Don't Blame Trump for Confronting China

By Colin Twiggs

June 23, 2017 4:00 a.m. EDT (6:00 p.m. AEST)

First, please read the Disclaimer.

It is difficult to separate the wheat from the chaff, with the constant media barrage of negative commentary on Donald Trump's latest trade sortie. From The Economist:

"It is becoming increasingly likely that the phoney trade war between America and China will develop into the real thing......China regards the first round of American tariffs as a unilateral violation of global trading rules. It has lodged a complaint at the World Trade Organisation (WTO). But Mr Trump's team maintains that China started the conflict, by stealing America's intellectual property and engaging in unfair industrial policy. Once tariffs have been imposed, the rights and wrongs—and even the role of the WTO itself in the dispute—could be forgotten."

But in this Bloomberg interview Lloyd Blankfein from Goldman Sachs says there is a lot of frustration with China and hints that, while aggressive threats are not his style, it does make sense to confront China.

Apart from the theft of intellectual property and unfair trade practices, some of the basic give-and-take fundamentals of international trade have been abused by China and others. How this was allowed to continue unhindered under the previous three presidencies beggars belief.

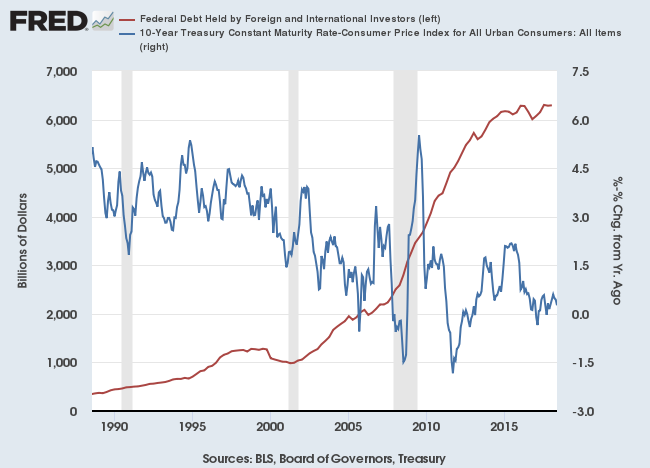

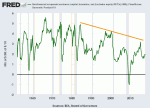

First massive international investment in US Treasuries over the last two decades distorted currency flows between the US and its major trading partners, creating an over-strong Dollar and undermining the competitiveness of US-based manufacturers.

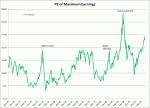

Second, an unforeseen consequence of the foreign inflow into US Treasuries was the dramatic fall in real long-term interest rates — illustrated by 10-year Treasury yields minus CPI on the above graph. Real long-term yields fell from a band of 3.0% to 4.5% during the 1990s to a band of 0.0% to 1.5% in the current era, distorting asset prices and threatening the very survival of financial markets during the 2008 financial crisis.

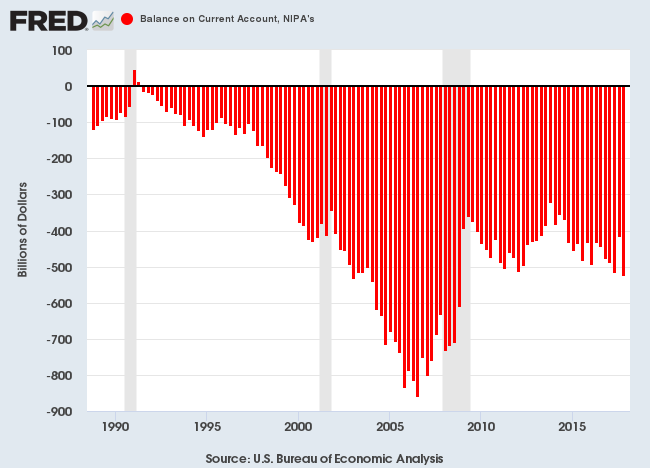

Third, the current account deficit ballooned as a direct consequence of efforts to undermine US manufacturing competitiveness.

Cries of unfair trade practices from China and other long-term abusers are unlikely to receive much sympathy behind closed doors in US boardrooms.

What is needed is another Bretton-Woods-style international accord encompassing trade and currency exchange rates. In the current hostile environment that may be difficult to achieve. But there is no real alternative. Other than an international trade war.

It is time to recognize that financial markets are inherently unstable. Imposing market discipline means imposing instability, and how much instability can society take? .... To put it bluntly, the choice confronting us is whether we will regulate global financial markets internationally or leave it to each individual state to protect its interests as best it can. The latter course will surely lead to the breakdown of the gigantic circulatory system, which goes under the name of global capitalism.

~ George Soros: The Crisis of Global Capitalism (1998)

Latest

-

S&P 500

S&P 500 retraces while Shanghai shudders. -

ASX 200

Bold play for Aussie banks. -

Gold and the Dollar

Gold weakens as Dollar dominates. -

Price & Earnings

The Race to the Top -

US & Global economy

Is GDP doomed to low growth? -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.