Seasons Greetings/Gold bounces

By Colin Twiggs

December 22, 2017 10:00 p.m. EDT (2:00 p.m. AEST)

This is my last newsletter for the year. I will return after the New Year, on January 8th. Our office will remain open but please use a support ticket if you require technical support.

Please note changes to the Disclaimer.

Currumbin Valley, Queensland - December 2017

We wish all our readers peace and goodwill over the Christmas season

and prosperity in the year ahead.

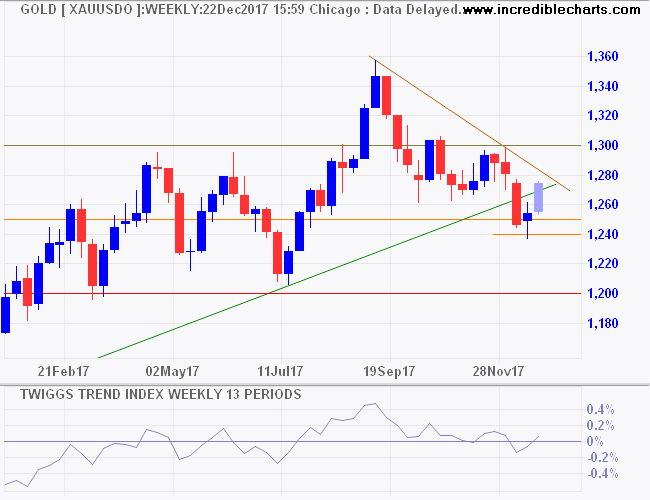

Gold Bounces

Gold bounced off support at $1240/ounce, ending the week with a strong rally. Penetration of the descending trendline would indicate the down-trend has weakened, while breakout above $1300 would suggest another advance. Twiggs Trend Index close to zero still indicates hesitancy.

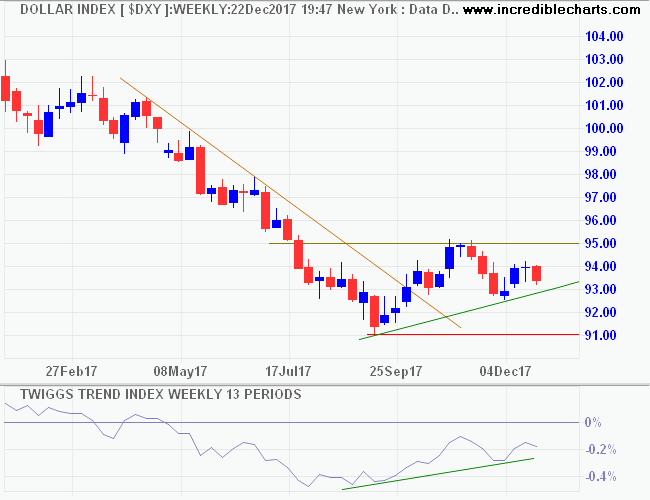

The greenback is weakening which is bullish for gold. Dollar Index reversal below 93 (and the rising trendline) would indicate another test of primary support at 91. A major Trend Index peak below zero would warn of another primary decline with a target of 87*.

* Target calculation: 91 - (95 - 91) =87

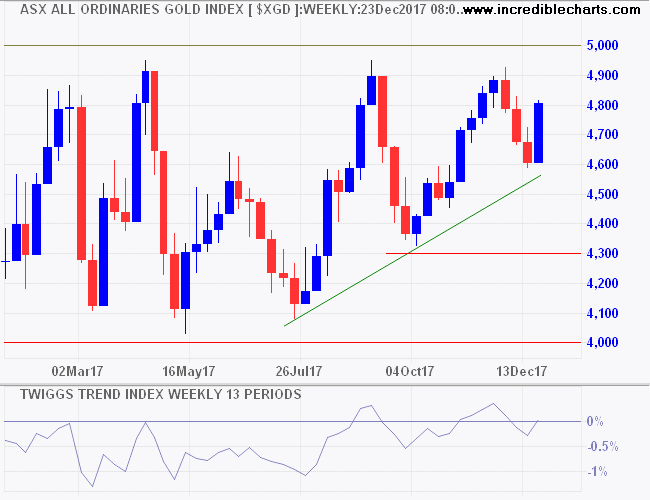

Australia's All Ords Gold Index is headed for another test of long-term resistance at 5000. Breakout would signal a primary advance.

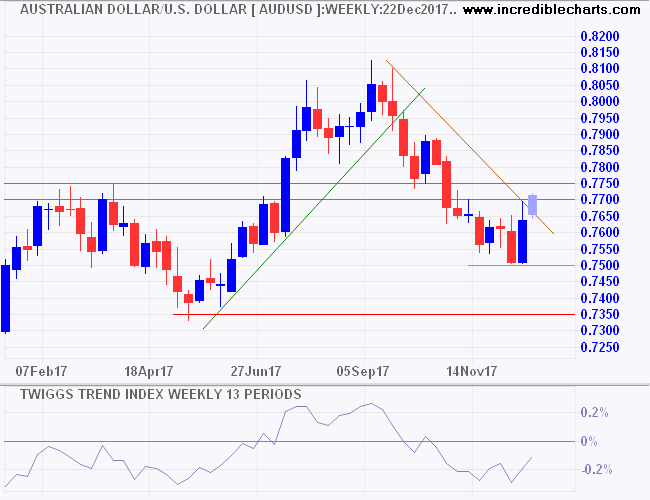

A weakening Aussie Dollar would strengthen demand for gold stocks. Respect of resistance at 77.5 US cents by the current bear rally would warn of a decline to test primary support at 73.5.

The biggest mistake in investing is believing the last three years is representative of what the next three years is going to be like.

~ Ray Dalio

Six of the Best

A selection of our most popular posts for 2017:

-

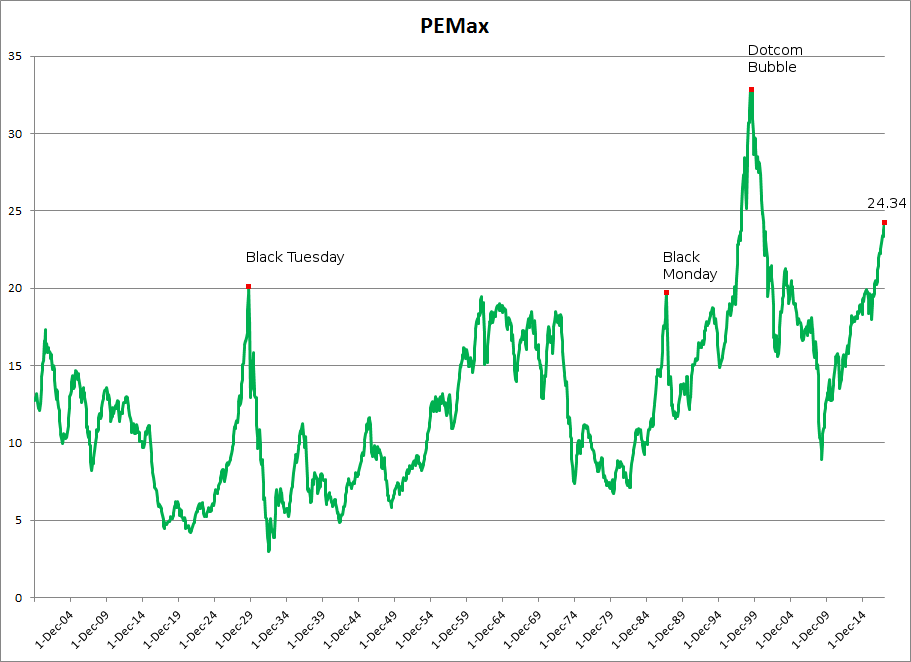

PEMax warns that stocks are over-priced

PEMax valuation is higher than the Black Tuesday crash of 1929 and Black Monday of 1987. -

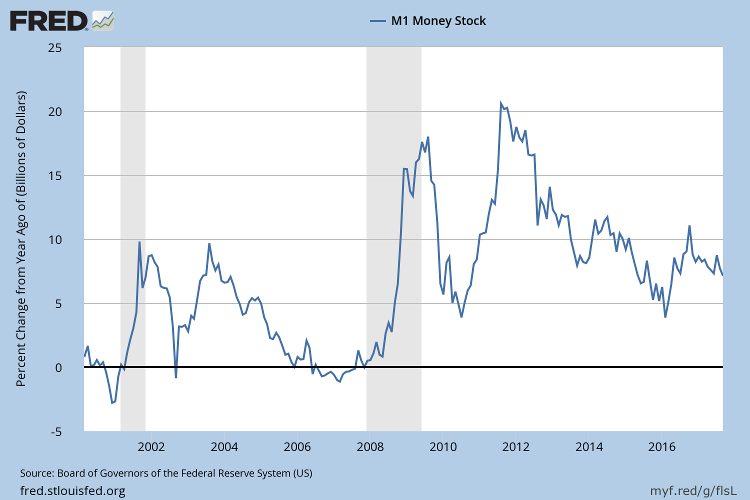

How long will the bull market last?

How long before inflation rises and the Fed is forced to tighten monetary conditions? -

Seven Signs Australians Are Facing Economic Armageddon

There are four major risks that need to be addressed: record household debt, $1 Trillion foreign debt, record low interest rates and a massive housing bubble. -

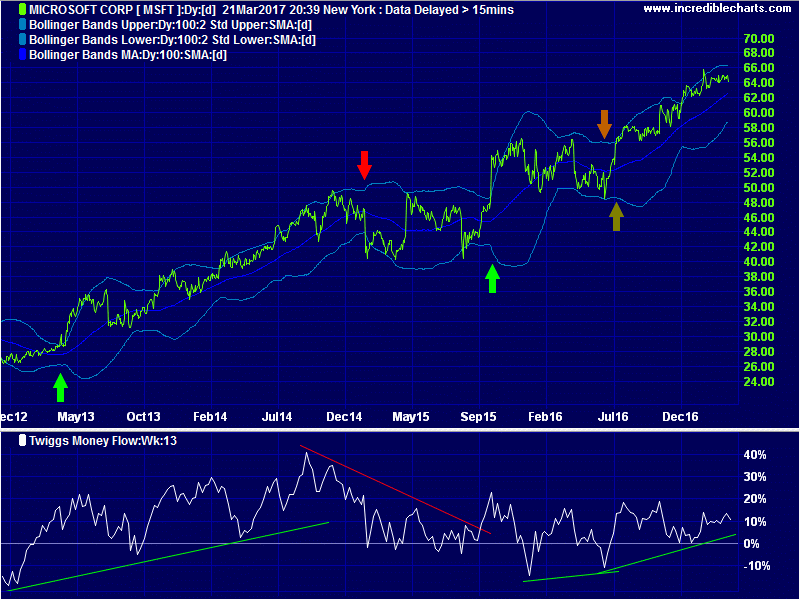

2 Great Bollinger Band Trading Strategies

Bollinger band squeezes and how to trade trends with 100-day Bollinger bands and 13-week Twiggs Money Flow. -

George Orwell's 1984 on steroids is growing right under our noses [video]

Facebook, Google and other social media giants advertise that their products are free ....but we are the products being sold. -

The challenge of Xi Jinping's Leninist autocracy

It is likely that the Chinese model will collapse under its own weight, as its inherent weaknesses are exposed, but the West cannot afford to bury its head in the sand.

Recent Posts

- ASX breaks resistance

- East to West: Footsie surprise

- Putin, pawns and propaganda (with Garry Kasparov) | Stay Tuned with Preet Bharara

- The aim of propaganda is to annihilate the truth | Garry Kasparov

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.