Never waste a good crisis

By Colin Twiggs

October 12, 2018 5:00 p.m. EDT (8:00 a.m. AEST)

First, please read the Disclaimer.

There will be no newsletter this weekend because of other commitments but here is a quick update on this week's events.

Crisis = Danger + Opportunity

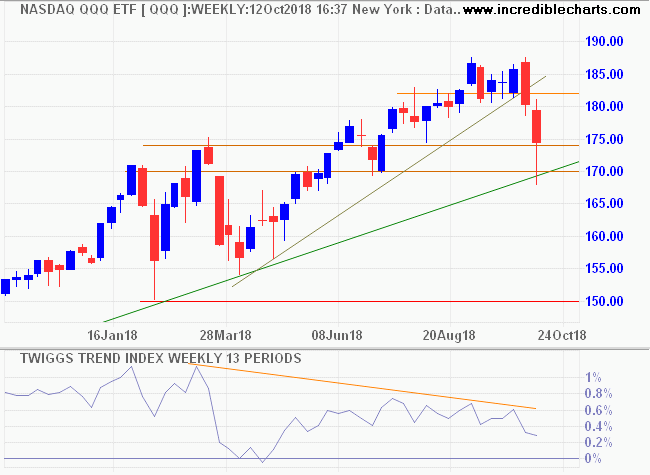

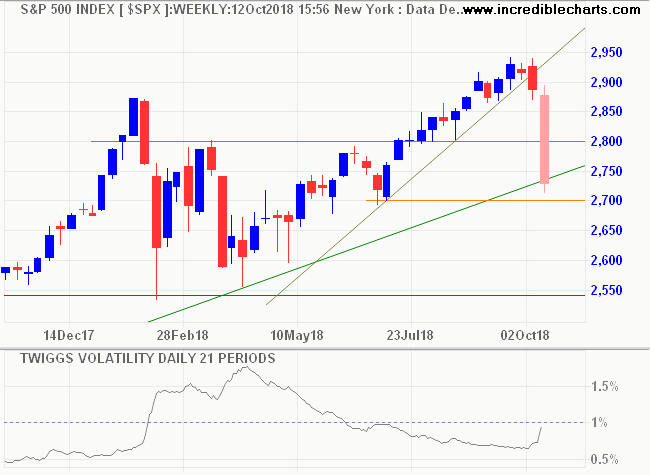

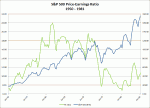

Tech stocks fell sharply, after the Nasdaq 100 broke support at 7400 at the beginning of the week. The sell-off spread to other markets across the globe, many signaling a primary down-trend. But there has been no broad downgrade in earnings and the current sell-off appears to be an overreaction to rising long-term Treasury yields which signaled the start of a bond bear market.

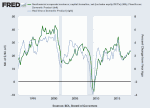

As I discussed several weeks ago, real bond yields, after adjusting for inflation, remain near record lows and pose no immediate threat to high stock valuations.

The Nasdaq 100 found support at its LT trendline, indicating the up-trend is intact. Trend Index holding above zero signals likewise. Selling pressure appears secondary.

The S&P 500 likewise respected its rising LT trendline. Volatility remains below 1.0%.

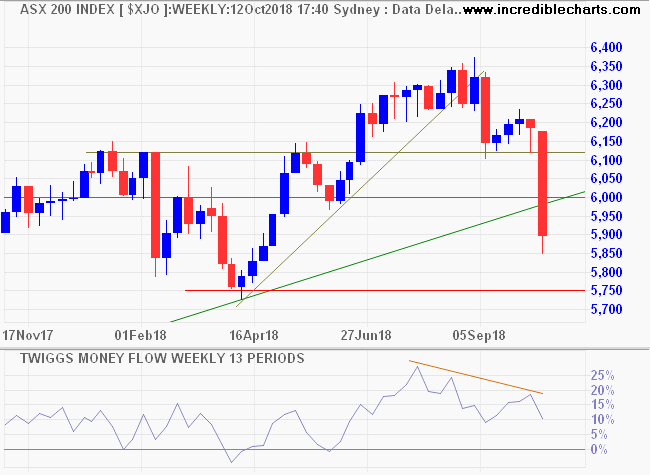

Australia

The ASX 200 penetrated its long-term trendline and is likely to test primary support at 5750. But the decline in Money Flow suggests a secondary sell-off.

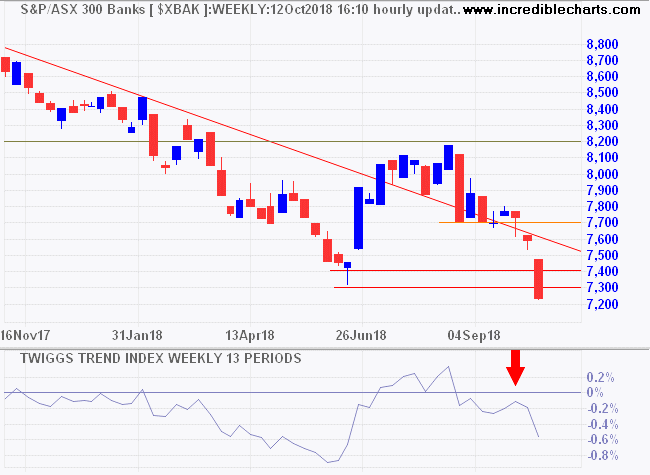

Banks are the Achilles heel of the local index, breaking primary support at 7300. Follow-through below 7000 would confirm a long-term target of 6600.

My advice to subscribers is: Don't waste a good crisis. This is a time to accumulate quality stocks that have experienced a strong sell-off. Stocks that tick all the boxes:

- Long-term, secular growth in demand

- Dominant market position

- Ability to defend market share against competitors

- Rapid growth in revenues

- Rising margins

- Strong cash flows

This includes many of the stocks that I marked "Hold" a week ago. I will update the list tomorrow.

Forgive me, but this George Soros quote is right on the button.

Markets are constantly in a state of uncertainty and flux, and money is made by discounting the obvious and betting on the unexpected. ~ George Soros

Latest

-

East to West

Nasdaq warns of broad market correction. -

US Unemployment

Extraordinary times: low unemployment and low inflation. -

US Economy

It's a bull market. -

Bonds

Treasury yields confirm bond bear market. -

Gold

Dollar strength keeps gold bulls in check. -

Bonds

How will a bond bear market affect stocks? -

Yield Curve

Does the yield curve warn of a recession?

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.