“Headwinds have turned into tailwinds”

By Colin Twiggs

March 9, 2017 11:30 p.m. EST (3:30 p.m. AEDT)

Please read the Disclaimer.

“While many factors shape the economic outlook, some of the headwinds the U.S. economy faced in previous years have turned into tailwinds. Fiscal policy has become more stimulative and foreign demand for U.S. exports is on a firmer trajectory.”

~ New Fed Chair Jerome Powell in his first testimony before Congress

Two very important sentences for investors. Expect further rate hikes but at a moderate pace.

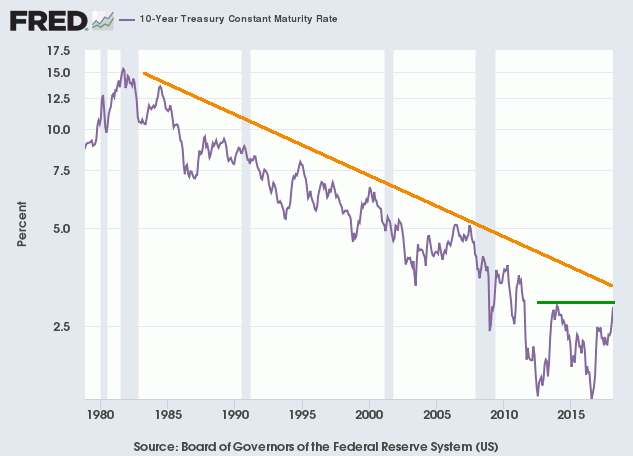

Bond yields have climbed in anticipation of higher inflation. Breakout above 3.0 percent would warn of a bond bear market, after the bull market of the last 3 decades, with rising yields.

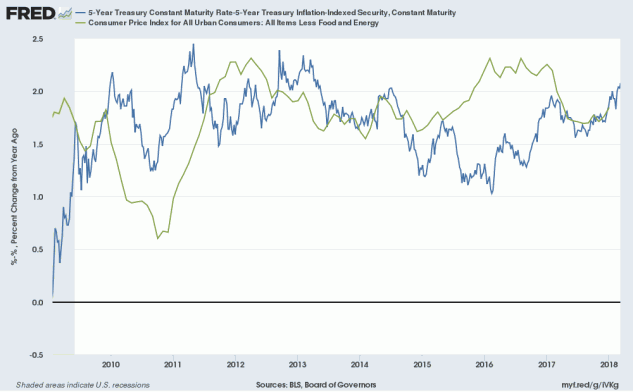

The five-year breakeven rate (Treasury yield minus the equivalent yield on inflation indexed TIPS) has been climbing since 2016.

But core CPI (CPI less Food & Energy) remains subdued.

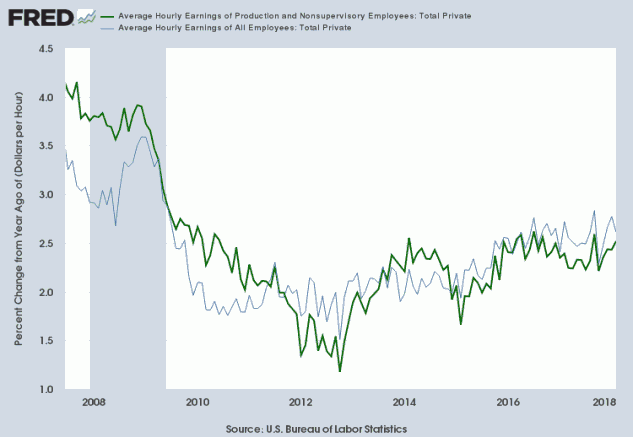

And average hourly wage rates, reflecting underlying inflationary pressures, continue to grow at a modest 2.5 percent a year.

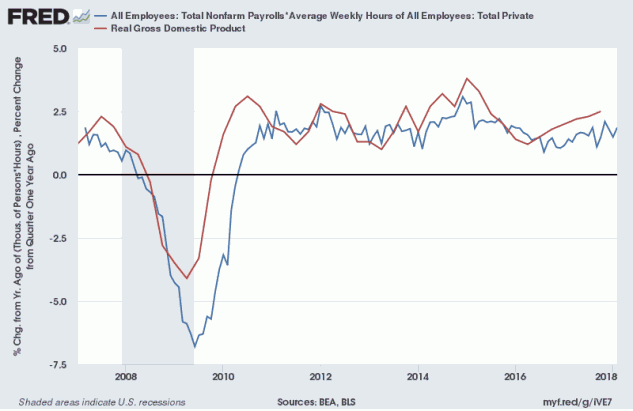

Real GDP is likely to maintain its similarly modest growth.

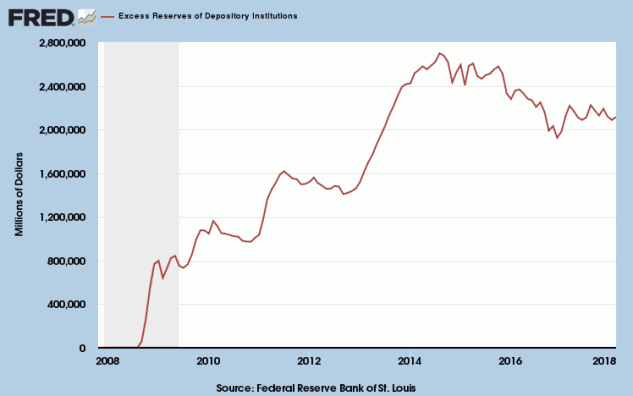

While the Fed is sitting on a powder keg of more than $2 trillion of commercial bank excess reserves, no one is playing with matches. Yet.

Those excess reserves on deposit at the Fed have the potential to fuel a massive bubble in stocks or real estate. But investors remain wary after their experience in 2008.

We should be careful to get out of an experience only the wisdom that is in it — and stop there; lest we be like the cat that sits down on a hot stove-lid. She will never sit down on a hot stove-lid again — and that is well; but also she will never sit down on a cold one anymore.

~ Samuel Clemens

Latest Posts

-

ASX 200

Bank relief but miners bearish. -

Gold waits on the Dollar

Gold is ranging, awaiting a Dollar breakout. -

East to West

S&P 500 strengthens while China, Japan and India weaken.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.