Crude and the inflation bogeyman

By Colin Twiggs

December 01, 2017 8:30 p.m. EDT (12:30 p.m. AEST)

Please note changes to the Disclaimer.

Inflation is probably the biggest bogeyman facing US investors at present. The Fed is expected to raise interest rates in December but this is more an attempt to normalize interest rates ahead of the next recession rather than slowing the economy to combat inflation.

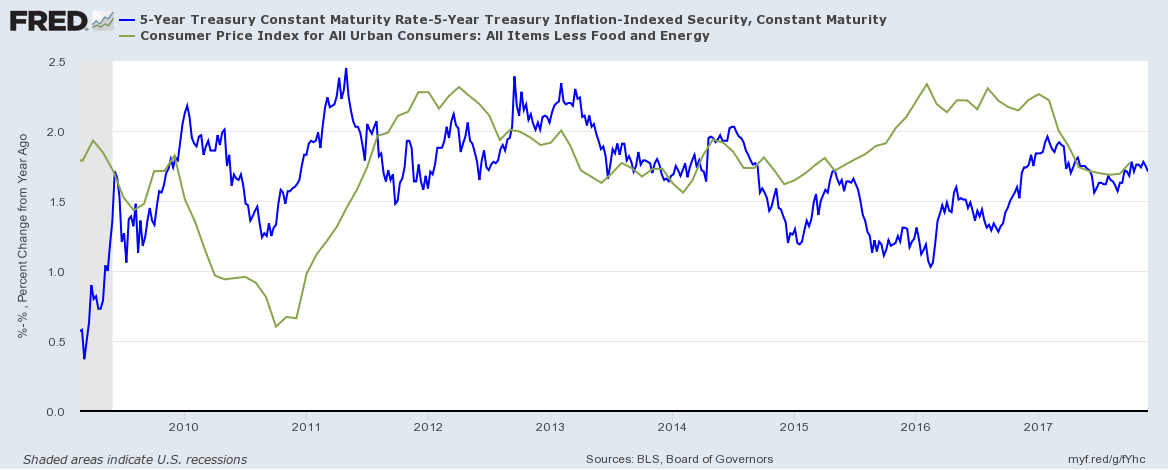

At present inflation remains benign, with the 5-year breakeven rate (Treasury Yield minus TIPS) hovering between 1.7 and 1.8 percent, in line with core CPI.

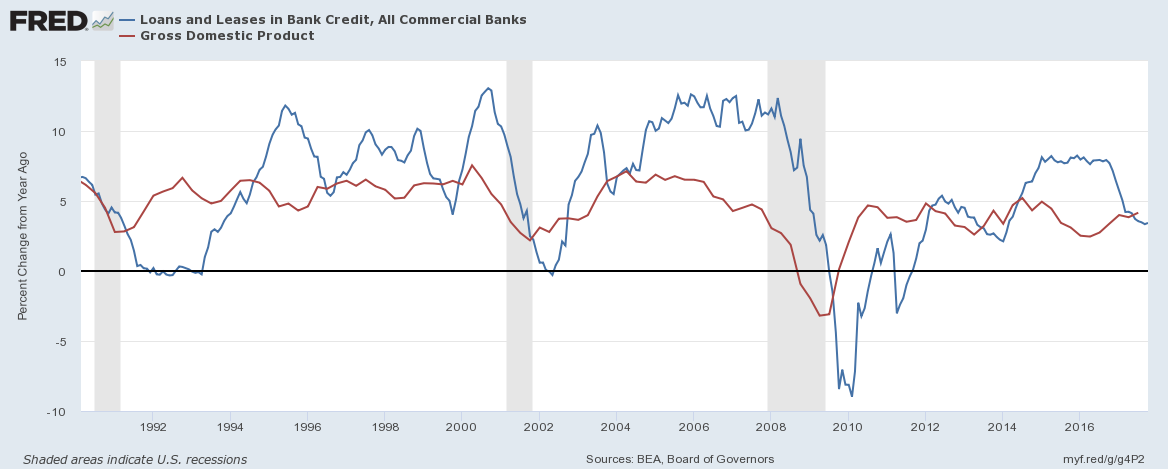

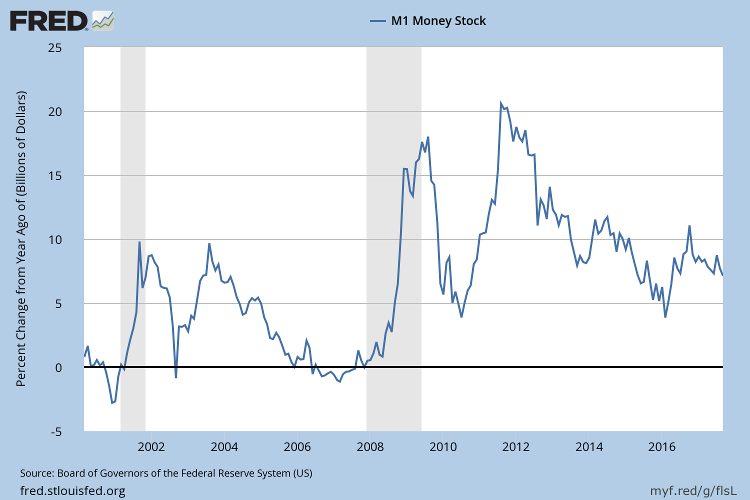

Bank lending growth has slowed to below nominal GDP, suggesting weaker price growth ahead.

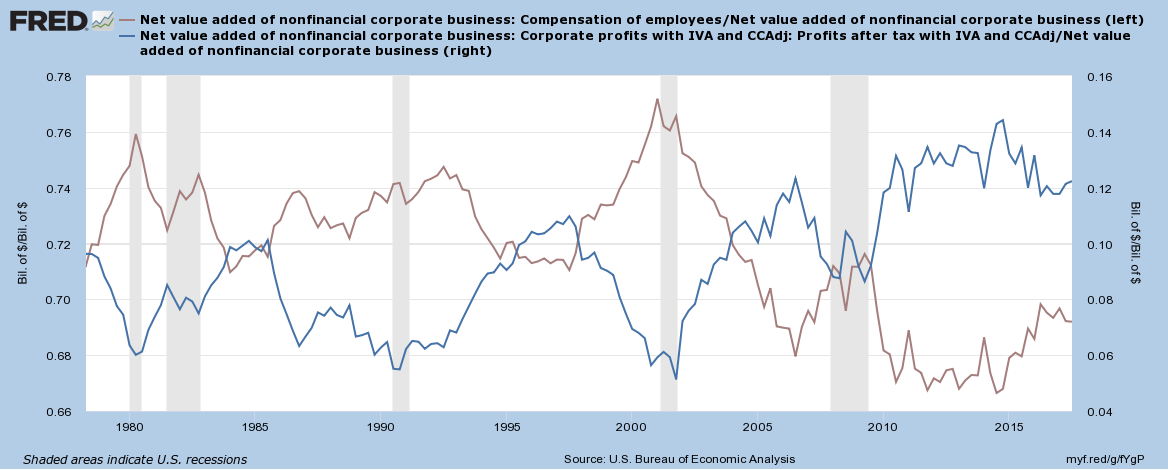

Corporate profits are likely to remain high provided that wage growth remains muted. The chart below compares corporate profits and employee compensation as a percentage of value added. The two have an inverse relationship: profits tend to rise when compensation falls and fall when compensation rises.

If hourly wage rates spike that would have a direct impact on profits because of the inverse relationship. But the Fed is also likely to step in and aggressively hike interest rates to subdue underlying inflation.

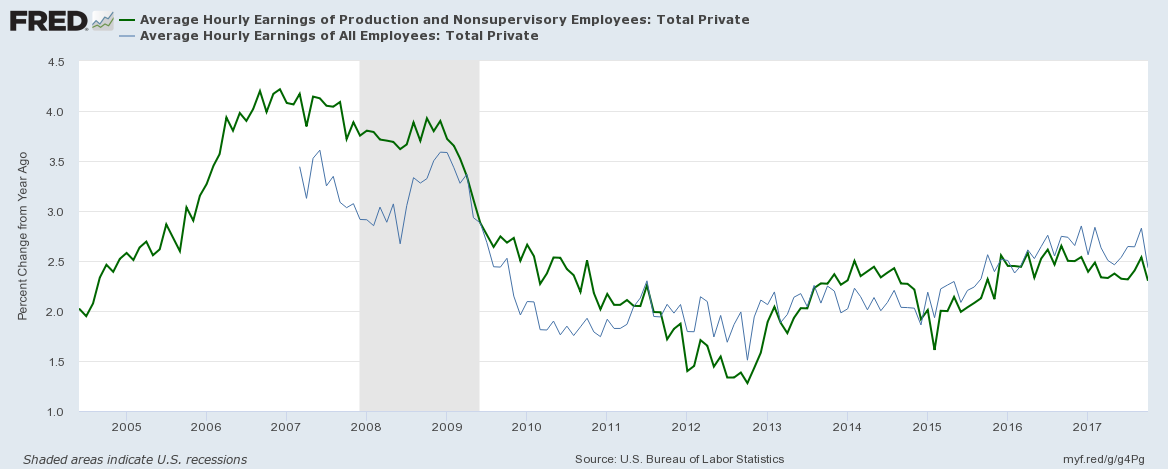

For the present, that appears unlikely as wage rate growth has retreated below 2.5 percent per year.

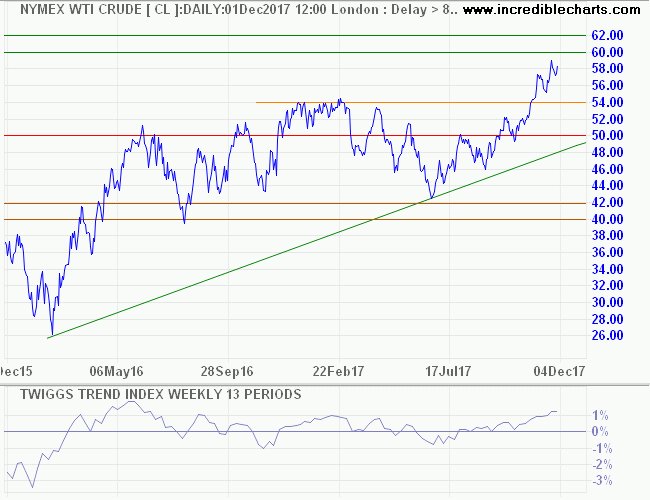

The only likely spoiler is crude oil prices which are headed for a test of resistance at $60/barrel — as oil producers persist with production cuts.

At present breakout above $60 is unlikely but would increase pressure on both commodity prices and wage rates, prodding the Fed towards further rate hikes.

They say you never grow poor taking profits. No, you don't. But neither do you grow rich taking a four-point profit in a bull market.

~ Jesse Livermore

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

More....

-

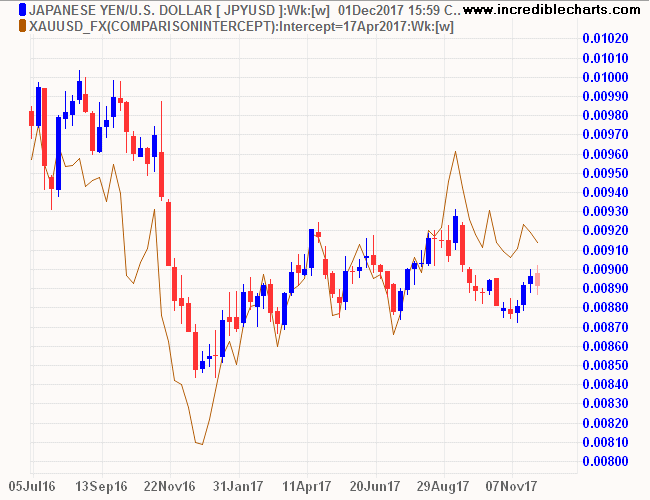

Gold as a safe haven

-

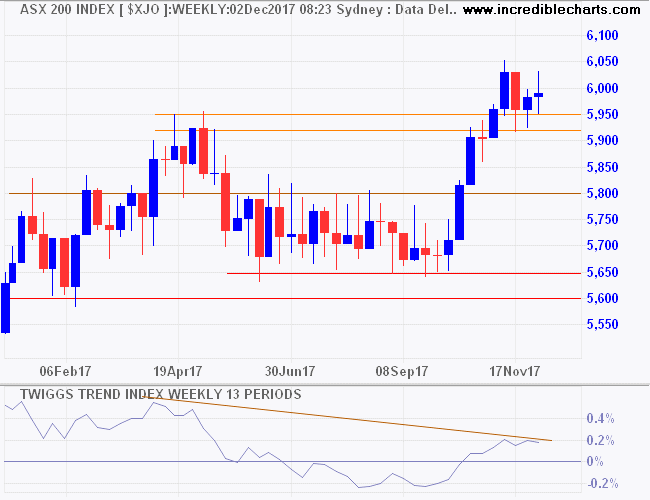

ASX still tentative

-

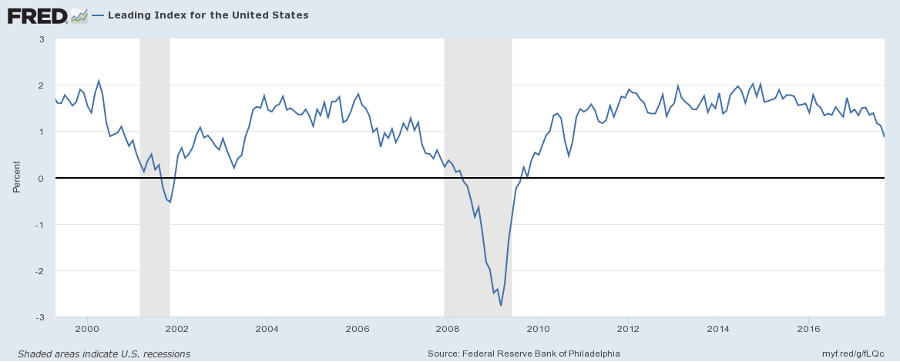

Leading Index gives early warning

-

How long will the bull market last?

-

George Orwell's 1984 on steroids is growing right under our noses [video]

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.