East to West: Trade wars, nukes and arrivederci

By Colin Twiggs

June 9, 2017 5:00 a.m. EDT (7:00 p.m. AEST)

First, please read the Disclaimer.

Markets are being kept on the hop, with trade tensions between Donald Trump and China, Trump and Canada, Trump and Mexico, and Trump and Europe. On top of that, President Trump has an upcoming summit with North Korea, while enduring a frosty reception from G7 allies after calling for reinstatement of Russia (to form the G8). Europe has its own worries: Brexit, a new populist government in Italy whose long-term agenda may include an arrivederci to the Euro, and several Eastern European leaders having a bro-mance with Putin.

It's impossible to keep up. Discerning the meaning of each tweet or threat and counter-threat, the probability of each outcome and the impact on one's investments. Perhaps we should heed the warning of French philosopher Michel de Montaigne:

My life has been full of terrible misfortunes most of which never happened.

Rather than jump at shadows, it is advisable to simply follow the market. That way you will not be buried under a deluge of conflicting information. You do have to trust that the market will synthesize all available information and arrive at a reasonable conclusion. At times the market will get it wrong but, like a guidance system on a missile, it continually re-calculates until it hits the target. It is difficult, if not impossible, for an individual to do better. Especially in times like this.

Asia

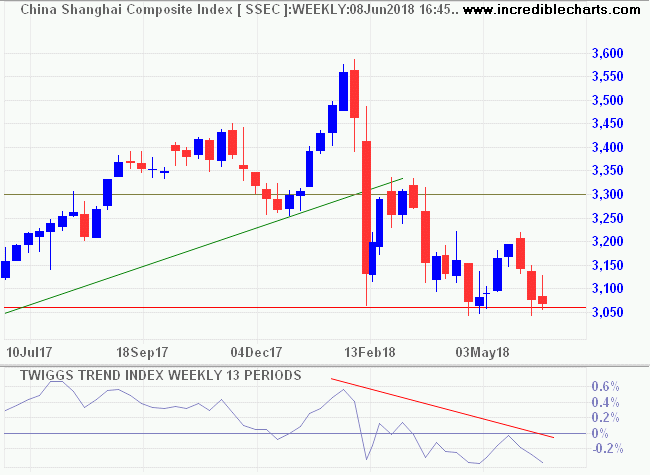

China and Korea reflect the uncertainty surrounding current tensions. The Shanghai Composite Index is testing primary support at 3060 while a Trend Index peak below zero warns of strong selling pressure. The market warns that China may not have a strong hand in trade negotiations.

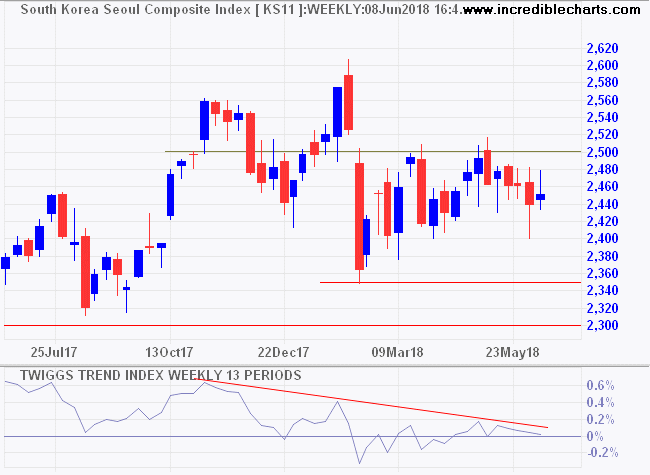

South Korea's Seoul Composite Index reflects uncertainty over the outcome of the upcomming summit. War or peace. Looks like a coin-toss at present.

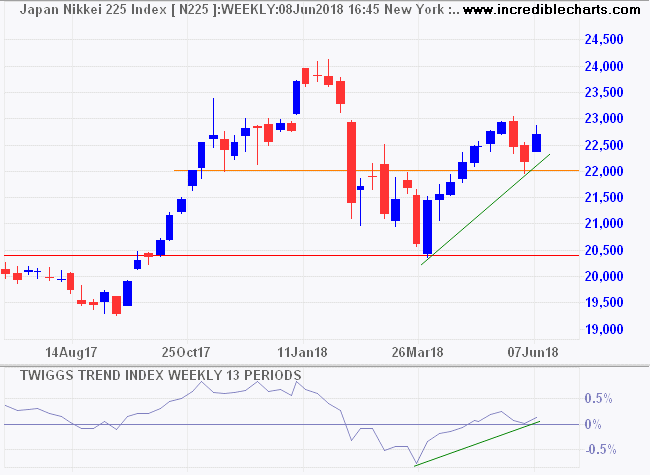

Japan is more removed from the upheaval and Nikkei 225 respect of its new support level at 22,000 signals an advance to test resistance at the January hiogh of 24,000.

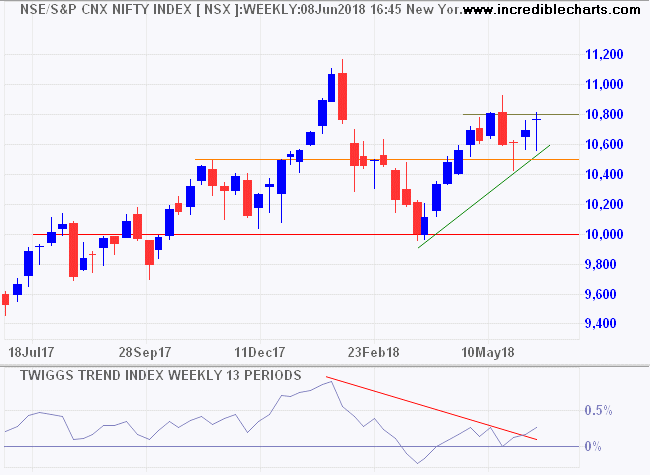

India, also on the periphery, is recovering as well. Nifty breakout above 10,800 would signal an advance to test its January high at 11,100.

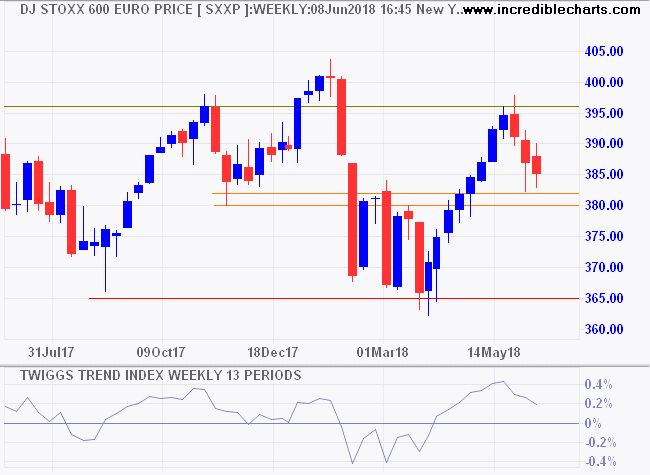

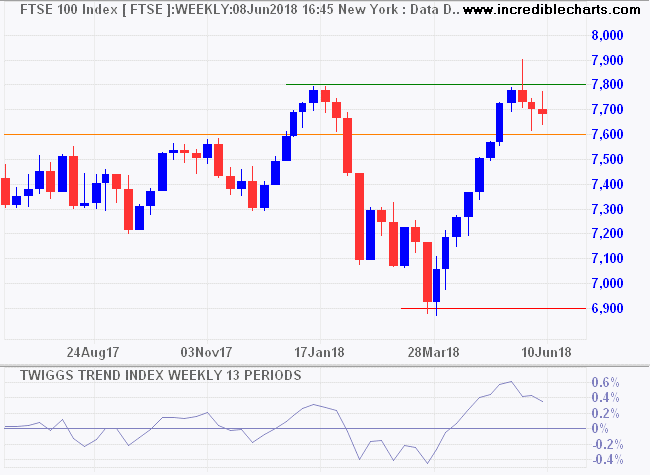

Europe

Dow Jones Euro Stoxx 600 Index, representing the top 600 stocks across Europe, retreated from resistance at 396 due to worries over Italy. Breach of medium-term support at 380 would be a bearish sign warning of a test of primary support at 365.

Footsie retreat from 7800 is a lot milder. Respect of 7600 would suggest another advance. A Trend Index trough above zero, or breakout above 7800, would strengthen the signal.

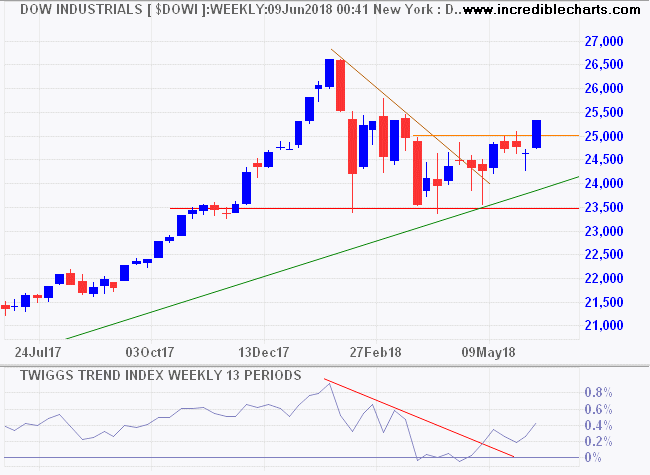

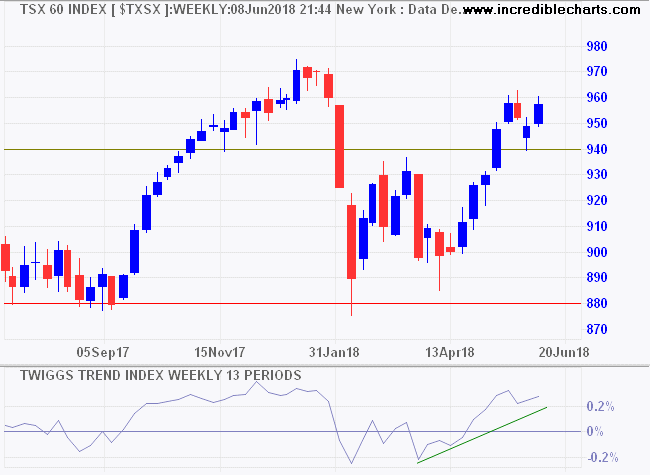

North America

The market appears immune to Trump, with the Dow breaking resistance at 25,000 to signal a test of its January high at 26,600.

Canada's TSX 60 has followed suit. Respect of new support at 940 offers a target of 1000.

No matter how cynical you become, it's never enough to keep up.

~ Lily Tomlin

Latest

-

S&P 500 and Nasdaq 100

Small caps lead US recovery. -

ASX 200

Is resurgence sustainable? -

Gold and the Dollar

Gold benefits from Dollar weakness. -

Australia

12 Charts on the Australian economy. -

Price & Earnings

The Race to the Top -

US & Global economy

Is GDP doomed to low growth? -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.