Bullish GDP numbers should encourage US investors

By Colin Twiggs

July 28, 2017 2:30 p.m. EDT (12:30 a.m. AEST)

First, please read the Disclaimer.

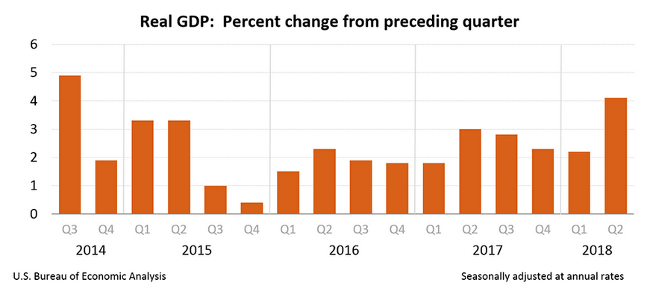

The Bureau of Economic Analysis (BEA) reports that real gross domestic product (real GDP) increased at an annual rate of 4.1 percent in the second quarter of 2018. This is an advance estimate, based on incomplete data and is subject to further revision.

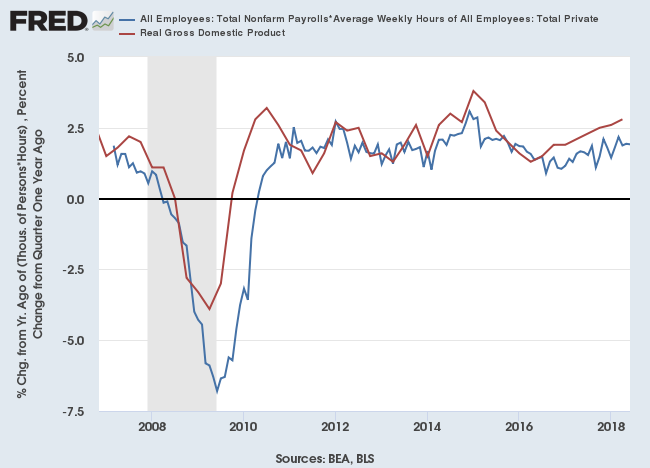

While the spurt in quarterly growth is encouraging, I find annualized quarterly figures misleading and prefer to stick to the annual rate of change, from the same quarter in the preceding year. Annual growth still reflects an improving economy but came in at 2.8 percent, more in line with the estimate of actual hours worked on the chart below.

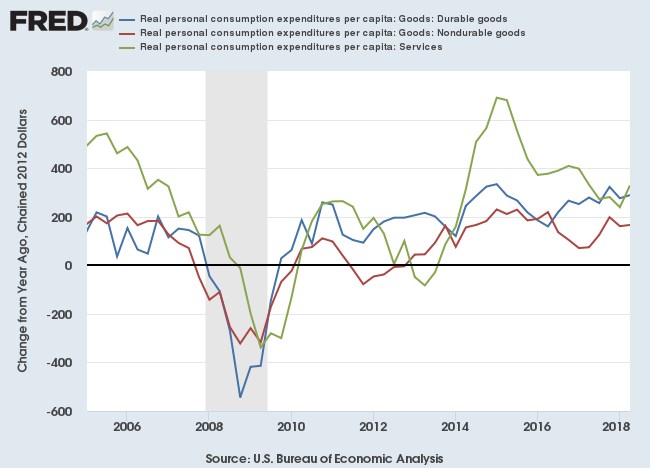

Personal consumption figures tend to decline ahead of a recession, so an up-tick in all three consumption measures is a positive sign for the US economy. Expenditures on durable goods is especially robust, suggesting growing consumer confidence. Non-durable goods expenditures are holding up, while services, which had been declining since a large spike in 2015, are maintaining at still strong levels.

There is no sign of the US economy slowing. Continued growth and positive earnings results should encourage investors.

Nobility of spirit has more to do with simplicity than ostentation, wisdom rather than wealth, commitment rather than ambition.

~ Italian conductor, Riccardo Muti (born 1941)

Latest

-

ASX 200

Iron ore bounce lifts the ASX. -

S&P 500, FTSE 100, Shanghai Composite

Bears in the East, bulls in the West. -

Gold

Falling Yuan strengthens the Dollar but weakens Gold. -

Trade Wars

Playing hardball with China. -

Model Portfolios

Australian & International model portfolios based on my investment strategy.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.