The jury is still out

By Colin Twiggs

December 7, 2018 6:30 p.m. ET (10:30 a.m. AEDT)

First, please read the Disclaimer.

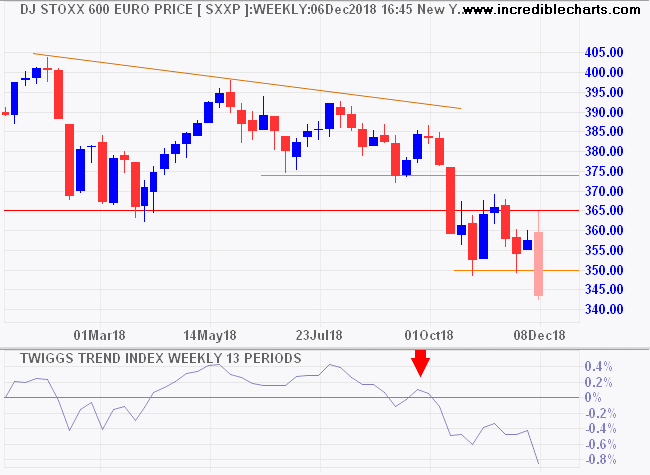

Dow Jones Euro Stoxx 600 broke support at 350, confirming a bear market in Europe. A Trend Index peak below zero warns of strong selling pressure. Expect a decline to test 305/310.

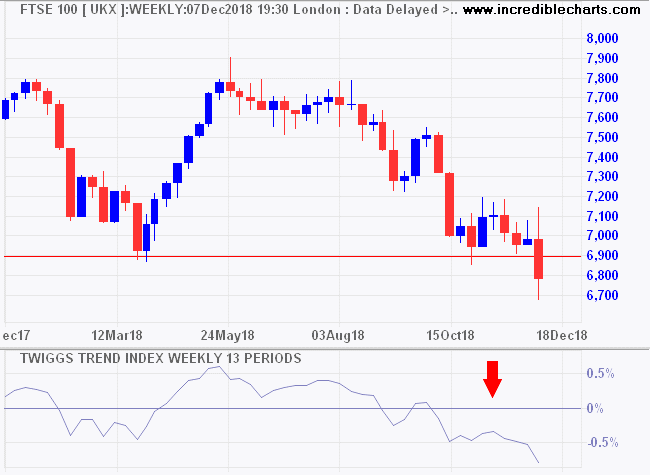

The Footsie broke support at 6900, signaling a primary down-trend, while a Trend Index peak below zero warns of selling pressure. Expect a decline, with a target of 6000.

US markets are high on volatility but low on direction.

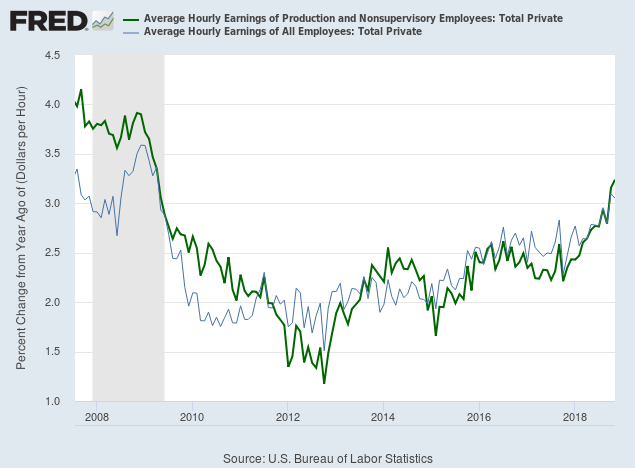

Average hourly earnings are rising, warning of further rate hikes from the Fed.

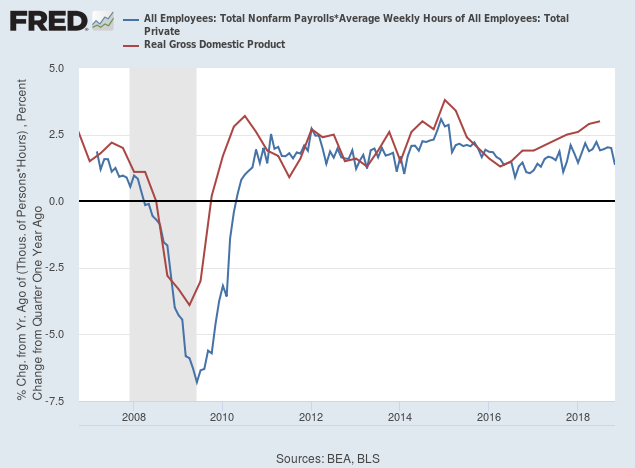

Growth in NonFarm Payroll x Average Weekly Hours is slowing, warning that real GDP growth is likely to follow.

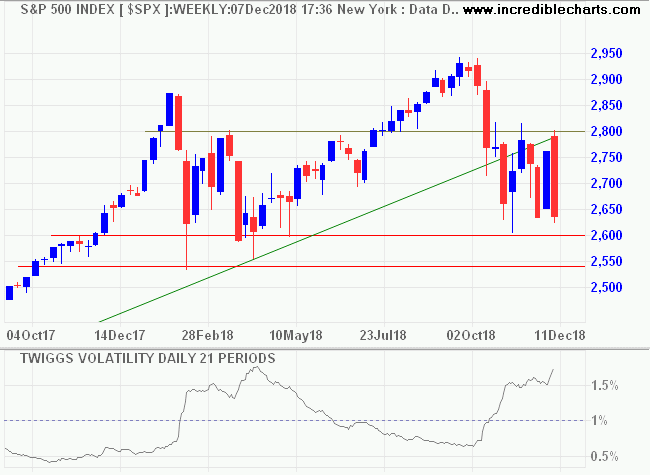

The S&P 500 continues to range between 2600 and 2800. Volatility is rising but does not flag immediate danger. A large trough above 1% extending over at least six to eight weeks, however, would warn of elevated risk. Breach of 2600 would suggest a primary decline. Follow-through below 2550 would confirm.

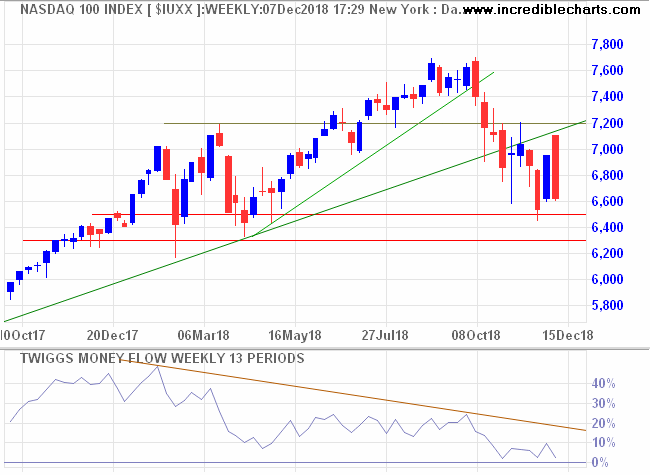

The Nasdaq 100 shows a W-shaped bottom above primary support at 6500. Declining Money Flow is still above the zero line suggesting that the sell-off is secondary in nature. Breach of 6500 would warn of a primary decline. Follow-through below 6300 would confirm.

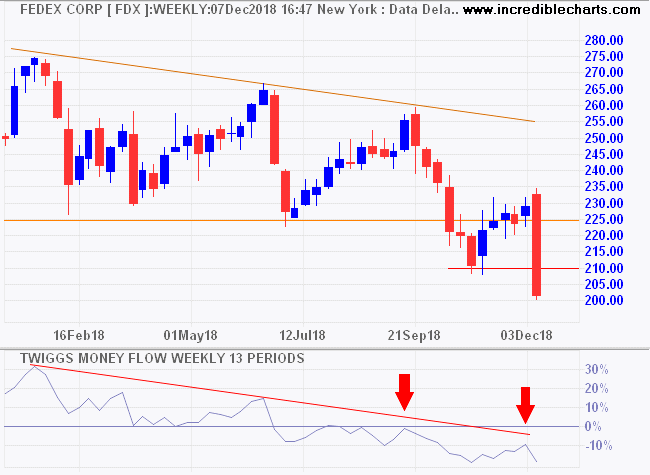

Bellwether transport stock Fedex broke support at 210 but entrance of Amazon as a competitor may be affecting the quality of the signal.

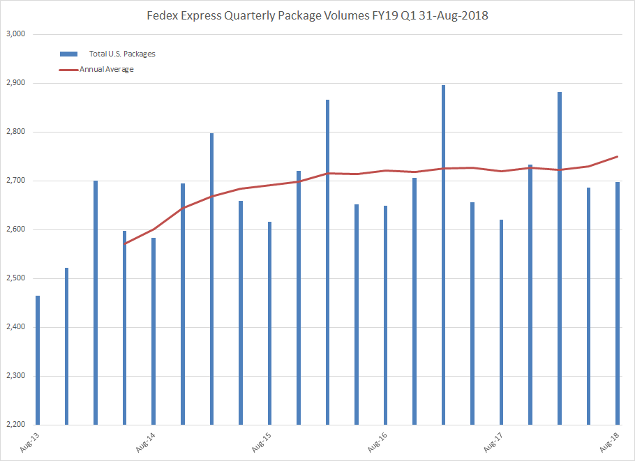

Quarterly Fedex Express package shipments were rising in August 2018. Statistics for Q2, ending November 30, are due for release on December 18 and I expect will continue to reflect a robust economy.

We are being barraged with bad news as the bears try to frighten the herd into a stampede. But the jury is still out. Europe is a worry. Rate hikes will continue but have little immediate impact on earnings. Valuations (P/E multiples) were high but have softened considerably. Bearish consumer sentiment may have some impact on sales. The yield curve is likely to invert but any impact is lagged by at least 12 months. Trade tariffs are a two-edged sword and will necessitate some adjustment. Tech leaders — Facebook, Alphabet, Amazon, Apple, Google and Microsoft — are still more bullish than bearish. If one or two more enter a primary down-trend, then I will accept this is a bear market. Until then, there is a reasonable chance that this blows over.

I never hesitate to tell a man that I am bullish or bearish. But I do not tell people to buy or sell any particular stock. In a bear market all stocks go down and in a bull market they go up.

~ Jesse Livermore

Latest

-

ASX 200

Testing primary support. -

Tech Leaders

Bearish but not a bear market. -

Making Rational Decisions

If it's flooded, forget it. -

Yield Curve

Does the yield curve warn of a recession?

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.