How will a bond bear market affect stocks?

By Colin Twiggs

September 22, 2018 1:30 a.m. EDT (3:30 p.m. AEST)

First, please read the Disclaimer.

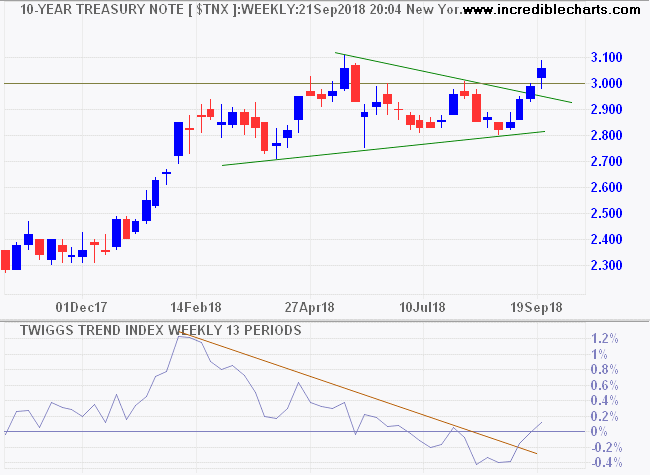

10-Year Treasury yields broke out of their triangular consolidation at 3.00%, while the Trend Index recovered above zero signaling a fresh advance.

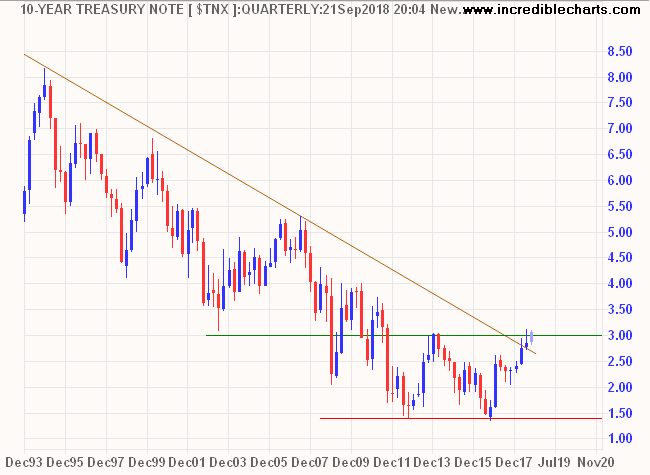

Importance of resistance at 3.00% is best illustrated on a long-term monthly chart. Yields declined for more than three decades (since 1981) in a bond bull market but the rise above 3.00% completes a double-bottom reversal, warning of rising yields and a bond bear market. Target for the advance is 4.50%.

The yield differential between 10-year and 3-month Treasuries has declined since 2010, prompting discussion as to whether a flat yield curve will cause a recession. Interesting that the yield differential recovered almost 20 basis points in September, with long-term yields rising faster than short-term. Penetration of the descending trendline would suggest that an imminent negative yield curve is unlikely.

How would a bond bear market affect stocks?

Capital losses from rising yields on long-maturity bonds would increase demand for shorter maturities, driving down short-term yields and causing a steeper yield curve. A bullish sign for stocks.

Inflation is low and the rise in long-term yields is likely to be gradual. Another bullish sign.

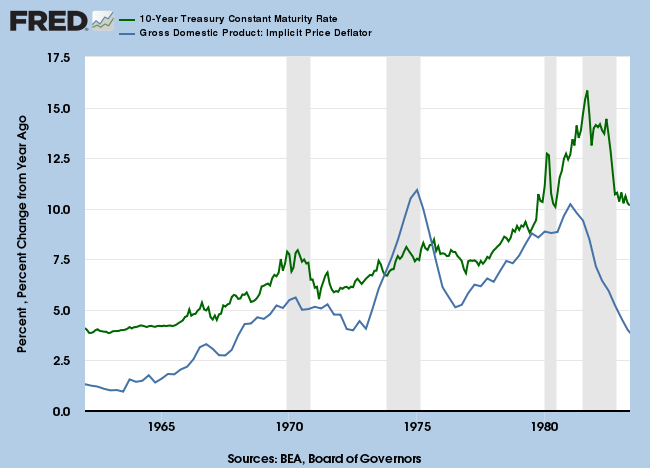

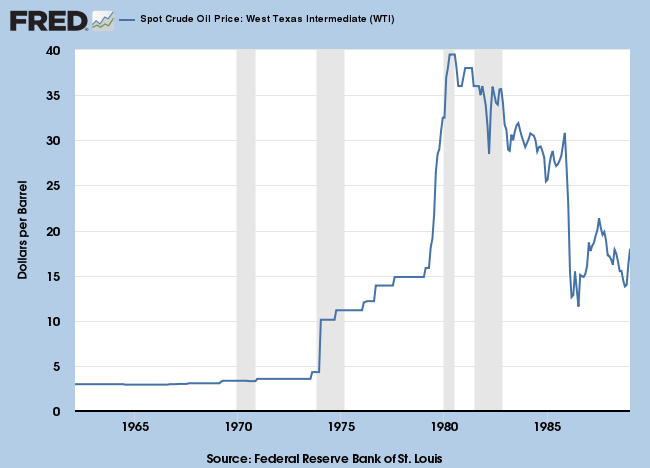

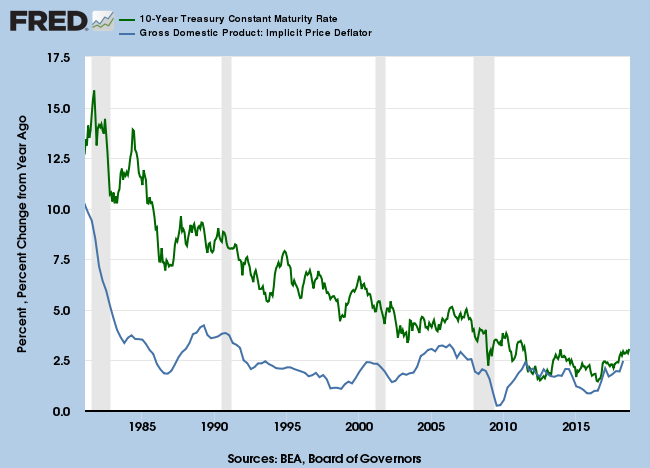

The last bond bear market lasted from the early 1950s to a peak in September 1981. Higher interest rates were driven by rising inflation ( indicated below by percentage change in the GDP implicit price deflator). The 1975 spike in inflation was caused by the OPEC oil embargo in retaliation for US support of Israel during the 1973 Yom Kippur war.

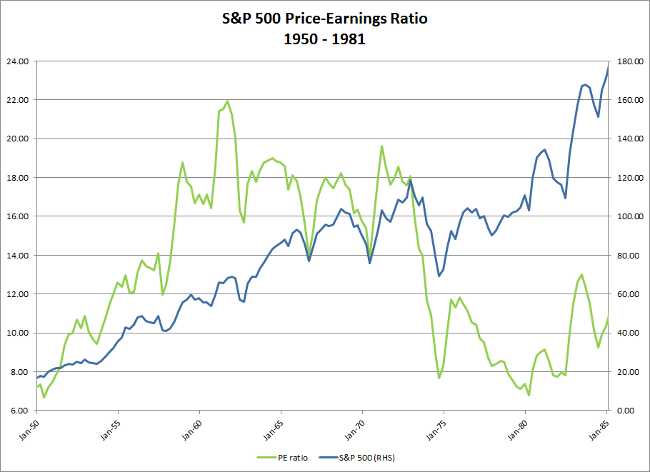

Stock prices continued to climb during the bond bear market, apart from a 1973 - 1974 setback, but the Price-Earnings ratio fell sharply in '73-'74 and only recovered 10 years later, in the mid-1980s.

Alarmists may jump to the conclusion that a bond bear market would lead to a similar massive fall in earnings multiples but there were other factors in play in 1975 to 1985.

First, crude prices spiked after the OPEC oil embargo and only retreated in the mid-1980s.

The rise of Japan also threatened US dominance in global markets.

We should rather examine the period prior to 1973 as indicative of a typical bond bear market. The S&P 500 Price-Earnings ratio was largely unaffected by rising yields. Real interest rates actually decreased during the period, with the gap between 10-year yields and the inflation rate only widening near the 1981 peak.

At present, real interest rates are near record lows.

We can expect real interest rates to rise over time but that is unlikely to have a significant impact on earnings multiples — unless there is a strong surge in long-term yields ahead of inflation.

Markets are constantly in a state of uncertainty and flux, and money is made by discounting the obvious and betting on the unexpected.

~ George Soros

Latest

-

ASX 200

Banks lack support but miners receive a boost. -

Gold

Aussie gold stocks rally. -

East to West

Trade tariffs spark a rally. -

Yield Curve

Does the yield curve warn of a recession? -

Model Portfolios

Performance at 31 August 2018.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.