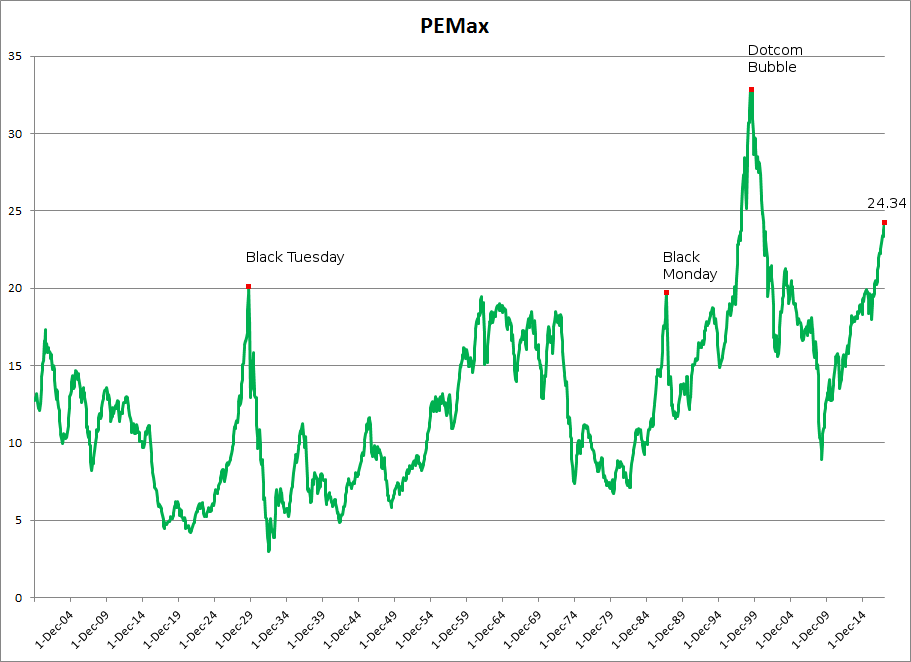

PEMAX since 1900

By Colin Twiggs

December 15, 2017 8:30 p.m. EDT (12:30 p.m. AEST)

Please note changes to the Disclaimer.

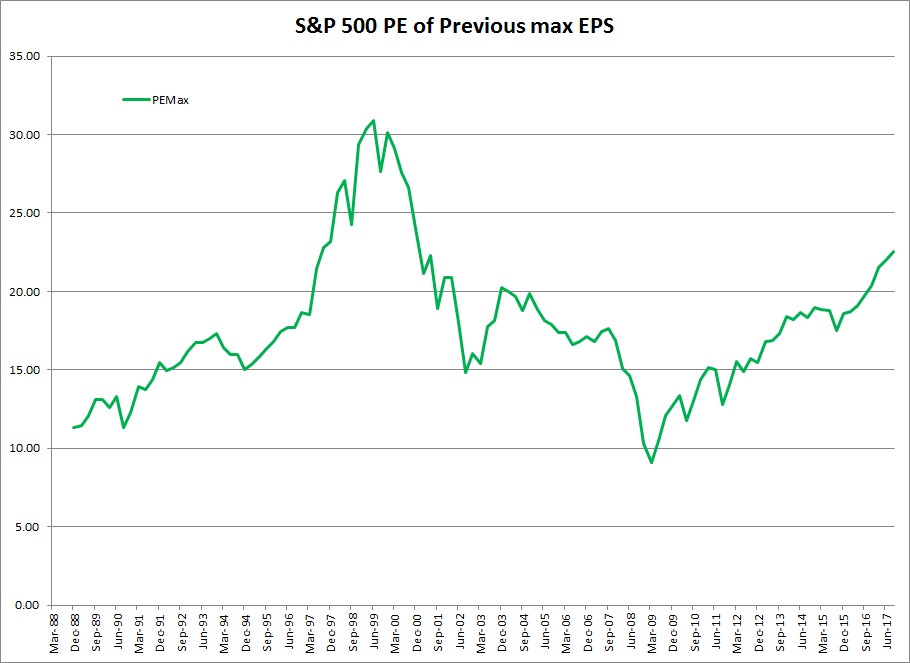

I published a chart of PEMAX for the last 30 years on Saturday. PEMAX eliminates the distortion caused by cyclical earnings fluctuations by using the highest earnings to-date rather than current earnings. The idea being that cyclical declines in earnings reflect a fall in capacity utilization rather than a long-term drop in earning potential.

Since then I have obtained long-term data dating back to 1900 for the S&P 500 and its predecessors, from multpl.com.

PEMAX for November 2017 is 24.34, suggesting that stocks are over-valued.

Outside of the Dotcom bubble, at 32.88, the current value is higher than at any other time in the past century. PEMAX at 24.34 is higher than the peak of 20.19 prior to the 1929 Black Tuesday crash, and higher than the 19.8 peak before Black Monday in 1987.

This does not mean that a crash is imminent but it does warn that investors are paying top-dollar for stocks. And at some point values are going to fall to the point that sanity is restored.

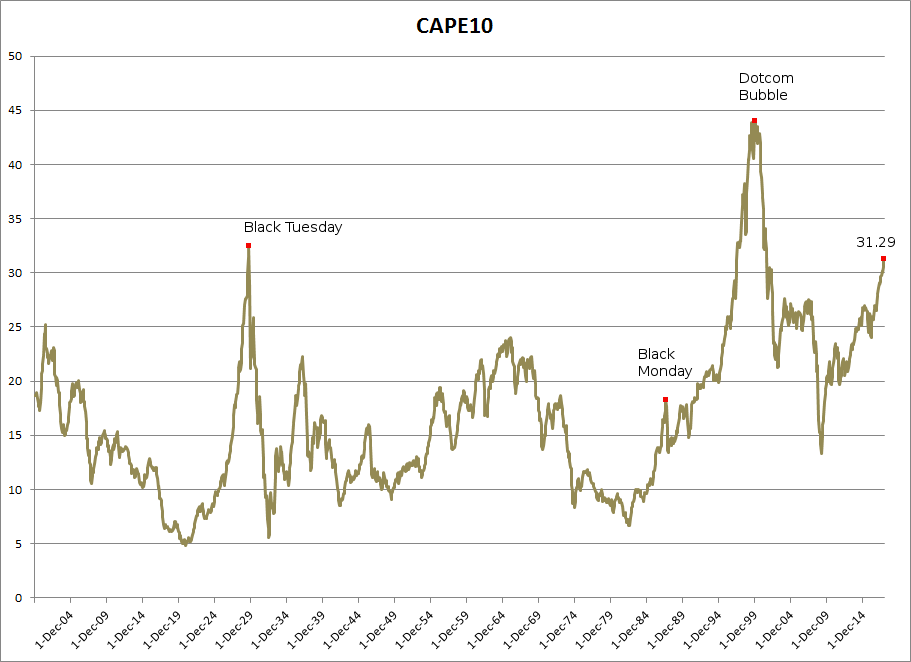

Robert Shiller's CAPE ratio

Here is Robert Shiller's CAPE ratio for comparison. CAPE attempts to eliminate distortion from cyclical earnings fluctuations by comparing current index values to the 10-year average of inflation-adjusted earnings.

While this works reasonably well most of the time, average earnings may be distorted by the severity of losses in the prior 10 years.

You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right.

~ Warren Buffett

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

More....

-

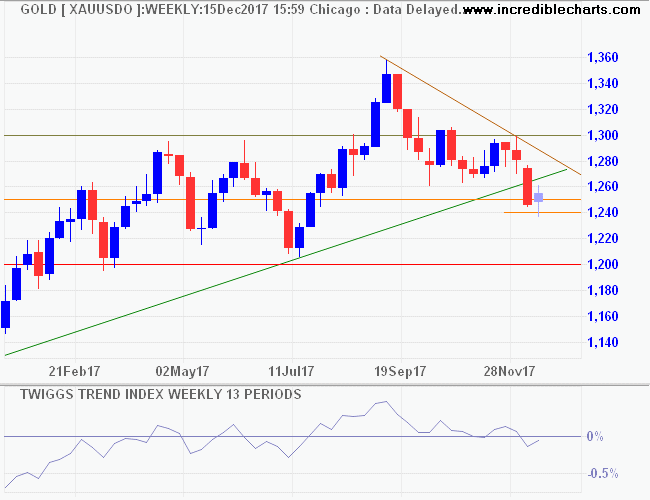

Gold finds short-term support

-

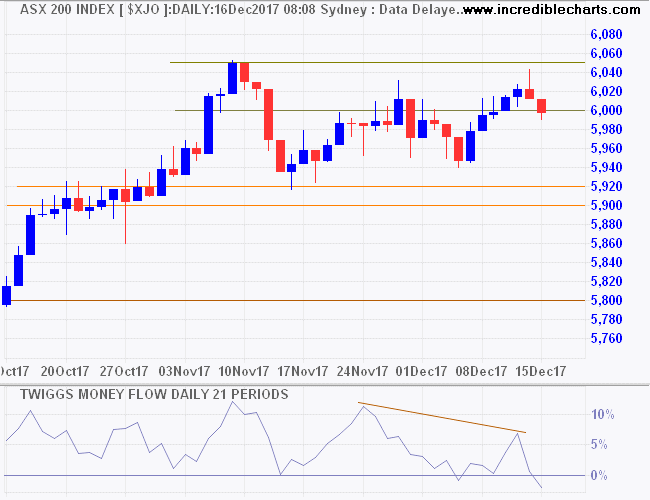

ASX struggles with resistance

-

CAPE v PEMAX: How hot are market valuations?

-

How long will the bull market last?

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.