Chart of the Week: "To infinity and beyond..."

By Colin Twiggs

March 14, 2020 4:00 a.m. EDT (7:00 p.m. AEDT)

First, please read the Disclaimer.

I know that Fed Chairman, Jay Powell, looks more like Woody than Buzz Lightyear but please allow me some leeway.

The New York Times reported Thursday that "something weird is happening on Wall Street, and not just the stock sell-off" :

"...reports from trading desks that many assets that are normally liquid—easy to buy and sell—were freezing up, with securities not trading widely. This was true of the bonds issued by municipalities and major corporations but, more curiously, also of Treasury bonds, normally the bedrock of the global financial system."

Debt markets and even the market in US Treasuries are shuddering. If either of these had to stop working, the entire financial system would collapse.

Tiffany Wilding & Rick Chan at PIMCO provide some background:

"Over the last few days, Treasury market liquidity was strained as a rise in broader market volatility prompted a wave of sales in off-the-run Treasury bonds. These sales were largely driven by investors who use leverage in an effort to amplify the returns of arbitraging the yield spread between Treasury bond yields and other market instruments, including Treasury futures. This wave of sales coupled with general investor outflows from fixed income markets forced the system to absorb a significant amount of bonds in a matter of days."

In short, hedge funds that hold more than $200 billion in highly-leveraged positions in US Treasuries are being forced to liquidate. Financial intermediaries (primary dealers) are unable to cope.

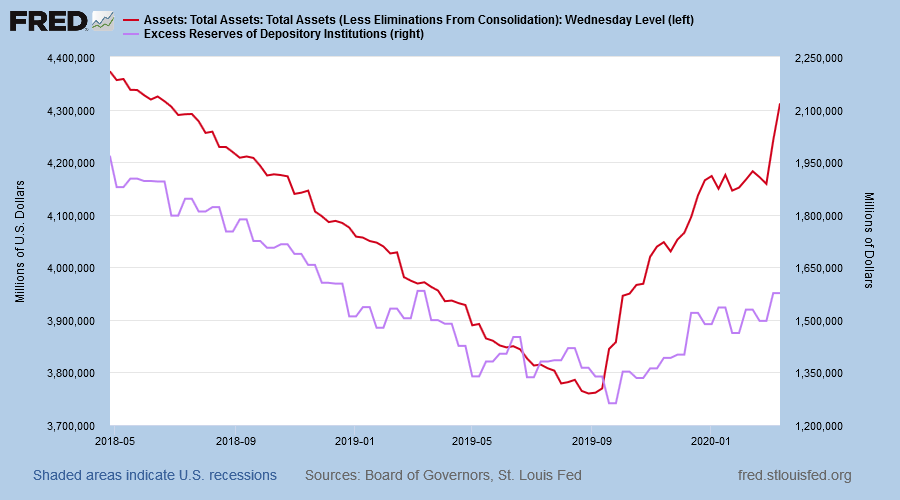

The Fed's balance sheet was already climbing. Earlier in the week, they had announced an additional $75 billion funding injection in repo markets.

On Thursday the Fed brought out the big bazooka, announcing $1.5 trillion in repo funding in an attempt to calm the markets. Their balance sheet is likely to balloon with the latest measures. The previous (2015) high of $4.5 trillion will soon be a distant memory.

The PIMCO pair continue:

"However, these actions ultimately may not be enough. Trading conditions in other markets are also strained. For example, the yield spread of agency mortgage-backed securities (MBS) to the 10-year Treasury is at its widest level since the 2008 financial crisis, according to Bloomberg, suggesting that pressures in that market are hindering the effective transmission of monetary policy.

Furthermore, the issues in the Treasury market may be a preview of broader market strains as businesses and consumers come under more severe duress from COVID-19-related disruptions, and credit fundamentals deteriorate...."

Several market pundits, including former Fed advisor Danielle de Martino Booth are predicting that the Fed will be forced to cut the funds rate to zero and also widen the array of assets purchased. PIMCO suggests this will include mortgage-backed securities (MBS), while others have speculated that it could even extend to equities. Equities are still unlikely. The Bank of Japan is the only major central bank that has gone that far — and ended up owning up to 80% of some ETFs — without achieving any noticeable economic recovery.

Zero interest rates promise not recovery but economic stagnation if the experiences of the BOJ and ECB are anything to go by.

Attempts by the Fed to wind back exposure to the markets have failed. They unleashed the beast but are no longer its master. We are now its slaves and must feed it whenever it cries out for "just a little bit more". There is no way to tame it without prolonged and severe hardship. No other exit strategy.

Unfortunately there is only one dragon-slayer like Paul Volcker born in any generation, and he sadly is gone.

Government response to the #WuhanVirus

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

- ASX: You'll be sorry

- Gold: "Nowhere to hide"

- "To infinity and beyond..."

- The show isn't over until the fat lady sings

- Gold: Still plenty of bears

- Black Monday all over again

- Bullish on Gold

- S&P 500 update: How low will it go?

- Coronavirus market selloff "a gross overreaction"

- "One bad day away from turmoil"

- China: Grim outlook for business

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.