S&P 500 and Nasdaq relief

By Colin Twiggs

July 6, 2017 8:00 p.m. EDT (10:00 a.m. AEST)

First, please read the Disclaimer.

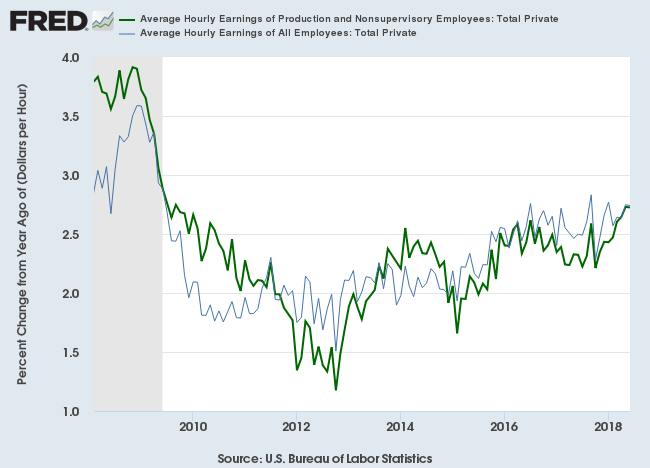

June average hourly earnings growth came in flat at 2.74% for Total Private sector and 2.72% for Production and Non-supervisory Employees. This suuports the argument that underlying inflation remains benign, easing pressure on the Fed to accelerate interest rates.

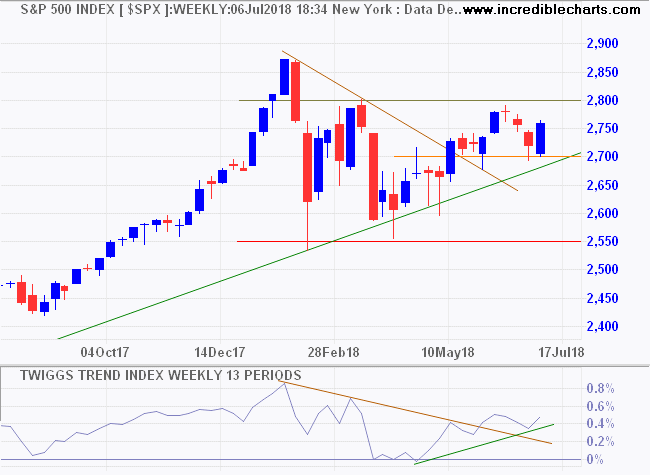

The S&P 500 rallied off its long-term rising trendline. Follow-through above 2800 would suggest another primary advance with a target of 3000.

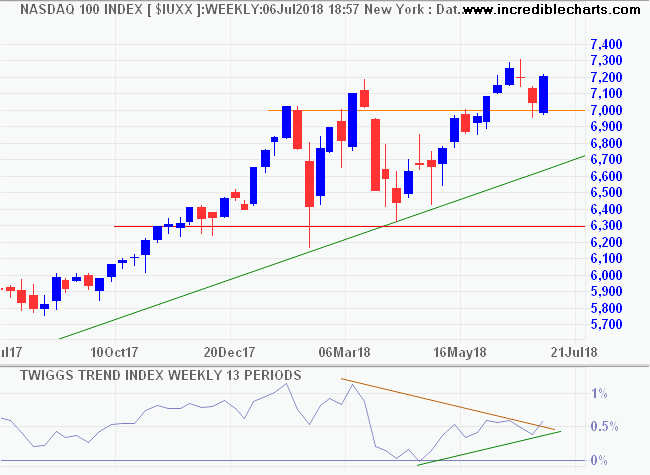

The Nasdaq 100 respected its new support level at 7000, signaling a primary advance. The rising Trend Index indicates buying pressure. Target for the advance is 7700.

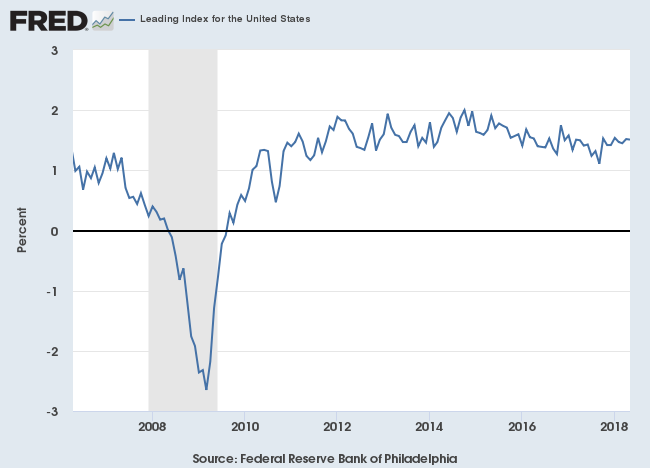

The Leading Index from the Philadelphia Fed is a healthy 1.51% for May. Well above the 1.0% level that suggests steady growth (falls below 1.0% are cause for concern).

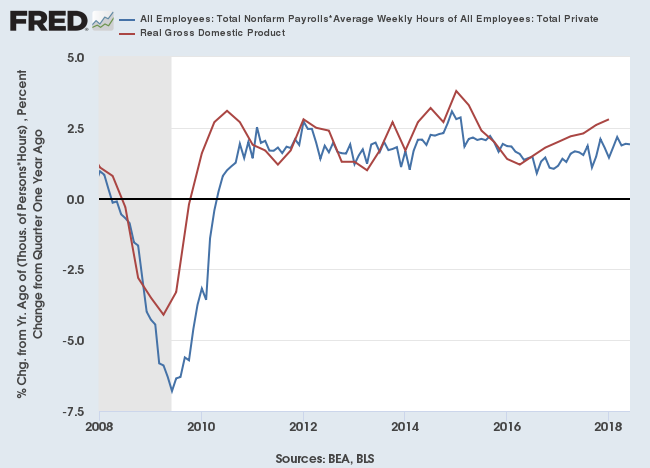

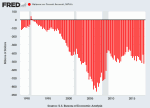

Our estimate of annual GDP growth — total payroll x average weekly hours worked — is muted at 1.91% but suggests that earnings growth will remain positive.

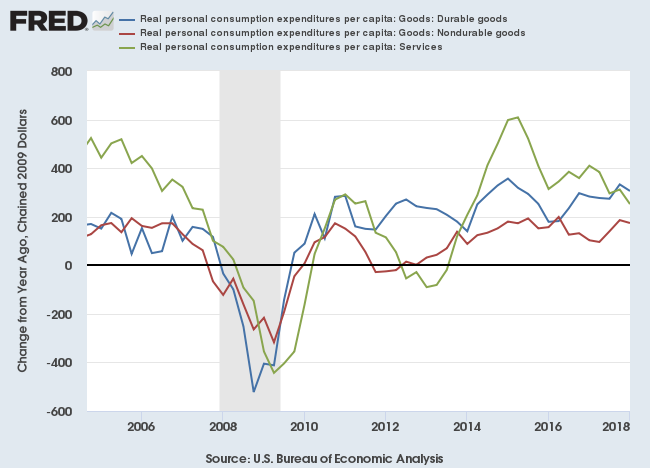

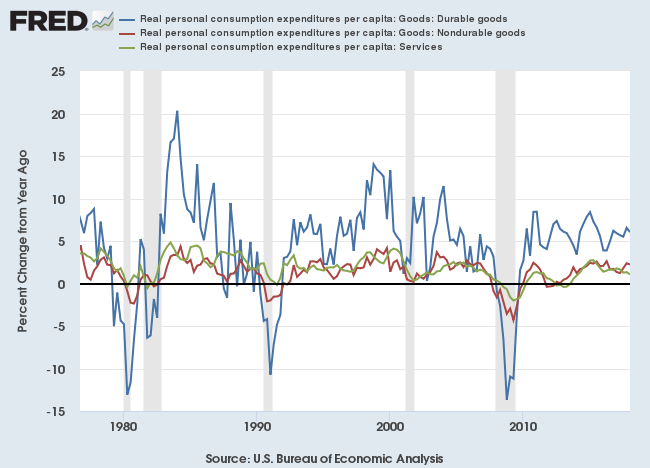

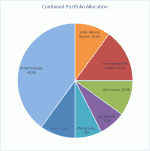

Personal consumption figures for Q1 2018 show growth in consumption of services is slowing but durable goods remain strong, while nondurable goods are steady.

Declining consumption of nondurables normally coincides with a recession but is often preceded by slowing durable goods — below 5.0% on the chart below — for several quarters.

Conclusion: Expect further growth but be cautious of equities that are vulnerable to escalating trade tariffs.

We live in a global economy, but the political organization of our global society is woefully inadequate. We are bereft of the capacity to preserve peace and to counteract the excesses of the financial markets. Without these controls, the global economy, is liable to break down.

~ George Soros: The Crisis of Global Capitalism (1998)

Latest

-

ASX 200

Banks lift the ASX. -

Australia

The good news and the bad news. -

Gold

Gold, Dollar and the Yuan. -

Australia

Australia's debt bomb. -

Trade Wars

Playing hardball with China. -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.