S&P 500, Stoxx selling pressure

First, please read the Disclaimer.

There is so much political noise leading up to the election that we will try to stick to the hard data.

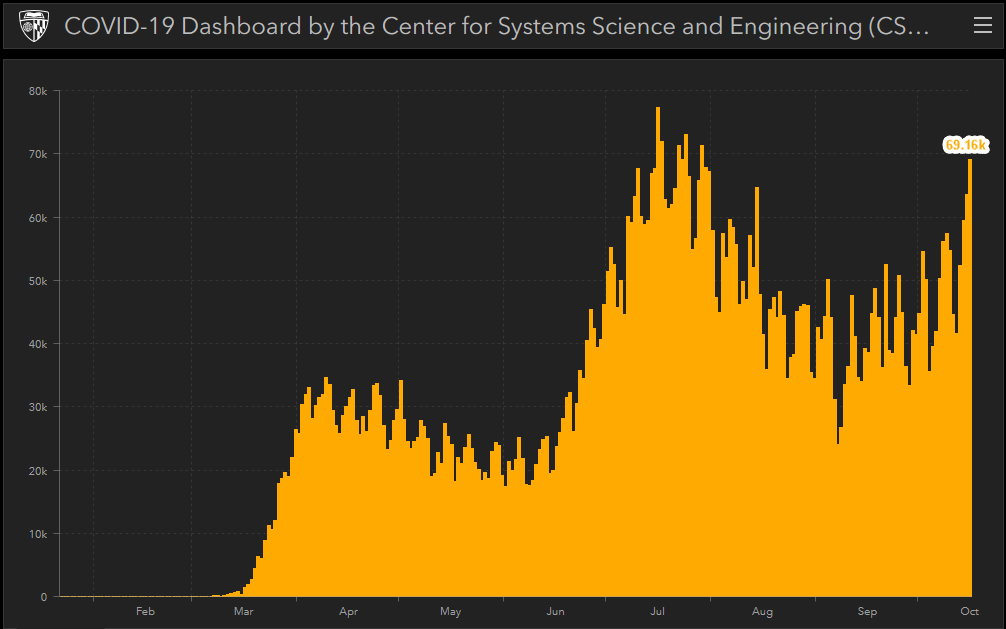

Daily new COVID-19 cases in the US are rising, reaching 69,160 on Friday.

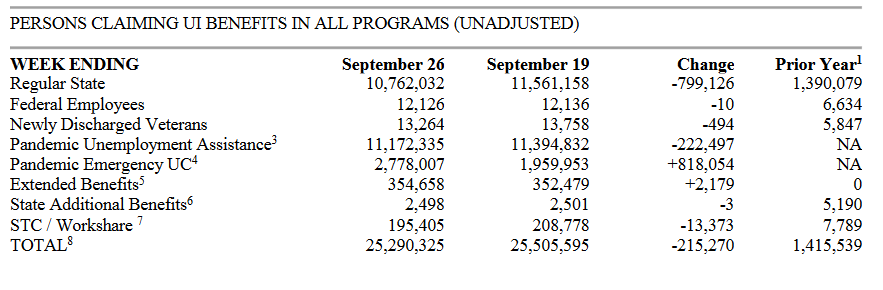

Total persons claiming unemployment benefits remains high, at 25.3 million. That is 16.6% of the Feb 2020 workforce, or almost one in six workers, on unemployment.

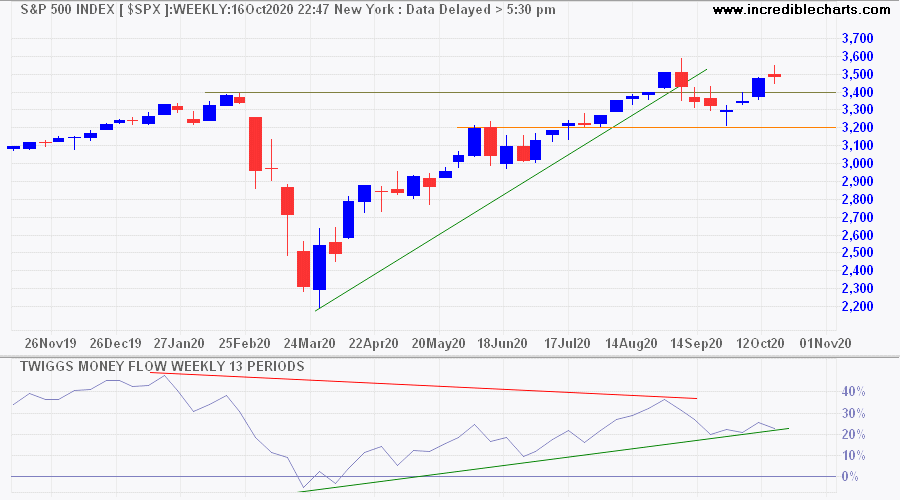

The S&P 500 is holding above support at 3400 but bearish divergence on Twiggs Money Flow continues to warn of selling pressure. Hopes for a stimulus deal are fading and we expect another test of support at 3200.

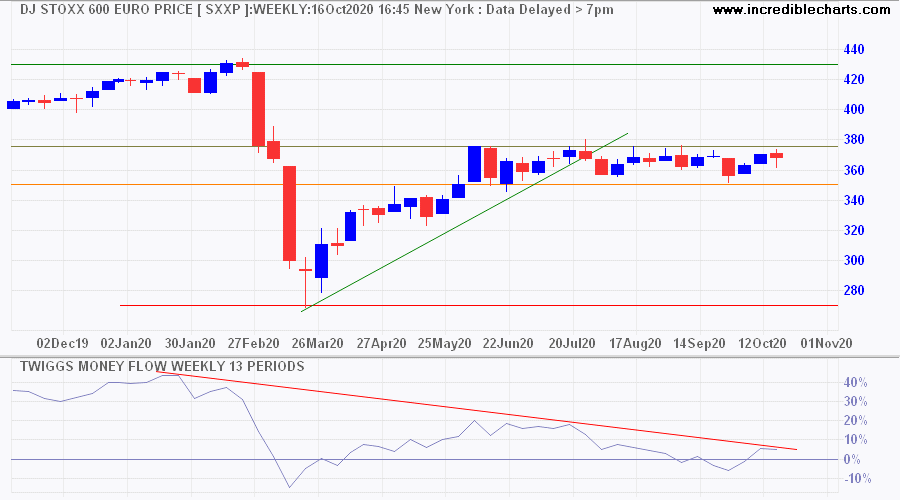

In Europe, declining Money Flow on the DJ Euro Stoxx 600 warns of similar selling pressure. Breach of support at 350 would indicate another test of primary support at 270.

Conclusion

A stimulus deal would help to support current stock prices but this grows increasingly unlikely as the November election approaches. Our long-term outlook for the S&P 500 and Stoxx 600 in Europe is bearish. A COVID-19 resurgence is expected to exacerbate already high levels of unemployment and, with declining benefits, would be likely to cause an economic contraction.

Quote for the Week

This decade is strewn with examples of bright people who thought they built a better mousetrap that could consistently extract abnormal returns from the financial markets. Some succeed for a time. But while there may occasionally be mis-configurations among market prices that allow abnormal returns, they do not persist.

~ Alan Greenspan

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.