East to West: Asia finds support

By Colin Twiggs

September 15, 2018 12:30 a.m. EDT (2:30 p.m. AEST)

First, please read the Disclaimer.

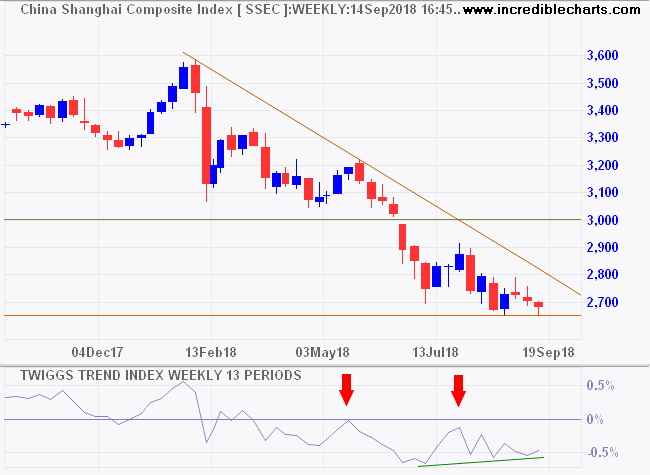

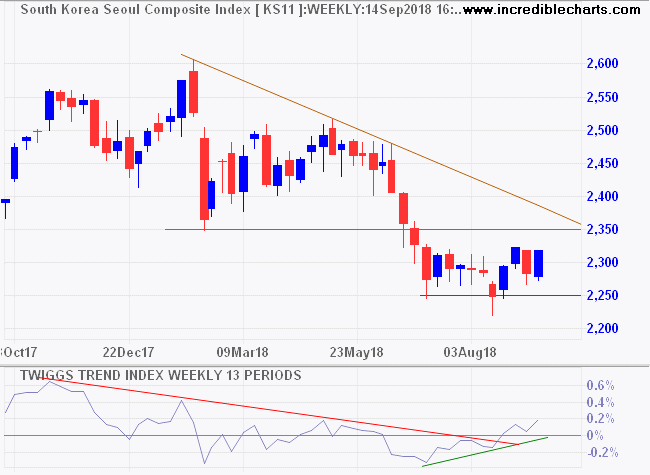

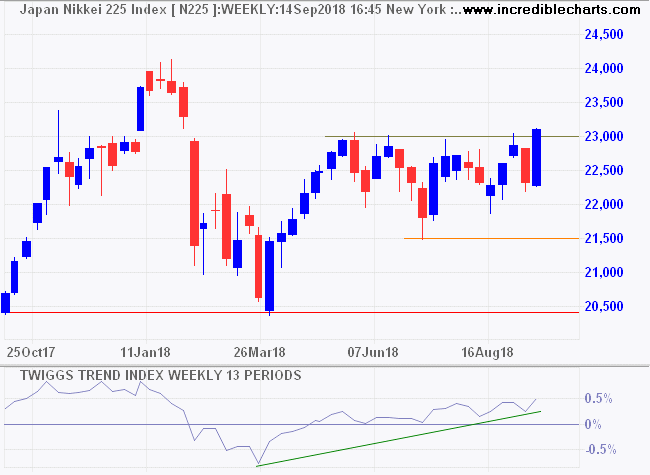

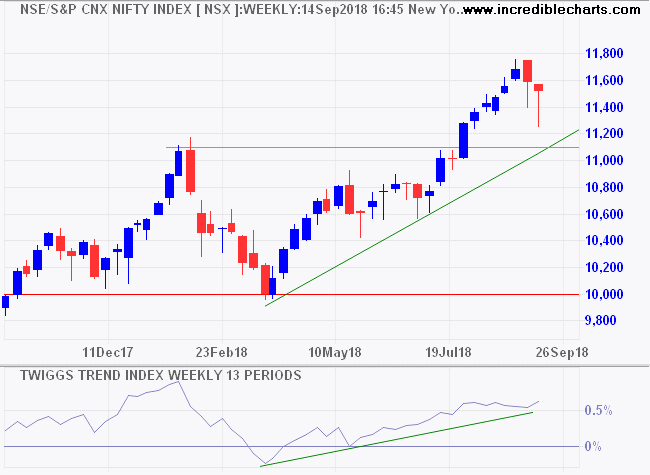

Asian stocks are finding support after a sell-off over the last three months.

The Shanghai Composite Index is showing a slight bullish divergence on the Trend Index. This is secondary in size and suggests a bear market rally.

South Korea's Seoul Composite Index displays a stronger bullish divergence. Breakout above 2350 and the descending trendline is still unlikely but would indicate that a bottom is forming.

Japan's Nikkei 225 broke through resistance at 23,000, signaling an advance to the January high at 24,000.

India shows strong buying pressure, with long tails on the Nifty suggesting another strong advance.

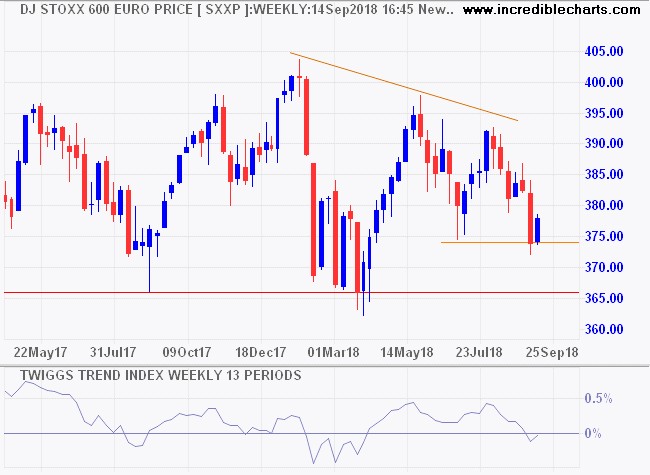

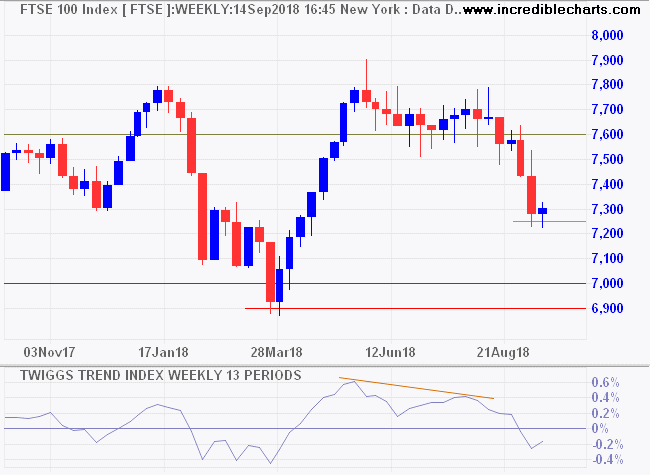

Europe

Dow Jones Euro Stoxx 600 is trending lower. Support at 374 is secondary but the Trend Index near zero indicates hesitancy.

The Footsie found medium-term support at 7250 but a declining Trend Index warns of another test of primary support at 6900/7000.

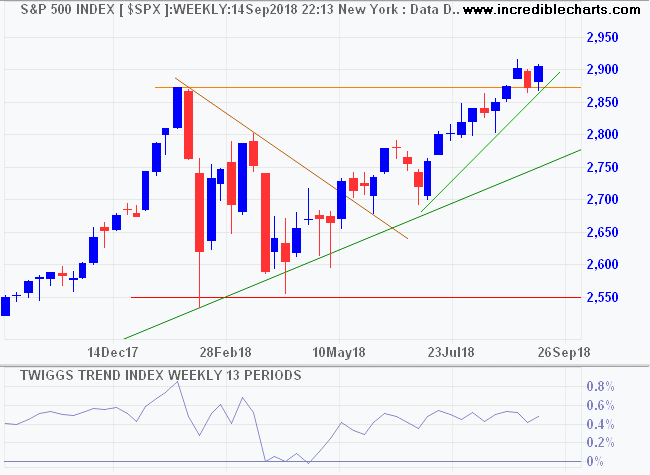

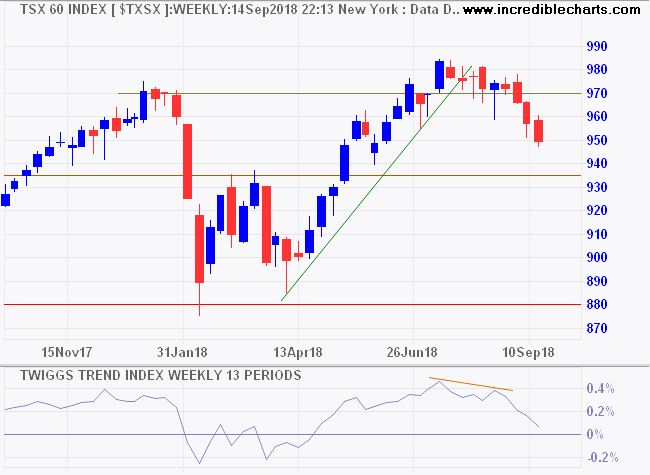

North America

The S&P 500 retracement respected support at 2875, suggesting an advance to the long-term target of 3000.

Canada's TSX 60 on the other hand is undergoing a correction, perhaps exacerbated by concerns over NAFTA. Expect support at 935/940.

Nothing much has changed. While Japan and India are bullish, China and South Korea remain in a bear market. Europe looks hesitant, while the S&:P 500 continues in a strong bull market.

The generally accepted view is that markets are always right — that is, market prices tend to discount future developments accurately even when it is unclear what those developments are. I start with the opposite view. I believe the market prices are always wrong in the sense that they present a biased view of the future.

~ George Soros

Latest

-

ASX 200

Correction to test 6000. -

Gold

Silver warns of further gold weakness. -

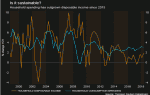

Australia

Households are spending more than they are earning | ABC. -

Wesfarmers Ltd (WES)

Investor update. -

Yield Curve

Does the yield curve warn of a recession? -

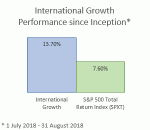

Model Portfolios

Performance at 31 August 2018.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.