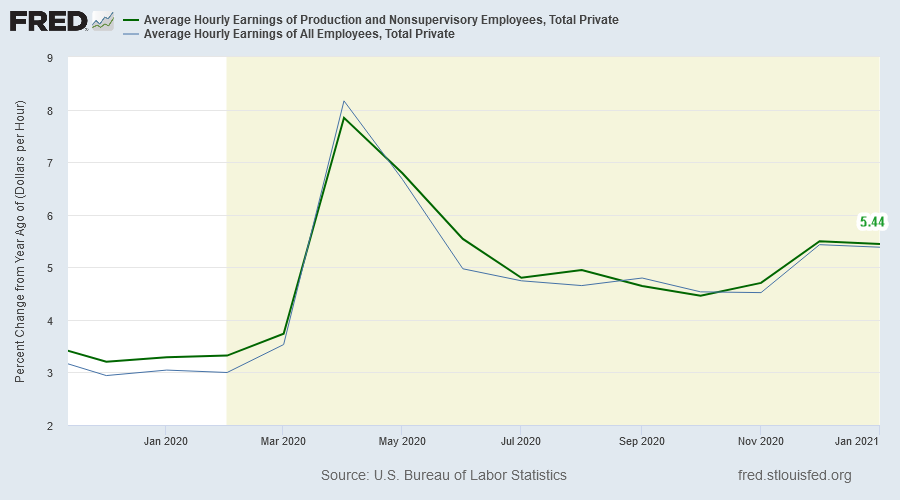

Average hourly earnings jumped 5.44% for production and non-supervisory workers but these are distorted by strong job losses in the lowest pay grades.

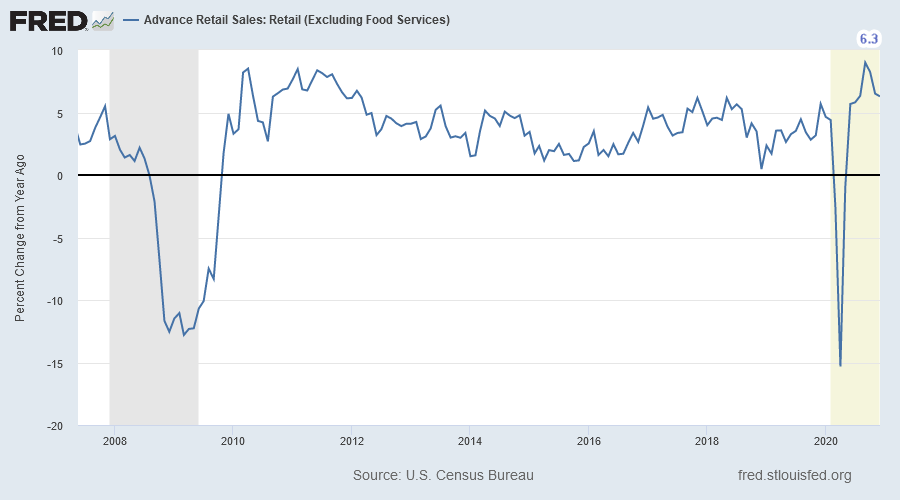

Retail sales (excluding food) have also been artificially boosted by government stimulus which added roughly 20% to disposable income.

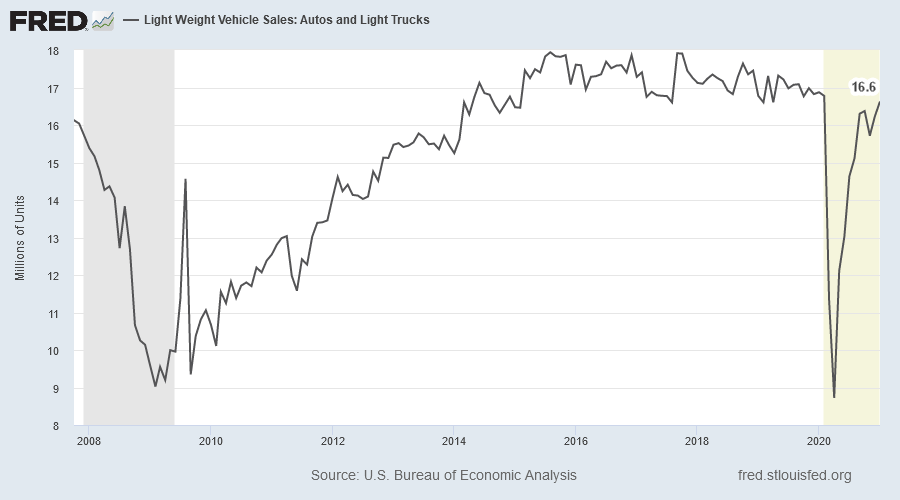

Light vehicle sales are similarly boosted.

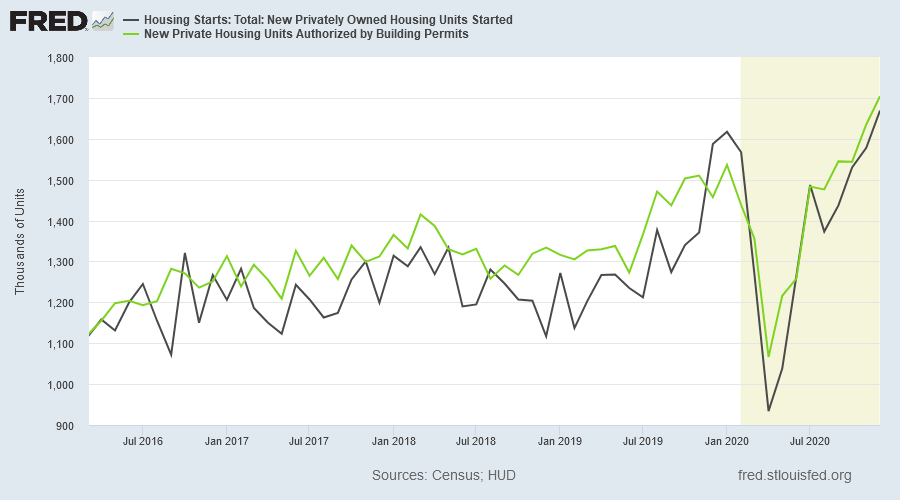

While housing starts are climbing in response to record low mortgage rates.

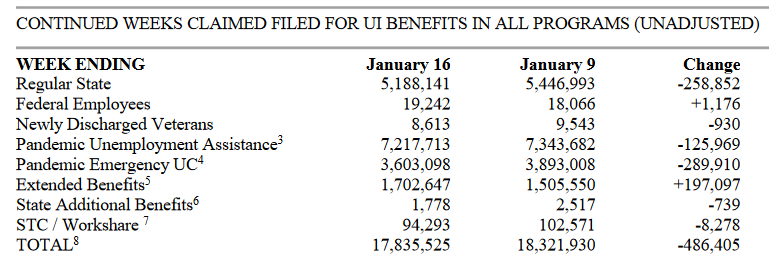

Total unemployment claims (state and federal) declined to a still high 17.8 million for the week ended January 16th.

The proposed Biden stimulus will support households and businesses but employment is likely to remain weak until the COVID-19 outbreak is clearly under control.

Conclusion

Economic activity is expected to remain weak in the first half of 2021. A key determinant will be the length of time it takes to bring the COVID-19 outbreak under control. Subsequent recovery is likely to need strong fiscal support, with federal debt expected to grow faster than GDP in 2021. This will require continued Treasury purchases by the Fed and commercial banks, with interest rates remaining low throughout 2021.

Quote for the Week

The first lesson of economics is scarcity: there is never enough of anything to fully satisfy all those who want it.

The first lesson of politics is to disregard the first lesson of economics.~ Thomas Sowell

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

- ASX: Iron ore casts a bearish shadow

- USA: Sales up, daily COVID-19 cases down but jobs still scarce

- Divergence between "paper" and physical Gold & Silver prices

- Does Gold warn of another "taper tantrum"?

- The Debt Trap (video)

- Long-term trends: Battery electric versus hydrogen

- Jim Bianco: Market worried about contagion (video)

- Australian Growth: Performance at 31 December 2020

- International Growth: Performance at 31 December 2020

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.