Nixon's Legacy

First, please read the Disclaimer.

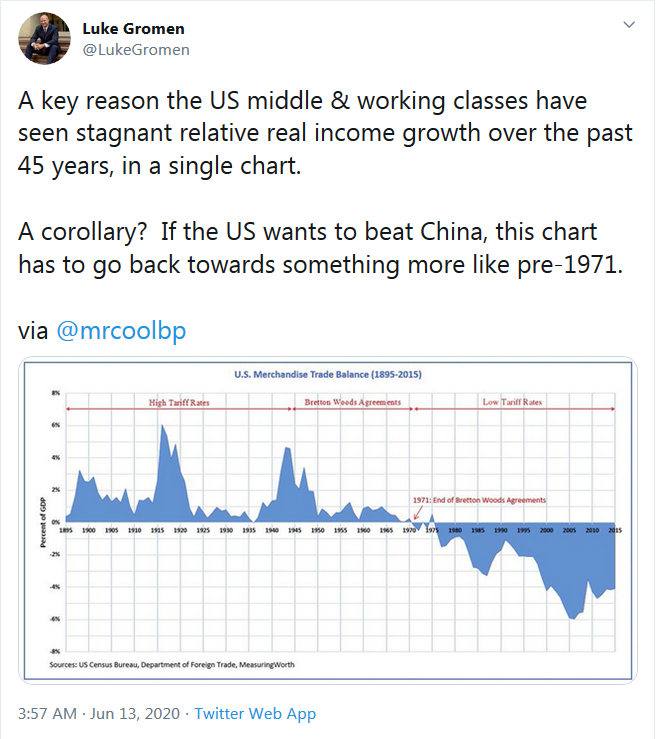

The graph below, posted by Luke Gromen, highlights the long-term impact of the Nixon Default, when President Nixon on August 15, 1971 unilaterally suspended convertibility of the US Dollar to Gold. This spelled the demise of the Bretton Woods system of managed exchange rates and led to widespread adoption of free-floating exchange rates by 1973.

Suspension of convertibility to Gold was part of a three-pronged attack on rising inflation that included a 90-day wage- and price-freeze and a 10% import surcharge to protect US products against expected exchange rate fluctuations. Paul Volcker, the architect of the scheme, related how they waited with trepidation for the market reaction. But it turned out to be a non-event, with bond and equity markets sailing on unperturbed. The Dow rose 33 points the next day, the largest daily gain at the time.

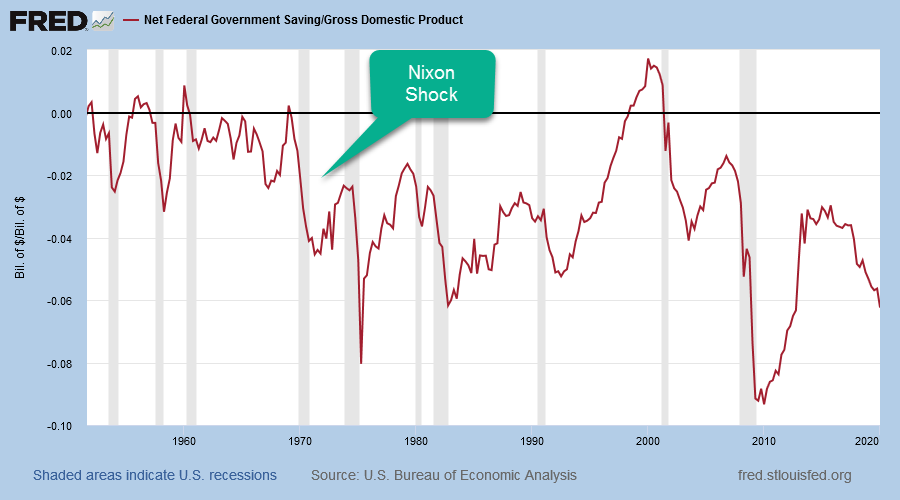

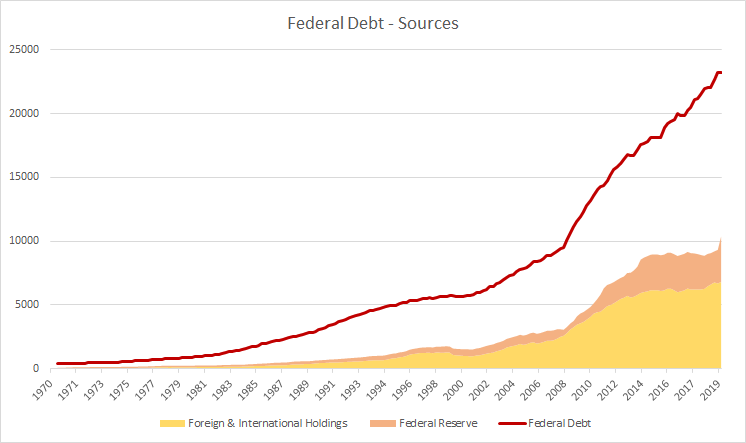

The move unshackled federal government from restraints of the gold standard and deficits ballooned. Apart from a brief respite during the Dotcom bubble, deficits have grown progressively larger and are expected to reach -14% of GDP during the current crisis, breaking all post-war records.

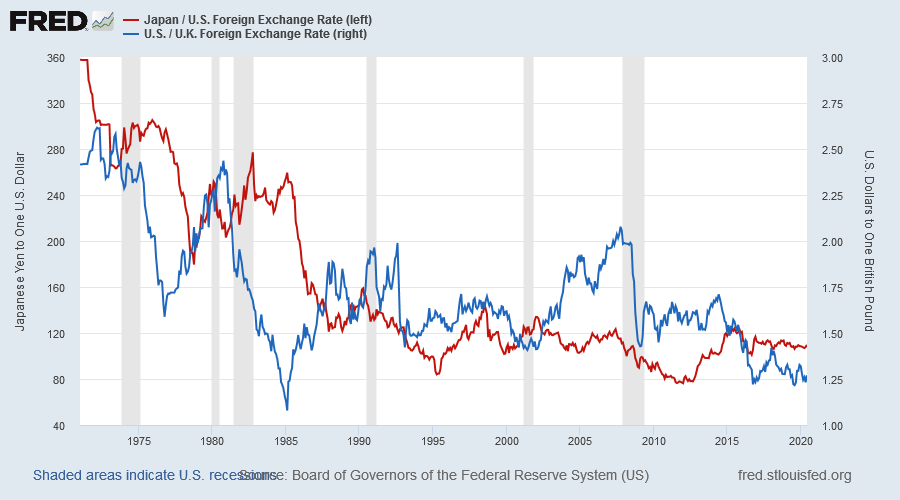

The Dollar depreciated sharply over the next two decades, forcing the Bank of Japan to buy Dollars to slow appreciation of the Yen. Other central banks followed suit and a new era of currency manipulation was born.

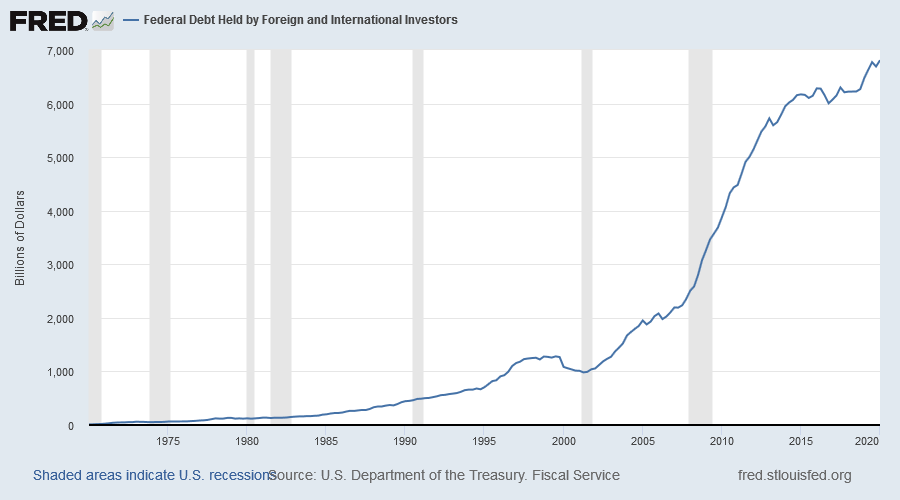

Federal debt held by foreign investors started to climb, especially when used by trading partners (e.g. China) to slow appreciation against the Dollar and maintain a trade advantage in export markets. Prior to 1971 the US would have been likely to neutralize capital account inflows, to maintain a stable exchange rate, by buying gold in international markets. But successive governments living beyond their means have grown to accept foreign investment in Treasuries as a legitimate form of funding.

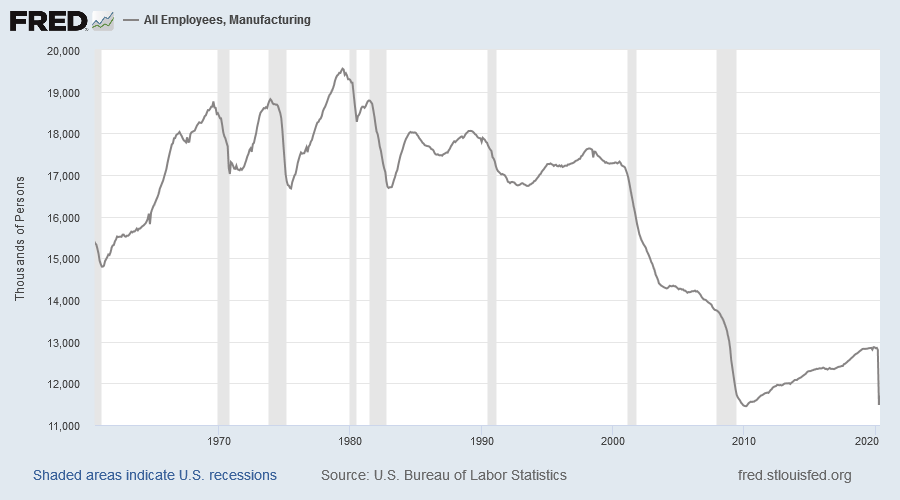

This had unfortunate consequences for the manufacturing sector. It lost the ability to compete in export markets � and against imports in domestic markets � because of the over-priced dollar.

Foreign investment in US federal debt is slowing in response to trade tensions, leaving Treasury with a problem: who is going to buy the expected net $3 trillion in new debt issuance this year? Their answer is the Federal Reserve: purchasing Treasuries in secondary markets and issuing newly printed Dollars in payment.

The result is likely to be another epic depreciation of the Dollar. This will probably pass largely unnoticed because other central banks are doing QE on a similar scale. Currency markets may seem undisturbed because all major currencies are depreciating together.

How do we fix the problem? A number of commentators over the years have suggested re-introducing the Gold standard. While this is usually met with cries of derision from some quarters, it would impose a stricter discipline on government finances and offer greater transparency when currencies are devalued. Realistically, however, it's not going to happen.

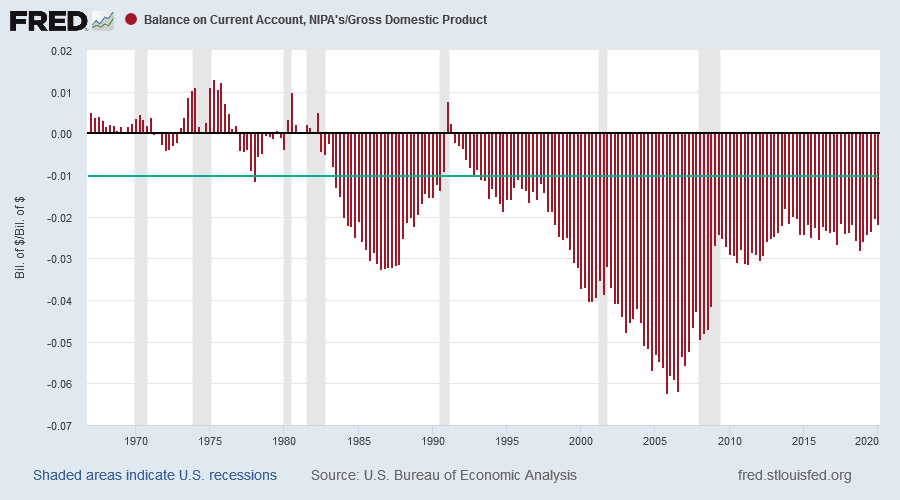

A more practical step may be to impose some discipline or limit on capital account imbalances. By definition, the capital account is a mirror of the current account in international trade. A current account deficit (or outflow) must be funded by a capital account (or investment) inflow. Setting a ceiling on capital account imbalances would limit the scope for federal government to fund deficits with foreign borrowing, restricting some of the excesses and limiting damage done to the exchange rate.

Requiring the Fed to purchase gold (and other hard assets in international markets) to offset capital account inflows in excess of 1.0% of GDP would set a healthy discipline in managing the fiscal budget. Over time, the limit could be restricted even further, with the long-term goal of maintaining parity in international trade.

This is no easy fix, though. Reducing excesses in one area is likely to expose countering imbalances in other parts of the international financial system, with a shortfall in the international Eurodollar market the most likely complication.

It is time to recognize that financial markets are inherently unstable. ....the choice confronting us is whether we will regulate global financial markets internationally or leave it to each individual state to protect its interests as best it can. The latter course will surely lead to the breakdown of the gigantic circulatory system, which goes under the name of global capitalism.

~ George Soros, The Crisis of Global Capitalism (1998)

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.