S&P 500 v. Earnings

First, please read the Disclaimer.

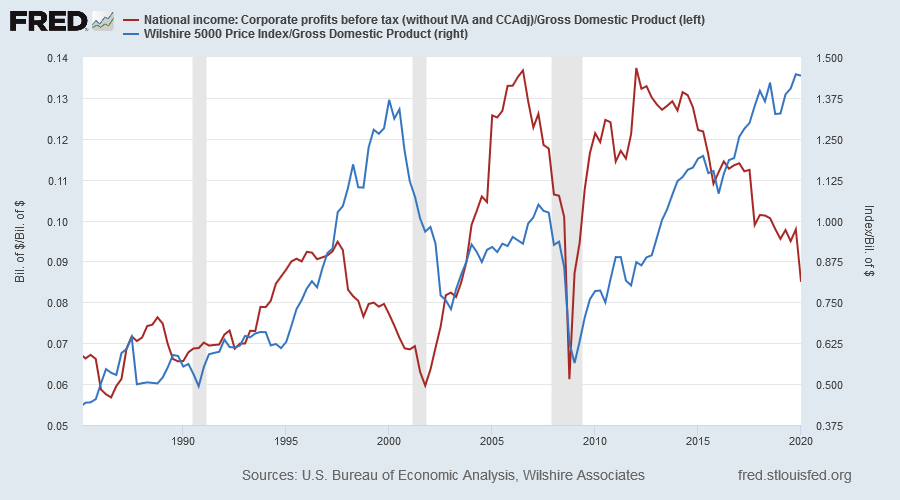

Corporate profits are plunging as a percentage of GDP, while stocks are still headed in the other direction. The last time this happened was ahead of the Dotcom crash when companies with names like Pets.com, eToys.com, Flooz.com and theGlobe.com — and billion dollar market caps but no cash flow — were erased from the boards.

Jim Bianco shows that S&P 500 is currently trading at a similar forward PE ratio of 25.88 compared to the Dotcom bubble peak of 26.98.

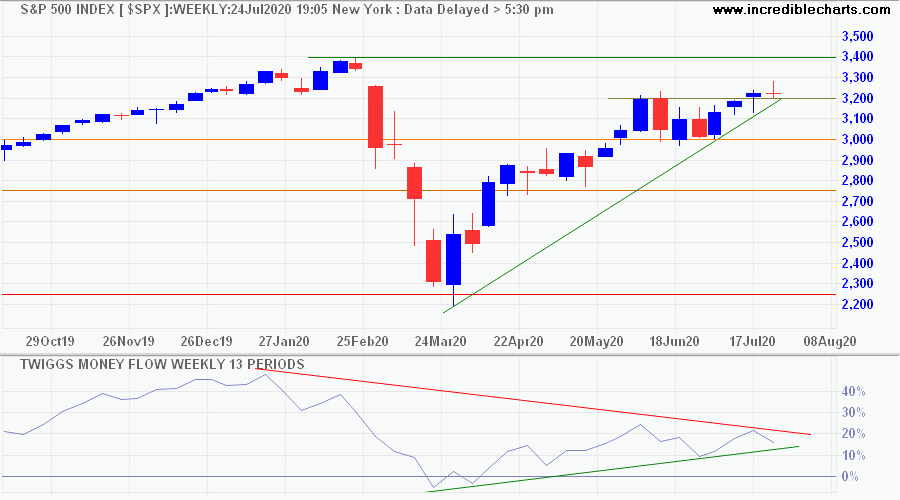

The S&P 500 itself is inching higher, reflecting the tug-of-war between technology stocks and the broader market, but declining Money Flow peaks warn of secondary selling pressure. Expect another test of support at 3000. Breach of support is still unlikely but would signal a correction.

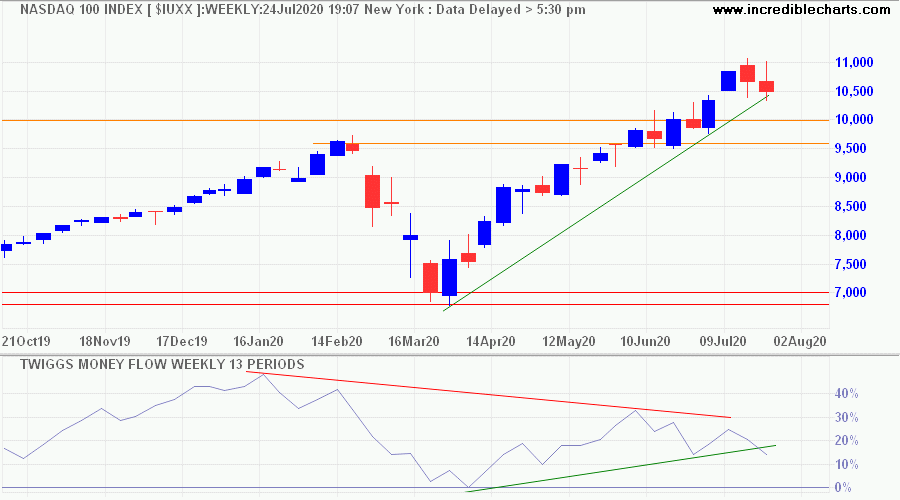

Bearish divergence on the Nasdaq 100 is more severe, flagging strong selling pressure. Expect another test of support between 9500 and 10000. Again breach of support is still unlikely but would warn of a strong reversal.

Conclusion

Stocks are over-priced and earnings are under pressure. We expect the market to re-price as the long-term outlook grows clearer and prospects of a V-shaped recovery fade.

"The public ought always to keep in mind the elementals of stock trading. When a stock is going up no elaborate explanation is needed as to why it is going up. It takes continuous buying to make a stock keep going up. As long as it does so, with only small and natural reactions from time to time, it is a pretty safe proposition to trail with it.

But if after a long steady rise a stock turns and gradually begins to go down, with only occasionally small rallies, it is obvious that the line of least resistance has changed from upward to downward. Such being the case why should anyone ask for explanations? There are probably very good reasons why it should go down...."~ Jesse Livermore

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.