BIS: S&P 500 is "rigged"

First, please read the Disclaimer.

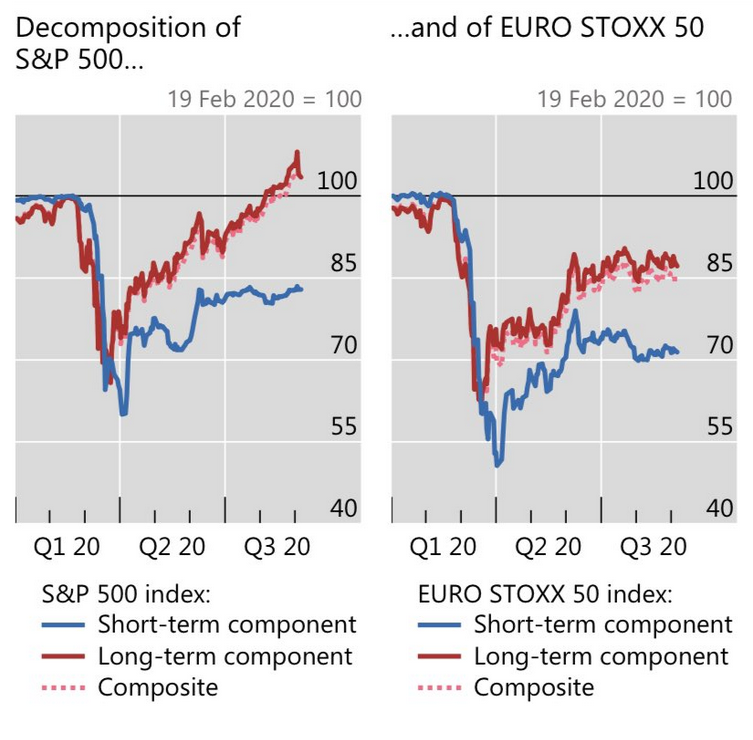

Analysis by the Bank for International Settlements suggests that Fed monetary policy accounts for roughly 50% of the S&P 500 rebound since the low in late March 2020 and 20% of the Euro Stoxx 50. Blue lines show the likely path of the index without intervention by the Fed and ECB.

"Stock markets price in long-term information, stretching far beyond the short-term cyclical fluctuation in the growth outlook. The recent rally in equity prices has attracted attention, among other reasons, for its possible disconnect from the underlying prospects of economies still reeling from the pandemic shock. In this box, we use dividend derivatives to decompose the US and European equity benchmarks into short- and long-term components, corresponding to the value of the short- and long-term dividend stream. Our main goal is to explore whether this dimension, together with depressed interest rates, sheds some light on the apparent disconnection. In line with the subdued short-term economic outlook mentioned above, we find that the short-term components of both indices have seen a limited recovery since March. The benchmarks' strong recent performance is thus predicated on steady gains in their long-term components. Moreover, these gains are related, to a large extent, to the drop in the term structure of interest rates that followed the policy response of central banks to the pandemic shock." (BIS: The short and long end of equity prices during the pandemic, Fernando Avalos and Dora Xia)

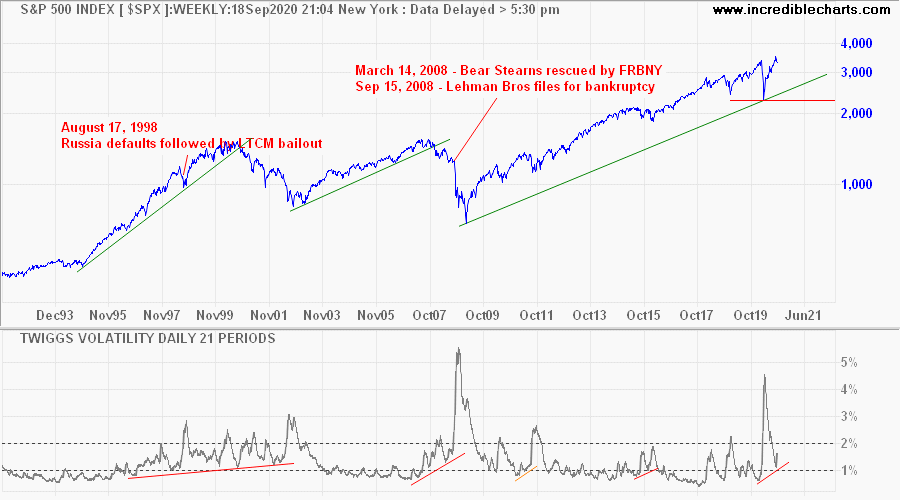

S&P 500 Volatility remains high, with 21-day Volatility forming a trough above 1%, warning of elevated risk. Past occurrences in the last 30 years have coincided with major market events, either a market reversal or disruption as in 1998, 2011 and 2015.

Conclusion

Stocks are over-priced and market risk is elevated.

Quote for the Week

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.