The inflation conundrum

First, please read the Disclaimer.

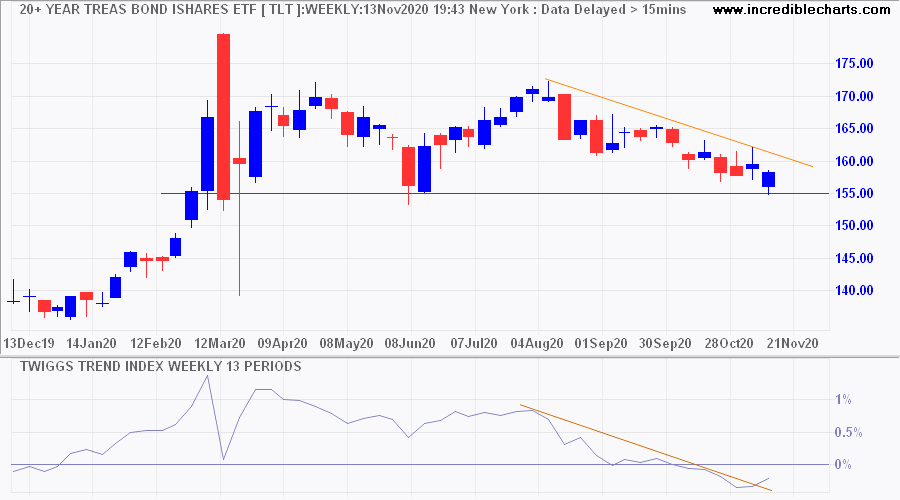

Long-term bond funds, like TLT below, are testing primary support as Treasury Yields edge upwards.

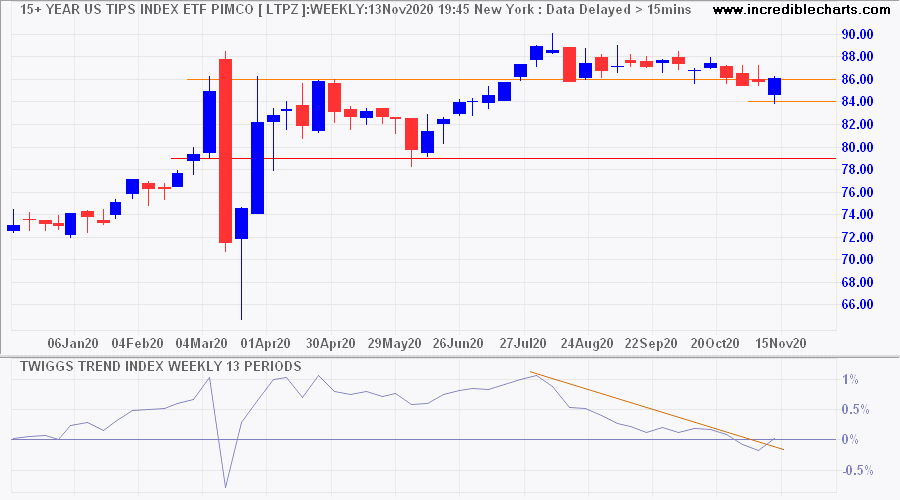

While TIPS funds, like LTPZ below, are decidedly stronger.

The divergence warns that inflation expectations are rising.

Introduction of an effective vaccine early in 2021 would accelerate the divergence.

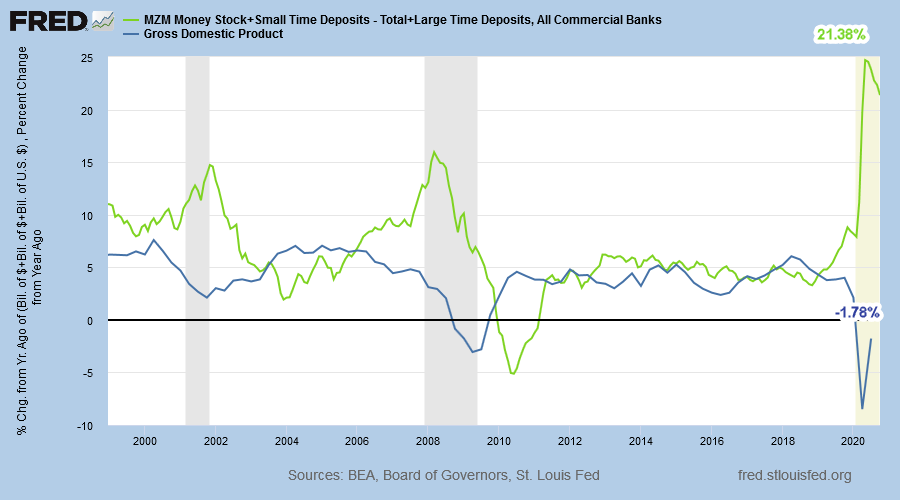

The Fed flooded financial markets with liquidity in the second quarter, causing broad money growth (MZM plus time deposits) to spike upwards.

We were assured by many pundits that there was no need to worry about inflation as the velocity of money (GDP/money stock) was falling. But introduce an effective vaccine and all bets are off. GDP growth in that case is likely to recover a lot faster than the Fed can withdraw liquidity without upsetting financial markets as it did in 2010.

The Fed is then faced with a difficult choice: tolerate higher inflation or throw the US Treasury under the bus by withdrawing liquidity from financial markets — and support for new Treasury issuance. Our bet is on higher inflation.

Quote for the Week

The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.

~ Alan Greenspan

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

- Vaccine rally but daily cases spike upwards

- ASX rallies on restriction easing

- Gold put to the test

- Low interest rates: No free lunch

- George Orwell and the appeal of Fascism

- Stick with Gold

- Time to get on with the serious business of beating COVID-19

- Australian Growth: Performance at 30 September 2020

- International Growth: Performance at 30 September 2020

- Defying gravity

- Cold War 2.0: Confronting China

- November: Never waste a good crisis

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.