East to West: US rallies, China falls

By Colin Twiggs

August 24, 2018 8:30 p.m. EDT (10:30 a.m. AEST)

First, please read the Disclaimer.

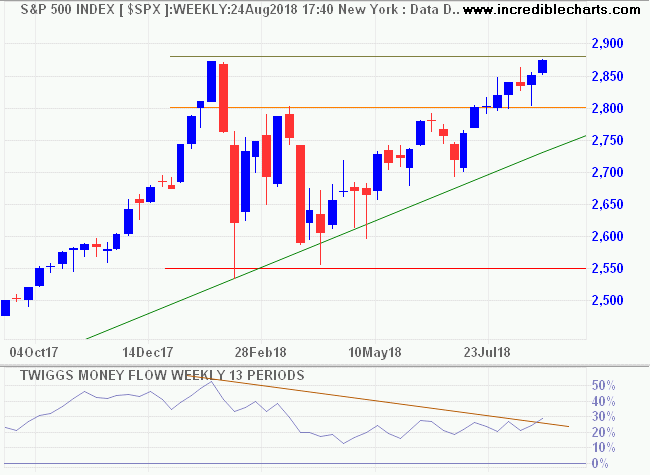

The S&P 500 is testing its January high at 2870. A rising Trend Index indicates buying pressure. Follow-through is likely to test resistance at 3000.

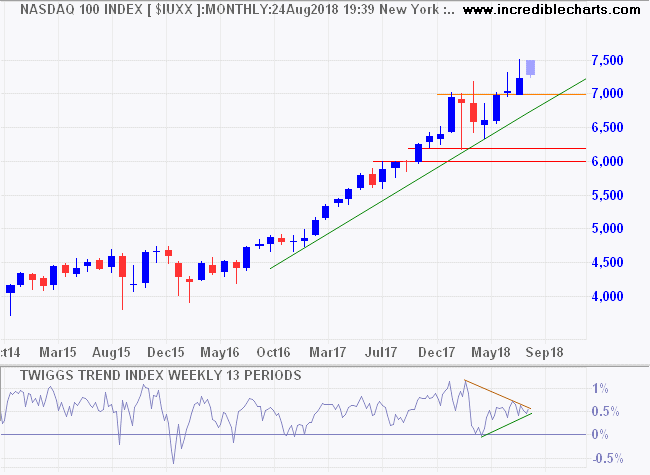

A monthly chart of the NASDAQ 100 illustrates tech stock strength, with a rally from 4500 to 7500 in just two years. Breakout above medium-term resistance at 7500 is more likely, offering a target of 8000, while a correction would test support at 7000. Breakout from the triangle pattern on the Trend Index would indicate index direction.

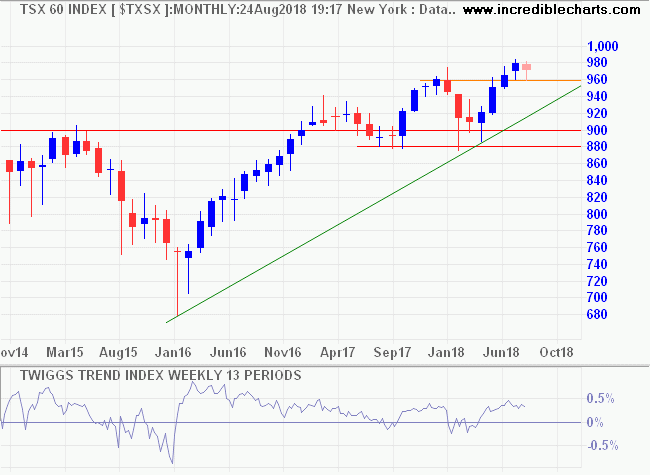

Canada's TSX 60 index is also advancing. A rising Trend Index suggests buying pressure. Retracement that respects support at 960 is likely and would signal another advance, with a target of 1040.

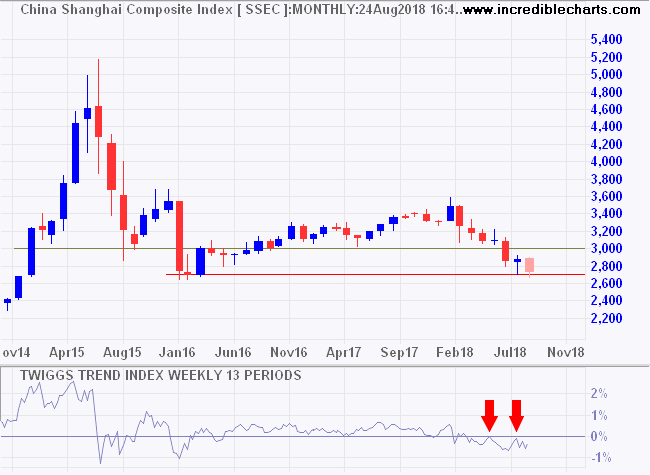

China paints the opposite picture, with the Shanghai Composite Index testing long-term support at 2700. Trend Index peaks below zero warn of selling pressure and breach of support would offer a long-term target of the 2014 low at 2000.

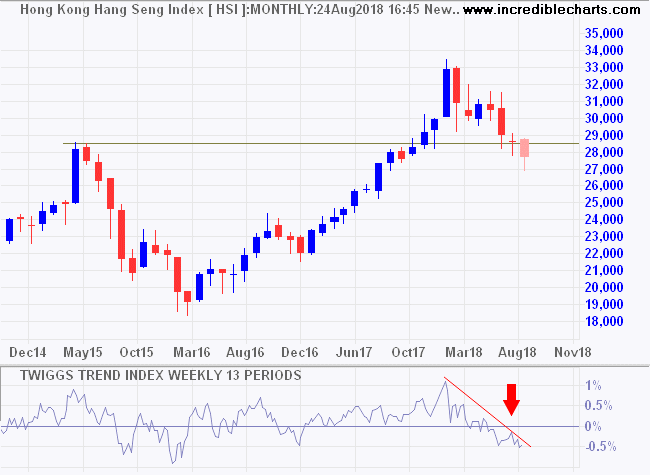

Hong Kong's Hang Seng Index broke support at 28,000/28,500 offering a long-term target of 25,000.

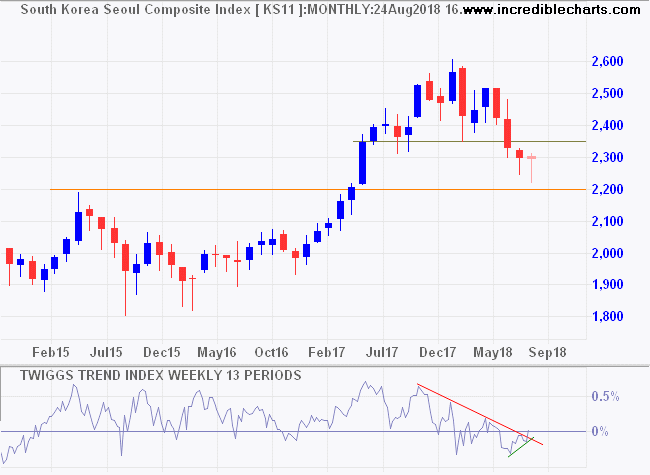

South Korea's Seoul Composite Index found support above 2200. Retracement to test new resistance at 2350 is likely. A lot depends on progress in peace negotiations with North Korea.

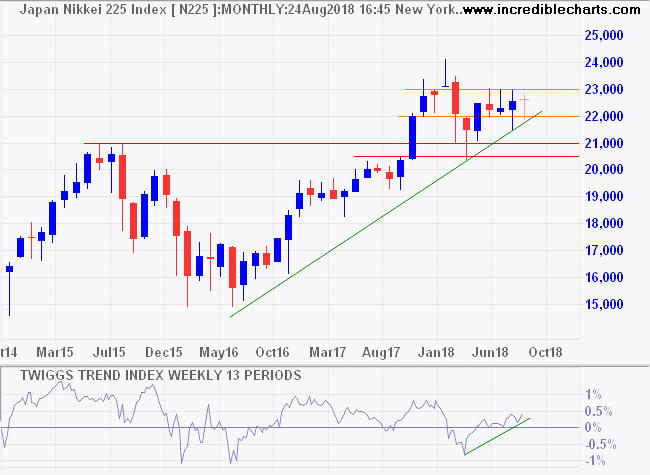

Japan's Nikkei 225 is consolidating between 23,000 and 24,000 suggesting uncertainty over fallout from a threatened US-China trade war.

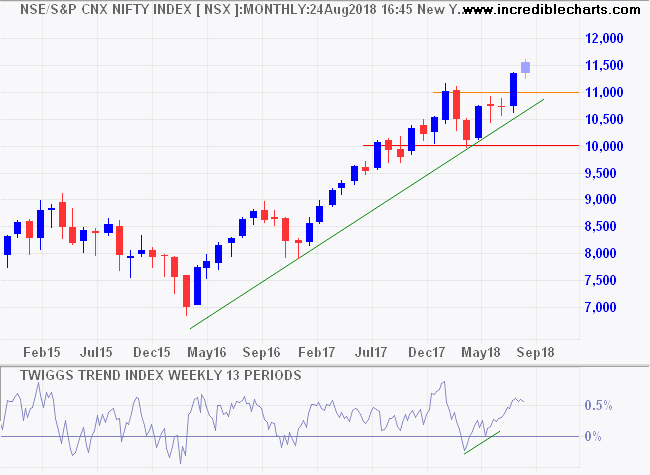

India is more on the periphery of current trade disputes, with the Nifty continuing its advance toward a target of 12,000.

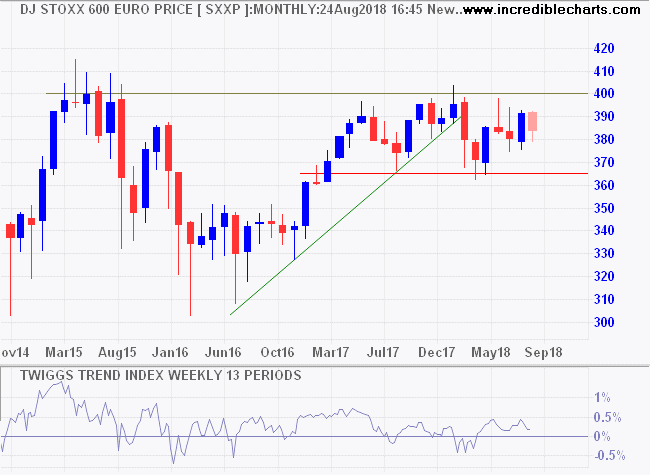

In Europe, Dow Jones Euro Stoxx 600 continues to reflect uncertainty, with long-term consolidation below 400. Breakout would signal a fresh advance but don't hold your breath. It could take a while.

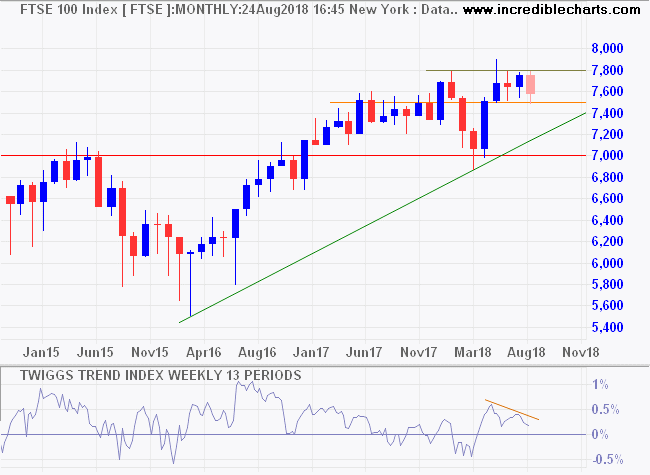

The Footsie is retracing to test support at 7500 but respect is likely and would offer a target of 8000.

North America clearly leads the global recovery, while Asia lags. Europe is sandwiched in the middle, with potential loss of trade in the East and West if a trade war erupts.

Thucydides once wrote "When one great power threatens to displace another, war is almost always the result." In his day it was Athens and Sparta but in the modern era, war between great powers, with mutually assured destruction (MAD), is most unlikely. What we are witnessing is negotiation to define rules for peaceful coexistence in the 21st century. A lack of clear rules increases the risk of miscalculation and rapid escalation to a hard conflict.

Absent the willingness to use military force, the country with the greatest economic power is in the strongest position to set the rules.

War is a matter not so much of arms as of money.

~ Thucydides (460 - 400 B.C.)

Latest

-

ASX 200

Hurt by banks, miners and politics. -

Gold

Support for the Yuan lifts Gold. -

Model Portfolios

Australian & International model portfolios based on my investment strategy.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.