Wage increases haven't made a dent in profits

By Colin Twiggs

September 7, 2018 10:30 p.m. EDT (12:30 p.m. AEST)

First, please read the Disclaimer.

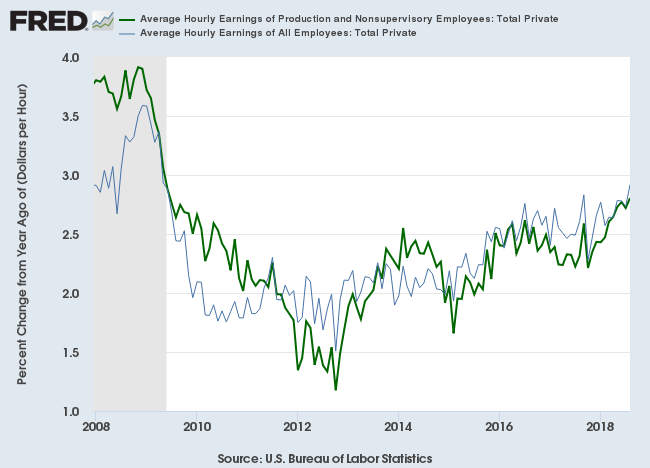

Average hourly earnings growth continues to rise, albeit at a leisurely pace. Average hourly earnings for all employees in the private sector grew at 2.92% over the last 12 months, while production and nonsupervisory employee earnings grew at 2.80% over the same period. The Fed is likely to adopt a more restrictive stance if hourly earnings growth, representing underlying inflationary pressures, exceeds 3.0%. So far the message from Fed Chair Jerome Powell has been business as usual, with rate hikes at a measured pace.

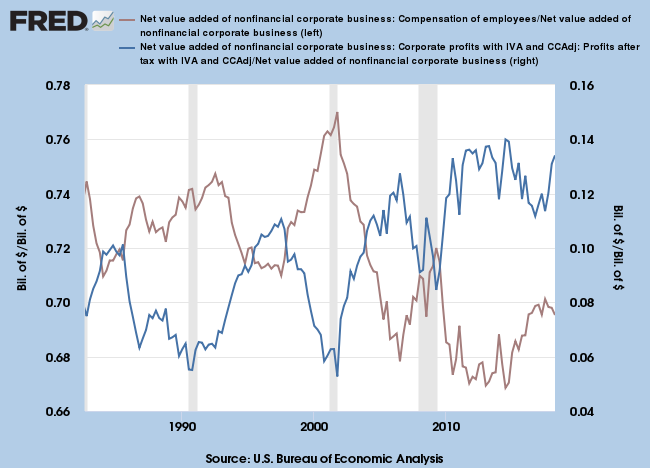

Rising wage rates to-date have been unable, up to Q2 2018, to make a dent in corporate profits. Corporate profits are near record highs at 13.4%, while employee compensation is historically low at 69.5% of net value added. Past recessions have been heralded by rising employee compensation and falling corporate profits. What we are witnessing this time is unusual, with compensation rising, admittedly from record low levels, while profits rebounded after a low in Q4 2016. There is no indication that this will end anytime soon.

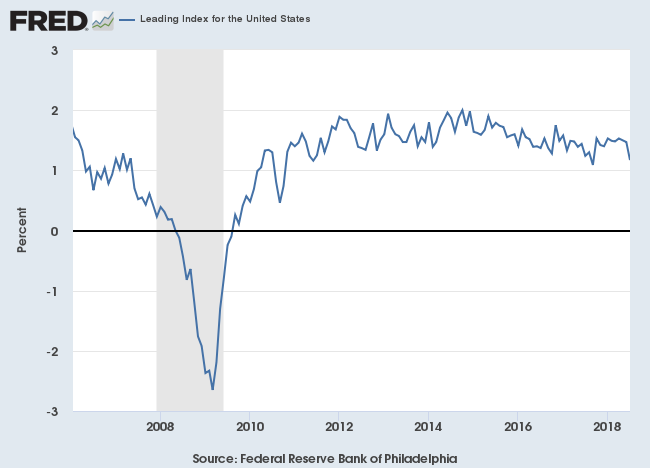

Weaker values (1.17%) on the Leading Index from the Philadelphia Fed reflect a flatter yield curve. A fall below 1.0% would be cause for concern.

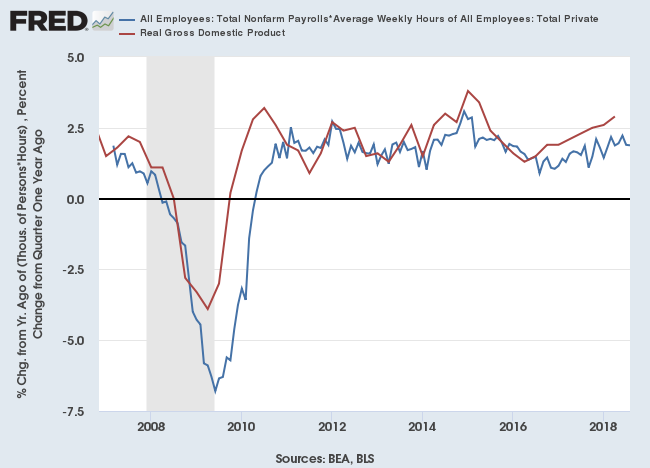

Our surrogate for real GDP, Total Payrolls x Average Weekly Hours Worked, is lagging behind recent GDP growth (1.9% compared to 2.9%) but both are rising.

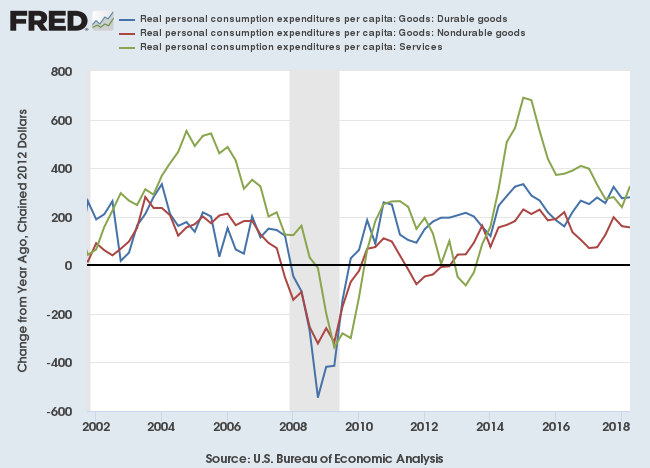

Another good sign is that personal consumption expenditure, one of the key drivers of economic growth, is on the mend. Services turned up in Q2 2018 after a three-year decline. Durable goods remain strong. Nondurables are weaker but this may reflect a reclassification issue. New products such as Apple Music and Netflix are classified as sevices but replace sales of goods such as CDs and videos.

There is no cause for concern yet, but we will need to keep a weather-eye on the yield curve.

Markets are constantly in a state of uncertainty and flux, and money is made by discounting the obvious and betting on the unexpected.

~ George Soros

Latest

-

ASX 200

Banks & miners lead correction. -

East to West

Bonds & tariffs hurt developing markets and crude oil. -

Gold

Gold stocks face selling pressure despite plunging Aussie Dollar. -

Yield Curve

Does the yield curve warn of a recession? -

Model Portfolios

Performance at 31 August 2018.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.