Facebook face-plant or Trump tantrum?

By Colin Twiggs

March 29, 2017 1:00 a.m. EDT (4:00 p.m. AEDT)

First, please read the Disclaimer.

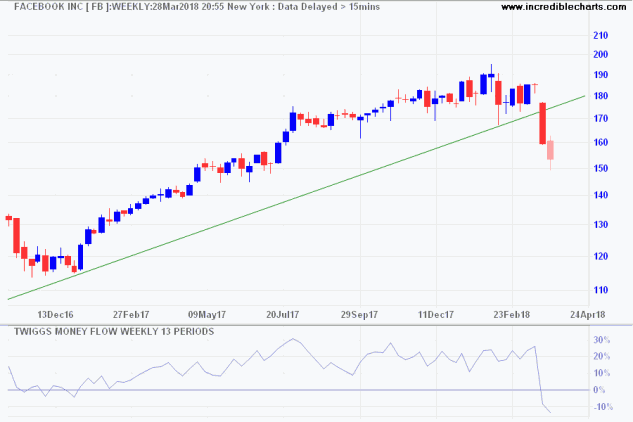

Facebook [FB] has done a face plant in handling the Cambridge Analytica debacle. The stock broke primary support at 170, signaling a down-trend.

Review of user privacy laws is long overdue and likely to clip the wings of the social media giant.

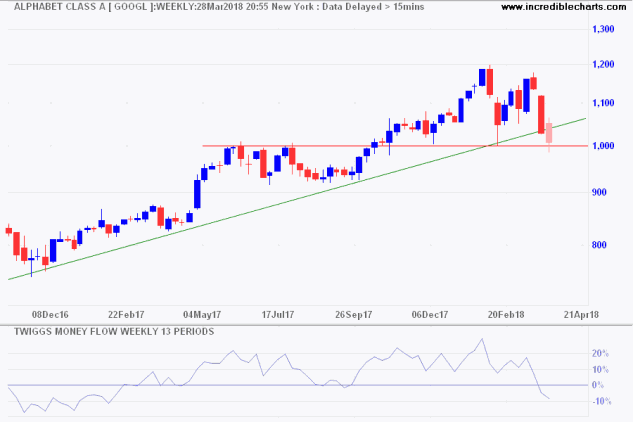

Google will also be affected, just not to the same extent. Holding company Alphabet [GOOGL] stock found support at the $1000 mark. Breach would signal a primary down-trend.

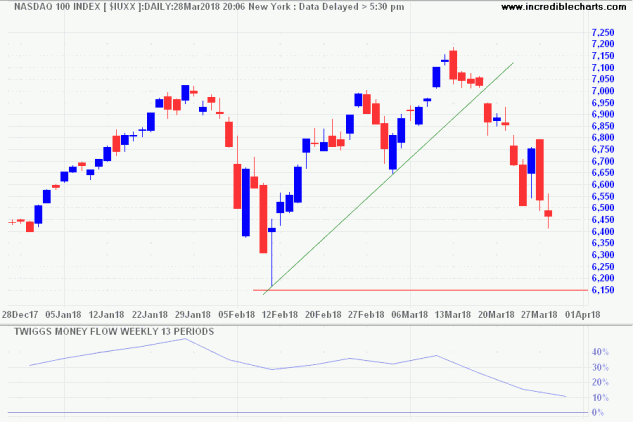

Fears of a Trump trade war seem to have dissipated and the market correction is now being led by a social media sell-off.

The Nasdaq 100 is falling but breach of primary support at 6150 now seems unlikely.

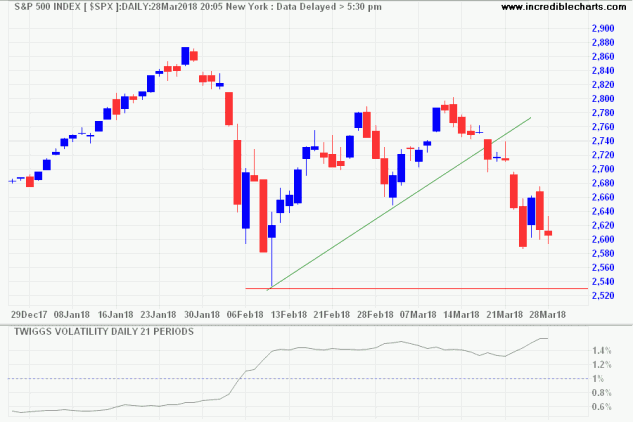

The S&P 500 index found short-term support at 2600. Twiggs Volatility Index remains in the amber zone, between 1% and 2%, suggesting that the correction is secondary in nature. Respect of primary support at 2530 is likely and recovery above 2800 would suggest another primary advance.

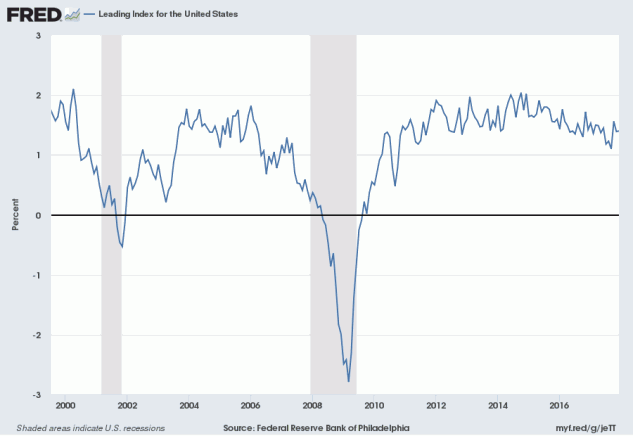

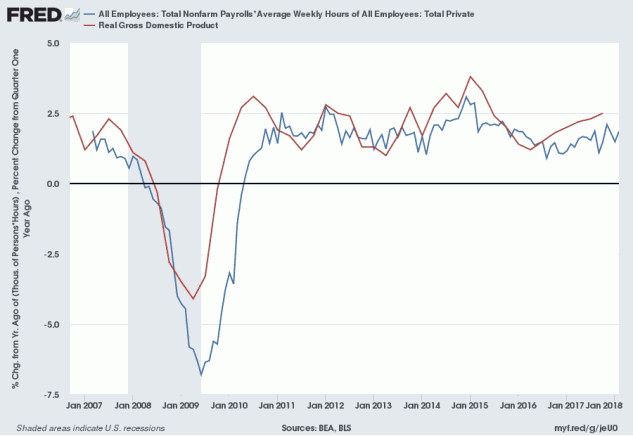

Economic indicators suggest the economy is still on track.

The Leading Index is safely above 1%.

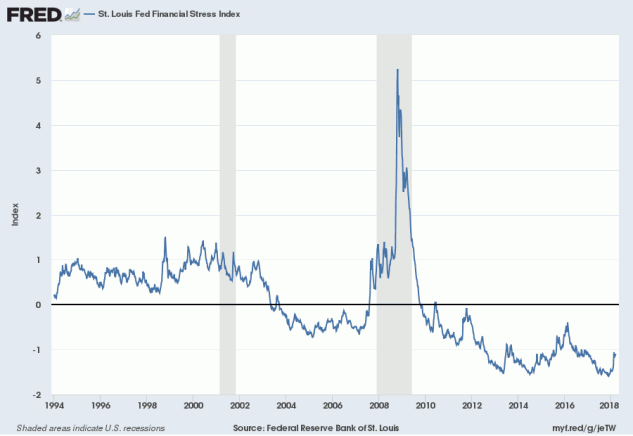

Financial stress is near record lows.

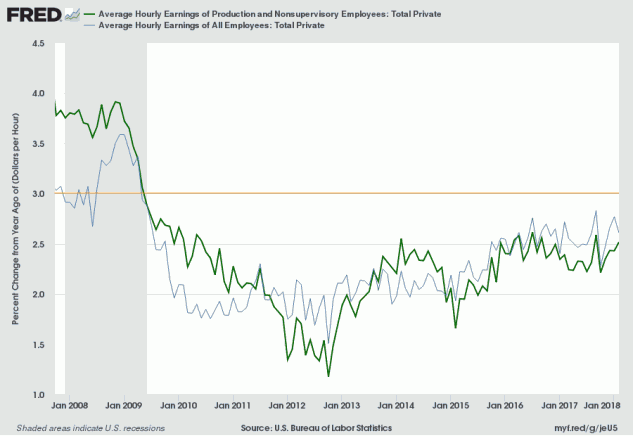

Earnings growth is subdued, only a rise above 3% for average hourly earnings growth would likely prod the Fed into raising interest rates at a faster pace.

And real GDP estimates are rising not falling.

Nothing that a few tweets can't upset but the world is learning to live with erratic messaging from the White House.

I hope that you enjoy the Easter break and look forward to chatting with you next week.

A great civilization is not conquered from without, until it has destroyed itself from within. The essential causes of Rome's decline lay in her people, her morals, her class struggle, her failing trade, her bureaucratic despotism, her stifling taxes, her consuming wars.

~ Will Durant

Latest

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.