Be Data-driven not Fear-driven

By Colin Twiggs

June 29, 2017 9:00 p.m. EDT (11:00 a.m. AEST)

First, please read the Disclaimer.

A few months ago, markets feared a nuclear war on the Korean peninsula. Those fears have now largely dissipated but been replaced by fears of a massive trade war with China. There is always a small probability that our fears may be realized but most market fears are not.

Unless you want to follow in the footsteps of some media-driven forecasters, and anticipate ten of the next two recessions, you need to focus on the data and not on your fears.

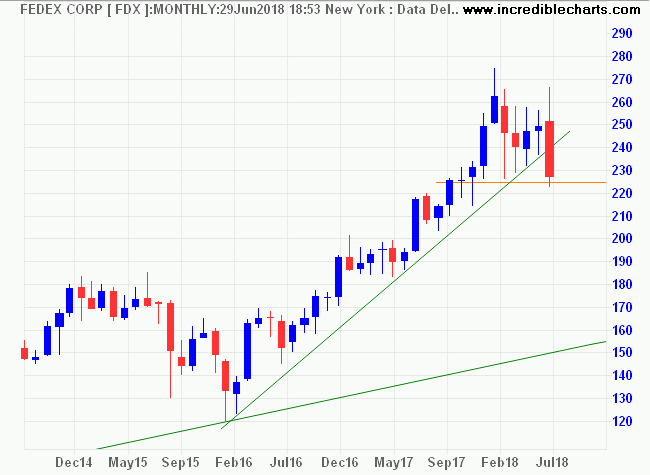

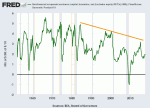

I have always used Fedex as a bellwether of economic activity in the USA. Shipments of goods are an excellent barometer of the economic climate — and closely tied to quarterly earnings which in the long-run drive prices.

Unfortunately Fedex stock price is likely to become less reliable over time as an indicator of economic activity, with the entry of a new competitor: Amazon.

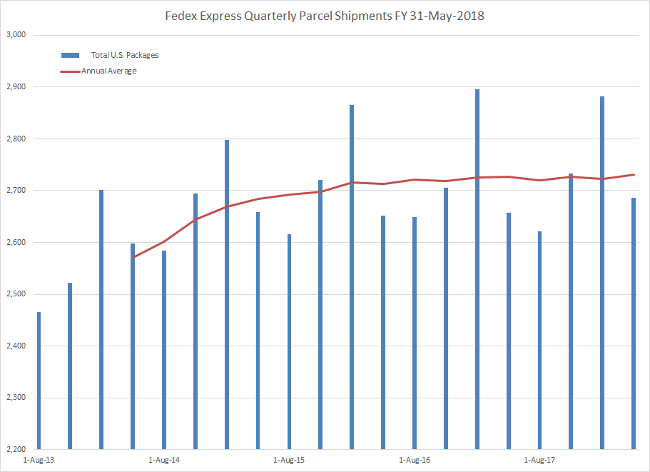

But Fedex produces excellent quarterly statistics of parcel shipments which remain a useful gauge of economic conditions.

Parcel shipments for the quarter ended May 31, 2018 are up 1.1% on the same quarter in 2017. And the annual average is rising. Not fantastic but a step in the right direction, suggesting that earnings for the next quarter will improve.

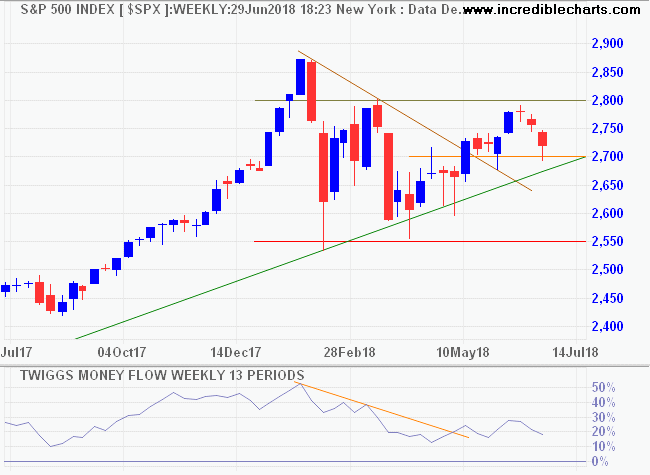

The S&P 500 is testing its long-term rising trendline. Respect of support at 2700 would suggest another advance. Breakout above 2800 would strengthen the signal.

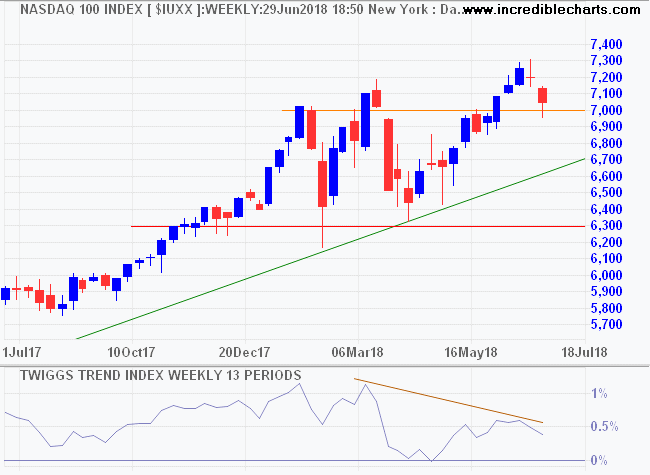

The Nasdaq 100 retraced to test its new support level at 7000. Bearish divergence on the Trend Index hints at selling pressure. Breach of support would warn of another test of primary support at 6300. Lengthy consolidation would be likely. Respect of 7000, while less likely, on the other hand, would signal a fresh advance.

Discount the obvious, bet on the unexpected.

~ George Soros

Latest

-

Australia

Australia's Debt Bomb. -

ASX 200

China Threat. -

Gold and the Dollar

Aussie Gold breakout. -

US & Global economy

Is GDP doomed to low growth? -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.