Big Spending Bernie and the stock market bubble

First, please read the Disclaimer.

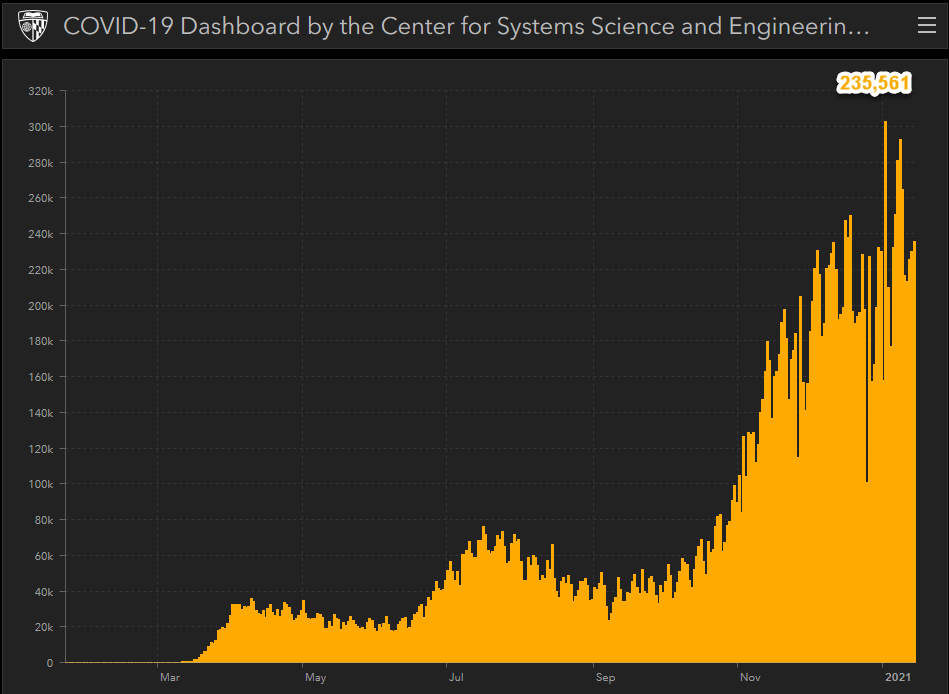

Daily new cases of COVID-19 appear to have peaked, falling to 235 thousand on January 14th.

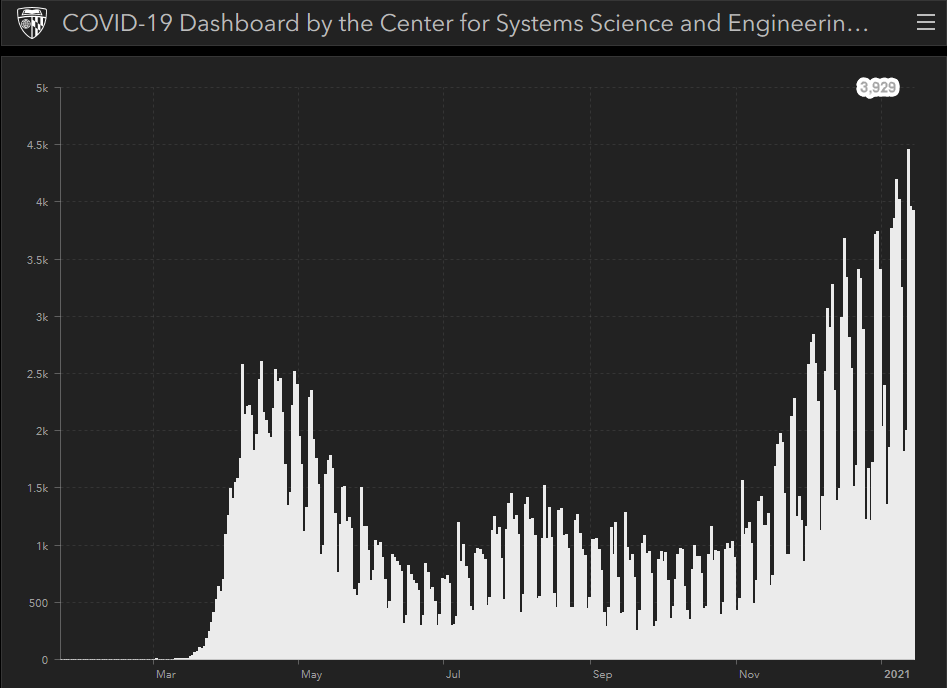

But the daily death rate continues to climb and may do so for several more weeks.

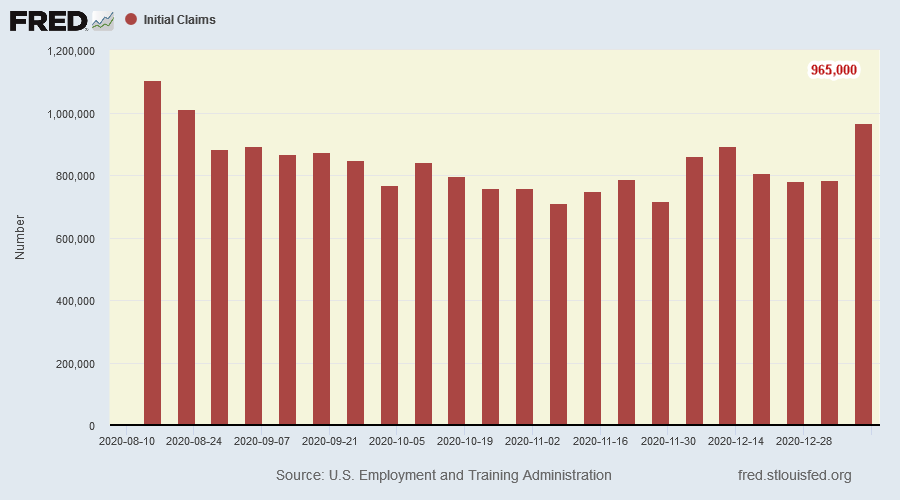

Jobs recovery has stalled, with initial claims jumping to 965 thousand for the week ended January 9th, while federal pandemic unemployment assistance claims added a further 284,000.

Big Spending Bernie

Joe Biden has promised close to $2 trillion in additional stimulus. With Bernie Sanders poised to head the powerful Senate budget committee Democrats' intentions are clear: to spend their way out of the slump. The controversial Vermont senator is known for his belief in big government and describing himself as a "socialist democrat".

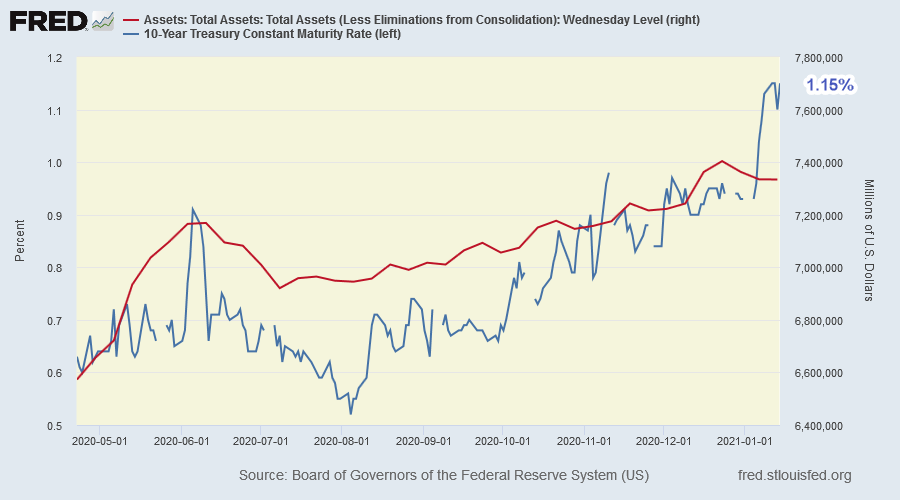

With Democrats in control of the Senate, albeit by the slimmest of margins, the biggest check on government spending is likely to be the bond market. 10-Year Treasury yields have already jumped 22 basis points in January.

The only escape valve is the Fed, expanding its balance sheet with further purchases of Treasuries to suppress interest rates. Low interest rates would fuel inflation, while high interest rates would not only check government spending, but threaten a fiscal crisis where Treasury has to borrow to service the interest on its outstanding debt — creating an exponential escalation in public debt from which there is no escape — and a collapse of the stock market bubble.

We expect Jay Powell to err on the side of inflation, as the lesser of two evils, while he attempts to walk the tightrope between conflicting demands on the Fed.

Stocks

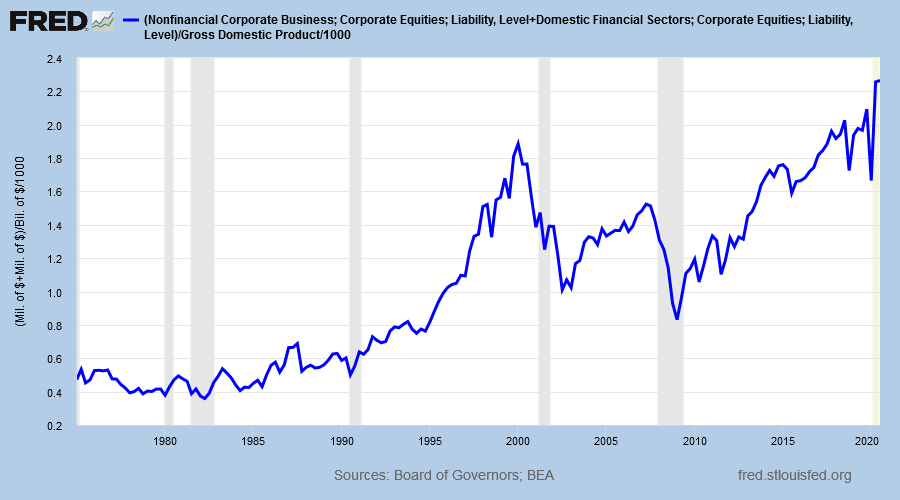

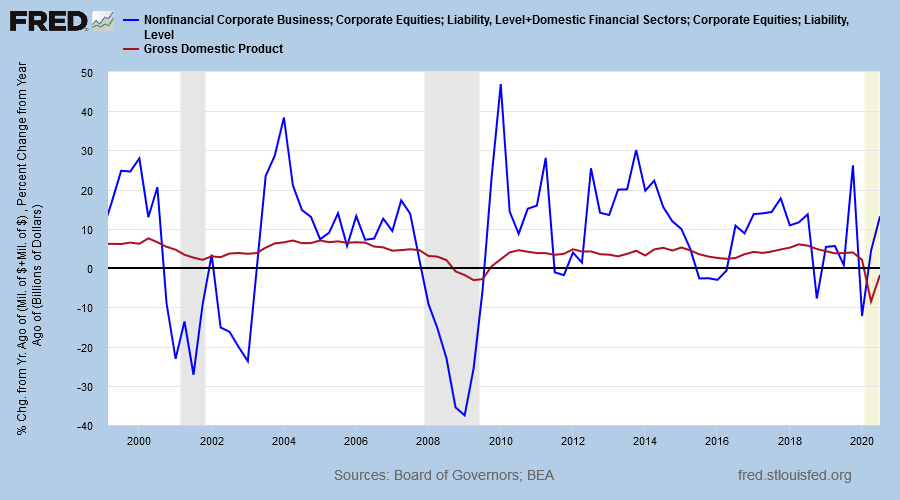

Stocks are already pricing in significant growth in nominal GDP, with Warren Buffett's favorite market indicator at a record high: market capitalization at 2.26 times GDP.

History shows that re-balancing normally occurs with a sharp drop in market capitalization rather than an upward spike in GDP.

Conclusion

Current stock market levels are reliant on the Fed put — where the Fed is expected to react to any hesitancy in the market with further stimulus — and out of touch with underlying fundamentals. This creates dangerous imbalances in financial markets. Risk levels are elevated.

Quote for the Week

"We do not think BTC is a bubble; we think BTC is the last remaining functioning fire alarm that has not been disabled by policymakers, and it is issuing an increasingly shrill alarm about the USD and fiat currencies more broadly. We have little doubt that policymakers will attempt to disable BTC as a functioning fire alarm as well, but its traits make that far more difficult to do to BTC than they have thus far done with gold."

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

- ASX 200 bullish except for REITs & Health Care

- USA: We're not "all rooned"

- Gold, Silver, futures and central bank reserves

- Gold: Net Stable Funding Ratio impact

- Danielle DiMartino Booth On The Future Of The Federal Reserve

- The Battle for Democracy

- Long-term interest rates and inflation

- Aberdeen Standard Physical Silver Shares ETF (SIVR)

- Mohammed El-Erian: No exit

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.